Today we bring you our latest market report, Travel Trendlines. It features data stories on 2021’s top Travel apps*, including which are the fastest-growing and why. The insights come from U.S. performance data for travel apps in the following categories: OTA (Online Travel Agencies), Hotels, Airlines, Vaccine Passports, Car Rental and Cruise Line apps.

*“Top travel apps” mean the most-downloaded in each of the travel categories listed.

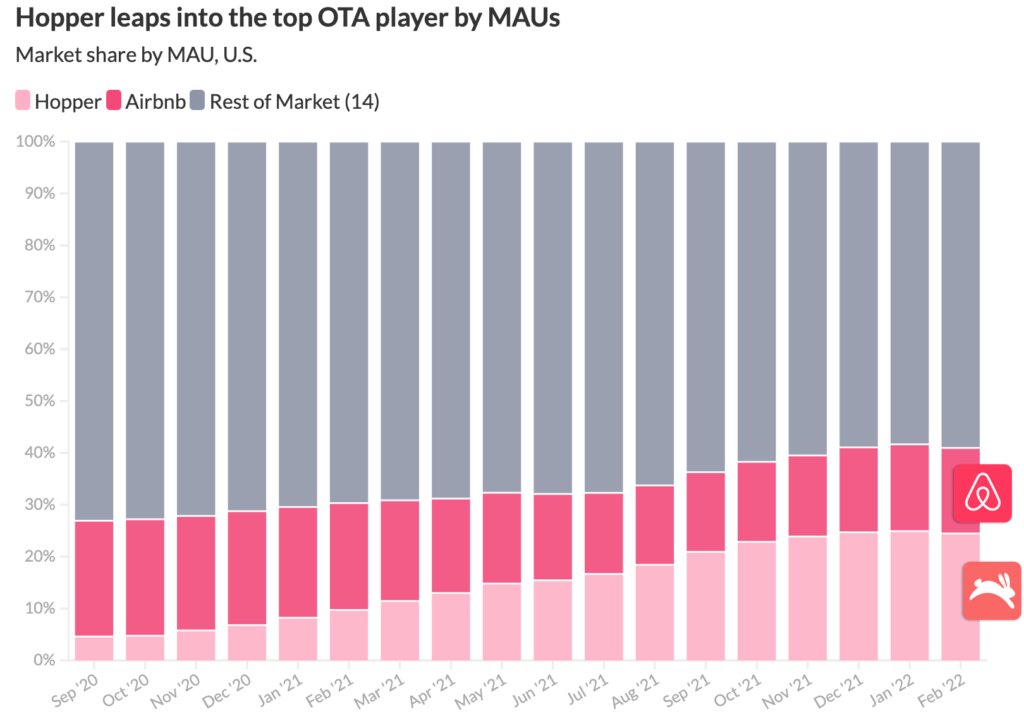

Highlights include Hopper overtaking Airbnb to lead market share among OTAs by monthly active users (MAUs). The rate keeps increasing (see chart below), and in January Hopper moved into direct competition with Airbnb with its short-term home rental product, ‘Homes’.

That’s not all from Hopper. It also led YoY growth in user sessions among the top 16 OTA apps – by a landslide. It increased user sessions by 494% from Q4 2020 to Q4 2021, compared to the second fastest-grower in the market, Expedia, which grew its usage 49%.

In a market of well-funded companies (much of the market is comprised of Booking Holdings or Expedia Group properties), Hopper’s lead is worth looking at. The report has more on the product strategy behind it.

Your next destination:

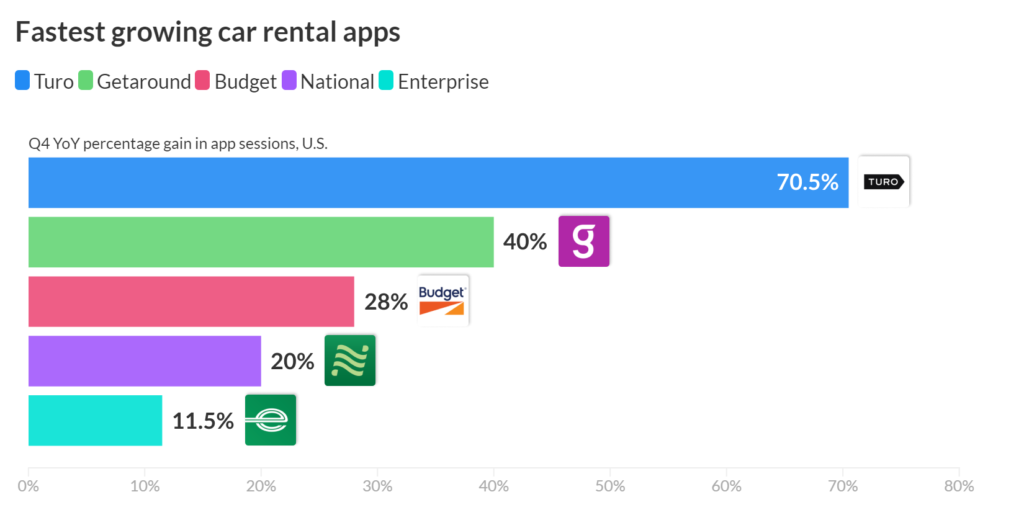

Speaking of travel apps that mobile leaders can learn from, Turo is another example that stands out in our analysis.

Turo, a Car Rental app which will be going public on NYSE in the coming months, had outstanding mobile performance in 2021 up to present day. It updates its app every 6 days – an above-average update cadence. Usually (not always) update frequency is a good indication of how well the app runs for users and the investment the company is making into mobile.

A recurring theme across Travel app categories is how travel companies are developing mobile apps to promote loyalty. Guest loyalty has long been the end game for travel companies. In Travel Trendlines, we see how mobile enables them to service guests better before, after and during their booking.

Your next destination: