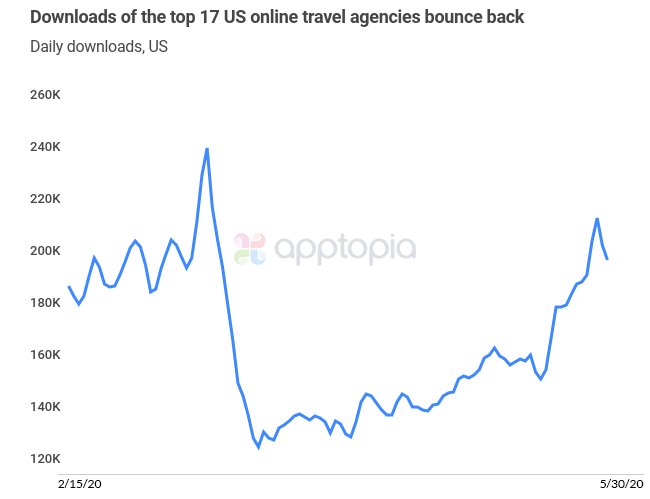

Downloads of the top 17 OTA (online travel agency) apps in the US got back to pre-pandemic levels on May 28th after increasing for 10 straight days. Combined sessions of these apps have grown 5% just over the past 10 days. Two weeks ago we saw app usage in China of the top international hotels bounce back. We’ll need to keep watching to understand if this is a true/full recovery.

The Top Players

There’s more to get into, but let’s quickly list off the top 17 US OTAs as defined by the number of new users added (downloads) over the past six months:

2. Expedia – 3.6M

3. Hopper – 3.4M

4. Booking.com – 3.3M

5. VRBO – 3.2M

6. Hotels.com – 1.7M

7. Priceline – 1.5M

8. Travelocity – 1.1M

9. Tripadvisor – 1M

10. Trivago – 980k

11. HomeAway – 920k

12. HotelTonight – 840k

13. KAYAK – 740k

14. Skyscanner – 720k

15. Orbitz – 660k

16. Skiplagged – 560k

17. Hotwire – 520k

Who’s in charge?

Combined, Expedia Group and Booking Holdings own more than half of the top grouping.

Expedia Group (NASDAQ: EXPE) owns six of them: Expedia, Trivago, Hotels.com, Orbitz, Hotwire, Travelocity.

Booking Holdings (NASDAQ: BKNG) owns three of them: Booking.com, KAYAK, Priceline

Airbnb owns HotelTonight and HomeAway owns VRBO.

Enjoying the data and insight? Get fresh learnings emailed to you ever Friday morning.

The Market

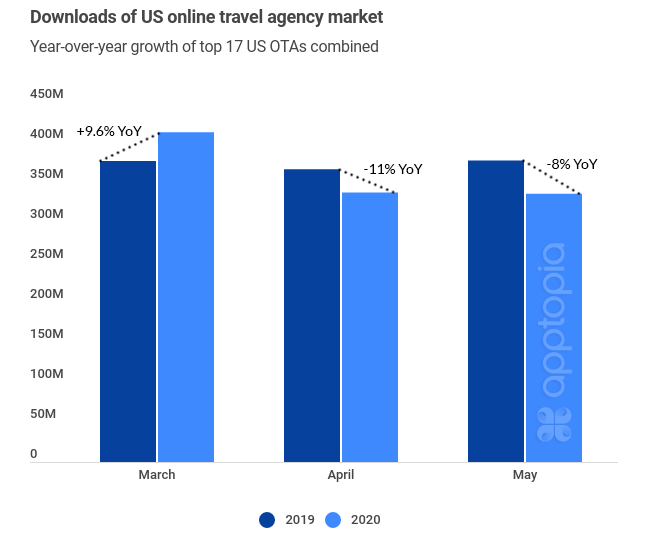

A quick check-in with how this market has been performing year-over-year as of late; March was off to a great start, enough to give it a YoY gain before plummeting in April and May.

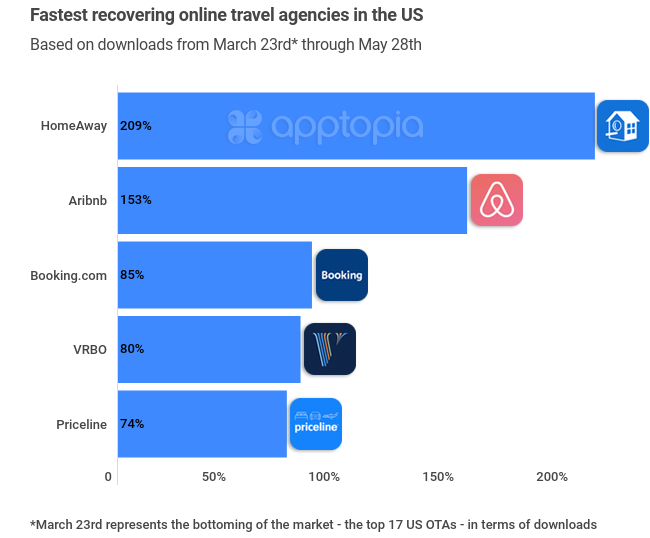

Fastest Recoveries

Looking at our market, the bottom for downloads was on March 23rd with 123,000. May 28th saw 215,000. From the bottom through May 28th, these are the fastest growing OTAs within our defined market:

The US OTA market is just one slice of the travel pie. I encourage you to explore Apptopia’s data to get a handle on what’s happening with hotels, airlines and more in the US and other geographies.