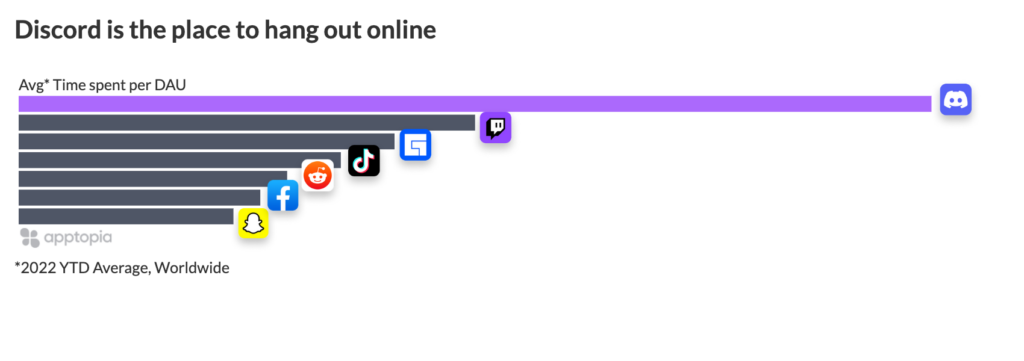

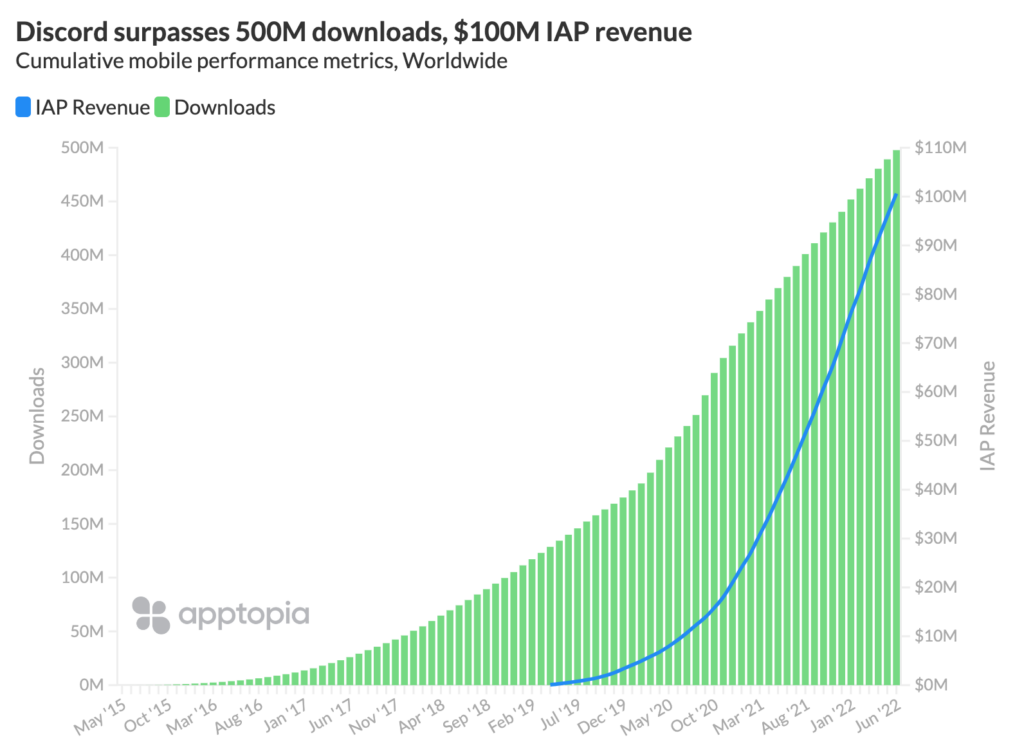

Discord just surpassed 500M lifetime downloads and $100M in-app purchase (IAP) revenue. Originally started in 2015 as a VoIP and instant messaging social platform for the gaming community, today it serves a wide spectrum of interest groups, connecting them in “servers” to chat via text, video, or audio. The average session time per daily active user (DAU) on Discord is twice as long as that of streaming platform Twitch, and more than double that of Facebook Gaming, Facebook, TikTok, Reddit, and Snap

The United States makes up 60% of Discord’s paying users over its lifetime. The UK (6%), Canada (5%), France (3%), and Australia (3%) follow in the top 5 countries by IAP Revenue. The US also leads by downloads, but by considerably less at 25%. Brazil makes up 7% of lifetime downloads, followed by Russia, India, and the UK, each at 5%. Discord users that do not pay for the subscription do not miss much – and that’s the most interesting thing about Discord and this milestone.

Discord is ad-free for all users, whereas comparable platforms like Twitch and Reddit put the ad-free experience behind a subscription fee. Discord’s sole way of making money is via its Nitro Subscription and Boosts, which grant users and servers premium features. The features include custom avatars, emojis, and tags, plus the ability to upload larger files and stream HD Video. By design, they are easy to forgo for casual users and meant to appeal to the passionate server leaders and participants.

Put another way, this revenue milestone speaks to the platform’s fandom.

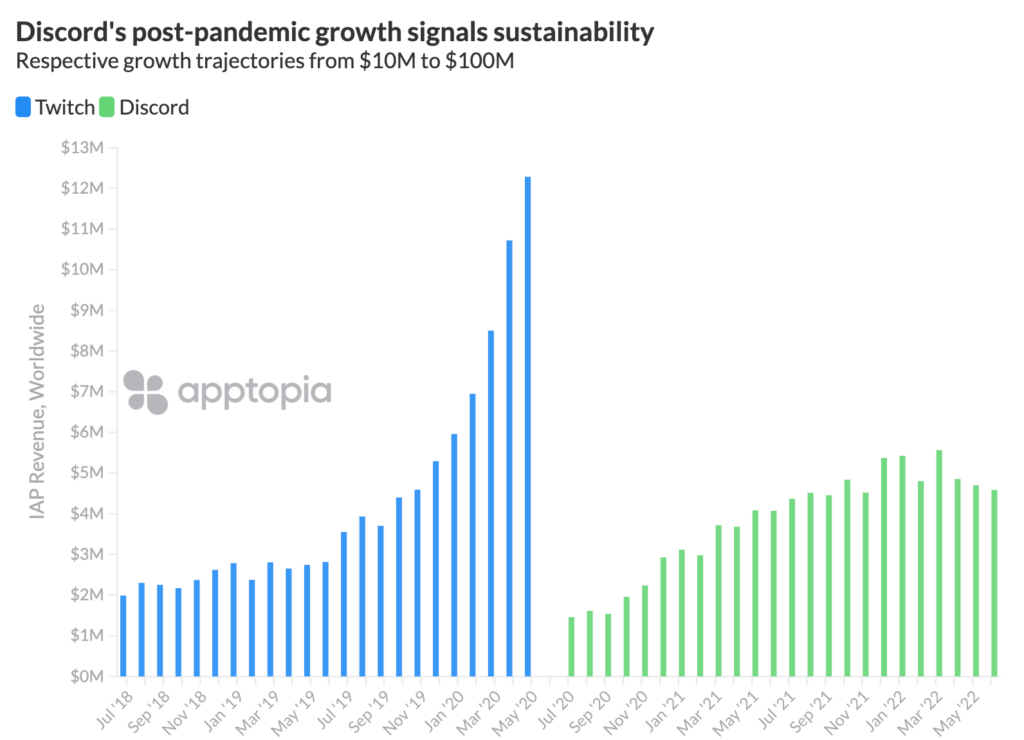

When comparing growth trajectories across similar streaming platforms, Discord’s IAP revenue rise is most similar to that of Twitch. In the chart below, you can see each platform’s two-year journey from the $10M mark to $100M. Twitch had a sprint to the finish, while Discord has maintained a steady increase over the period.

Both Twitch and Discord benefitted from pandemic lockdowns that drove more people online to connect. But pandemic winners like Peloton and meditation apps started to cool in early 2021 – a trend that Twitch’s IAP revenue has followed. Since April 2021, monthly IAP Revenue has declined consecutively. June’s total was a 64% loss from April 2021, and its lowest month for IAP Revenue since February 2020. Discord, on the other hand, continued upward IAP revenue growth into 2022, and declines in recent months are incremental.

Between Discord’s average session length and its post-pandemic monetization stride, it’s clear there’s something special about what Discord has built. (Meta knows it too and started changing Facebook Groups to look more like Discord last month.) Users love the product, and, whether it’s conscious or not, I bet some of that affinity comes from the fact that they are not the product. The model of attracting mass amounts of users to a platform and efficiently monetizing them, instead of making them the commodity to an advertising business, is a core principle to “Social Media 3.0”. While Discord may not one of the thousands of apps labeling itself as Web3 in the app stores (or anywhere on their website, for that matter), it’s been working on that ideal since it started. Crossing 500M downloads and $100M IAP revenue at once, Discord looks to have a solid formula that will take it into the next generation.

Dive deeper into Social Media 3.0 with a

free custom report