In looking at the iOS and Android Shopping categories on Apptopia, something is immediately apparent. The stores people visit at the mall are nowhere to be found in the top apps. The next thing one notices is the large number of top apps that don’t have physical retail stores. Analyzing the past three quarters (October 2016 through June 2017), Wish is the fastest growing app in Shopping and it’s not even close.

*All data is courtesty of Apptopia estimates.

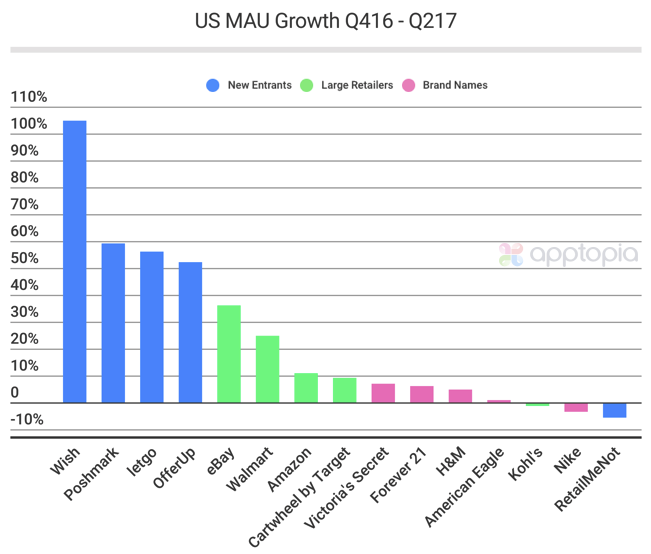

Wish has grown it’s US monthly active users 105% from Q416 to Q217.

Mobile shoppers are savvy – New apps with low prices are growing faster than any other segment within the Shopping category of the App Store and Google Play.

Death of the brands – Name brands have fallen behind savvy shopping apps and large aggregation retailers.

I broke the Shopping category into three sections and took 5 tops apps from each section; New Entrants, Large Retailers, and Brands.

– New Entrants: Wish, letgo, OfferUp, Poshmark, RetailMeNot

– Large Retailers: Amazon, Walmart, eBay, Cartwheel by Target, KOHL’S

– Brands: Nike, Forever 21, H&M, Victoria’s Secret, American Eagle Outfitters

During the same time period we just discussed, New Entrants apps grew US MAU at an average of 53%. Large Retailer apps grew US MAU at an average of 16%, and Brands apps grew US MAU at an average of 7%.

This tell me that mobile shoppers are savvy. They wants deals and they know where to get them. The New Entrants sell items shoppers can find from other retailers but for significantly less. Many of these apps are similar to eBay in that in addition to purchasing items, they enable users to sell items directly through the platform too. This also tells me that there are certain gaps in the marketplace that eBay is not filling. Everyone knows eBay and yet people are turning to apps such as letgo, OfferUp and Poshmark to buy and sell their goods.

People love to browse and get a deal so looking at individual brand apps is not top of mind unless the user is very loyal or already knows exactly what they want. Shoppers prefer to have a wide selection of items and prices which is why even large retailers like KOHL’S outperform brands like H&M or Nike in the app economy.

A note on advertising

When looking at any category at Apptopia, we always like to see if the top apps are advertising on mobile ad networks such as AdColony, Vungle, Chartboost, MoPub, etc. Of the 15 apps we looked at, 10 were advertising on mobile networks in the US over the past 90 days. The five apps not advertising were all Brands. In the shopping category, advertising on mobile is a must to drive downloads rank high. Using Apptopia’s Acquisition Pro, I was able to determine that if Forever 21 wanted to be ranked as the 10th app in the App Store Shopping category, it would need an additional 5,000 downloads to get there (as of 8/1/17, these things change daily). The tool goes into more detail about cost required to do this and how to sustain the rank spot.

Honing in on Wish

To wrap up this post I wanted to dig a little deeper on Wish specifically since it has been taking the Shopping category by storm. When looking at App Store Shopping category rank the past 6 months, Wish never dropped below the #4 spot but was largely in the #2 spot behind Amazon. Amazon only fell out of the #1 spot a total of 38 days during this period and the majority of the time, Wish moved in.

Wish performed even better in Google Play’s Shopping category ranks over the past 6 months. Wish only fell out of the #1 spot for a total of 19 days but Amazon only took the crown on two of those days. Spots 2, 3 and 4 alternated between OfferUp, letgo and Amazon. Most of the time Amazon was resigned to the #4 spot.

When analyzed for Retention in the US on both stores, Wish retained a higher percentage of its users on each of the first 30 days after download than the top 10% of the Shopping category apps’ retention averaged together. Who is the US Wish user? Apptopia Demographics data estimates 60% of the app’s users are aged 12 – 34 and 63% of its users are female.

If you’d like to dive deeper or get similar data for any other mobile app in the world, please contact us or schedule a demo.