This was first published May 23, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

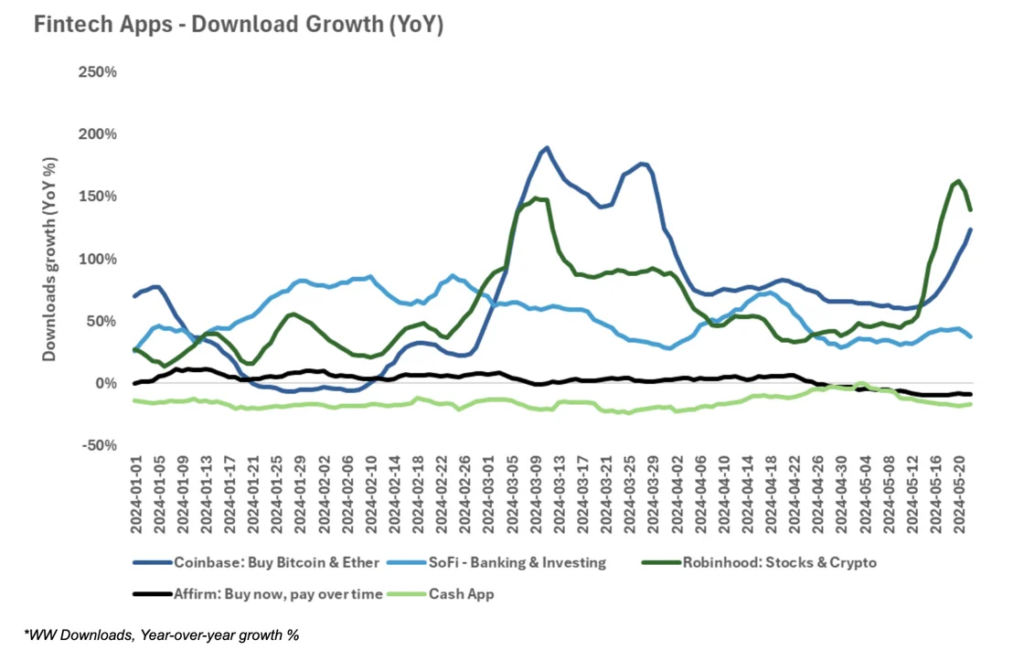

- Coinbase (COIN) – Coinbase downloads are accelerating in May, picking back up after strong trends in 1Q. Download growth accelerated to +162% YoY in the most recent week, up from ~60% in April. Coinbase downloads continue to trend up through 5/22, while Robinhood’s downloads peaked on 5/17 (now ~40% below that).

- Robinhood (HOOD) – The return of meme-stock interest drove consumers to the Robinhood app, with downloads spiking to +143% YoY in the most recent week – though downloads have fallen off from peak.

- SQ/AFRM/SOFI – Other fintech apps are not seeing the same surge – payment apps are weak and slowing with Cash app downloads -15% YoY and Affirm -10% YoY. SoFi downloads are solid (+36% YoY in May) but growth is slowing from 1Q.

Fintech apps are surging again in May, with both COIN and HOOD downloads jumping up over +140% YoY in the most recent week. This picks back up on strong trends in recent months with both apps posting solid growth in 1Q.

While both apps are showing strong growth, we note that Coinbase’s trends look more sustainable while Robinhood’s look more like a spike hand-in-hand with meme-stock trading. Coinbase downloads continue to trend up through 5/22, while Robinhood’s downloads peaked on 5/17 (now ~40% below that).

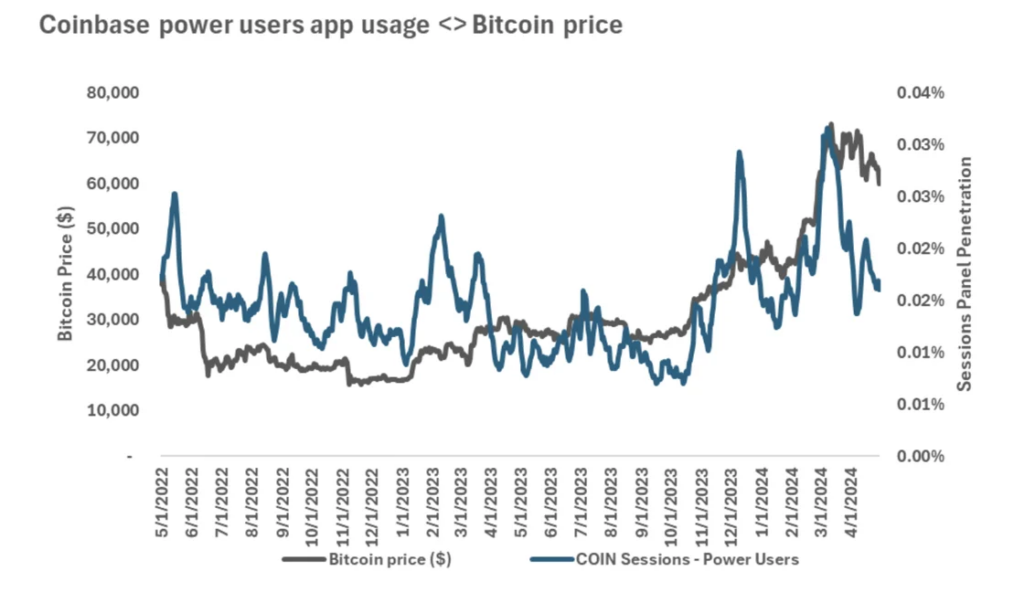

Coinbase app usage is related to Bitcoin prices – when Bitcoin prices increase, app usage increases.

Outside of trading/crypto apps, fintech apps are not seeing the same surge in usage. Payment apps are weak – with Cash App downloads -15% YoY in the most recent week and Venmo downloads down 20%. BNPL also looks weak with Affirm, downloads down 10% YoY in May and trending lower. SoFi continues to grow year-over-year (+30% YoY in May) but growth is slowing from 1Q.