This was first published February 21, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

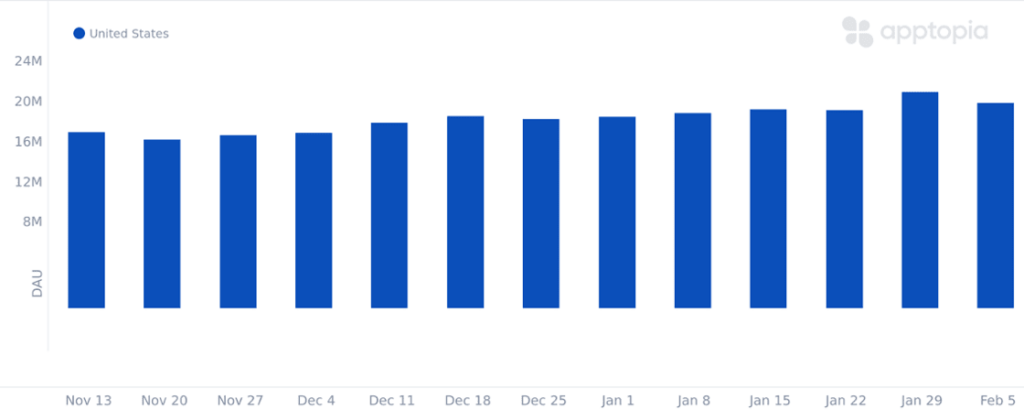

- While Temu (PDD) MAUs grew +59% QoQ in 4Q23, first-quarter trends indicate that Temu’s user growth is decelerating, with a sequential decline in DAUs in February.

- Despite increased advertising, Temu’s download trend following the Super Bowl was weaker than last year (-9% YoY).

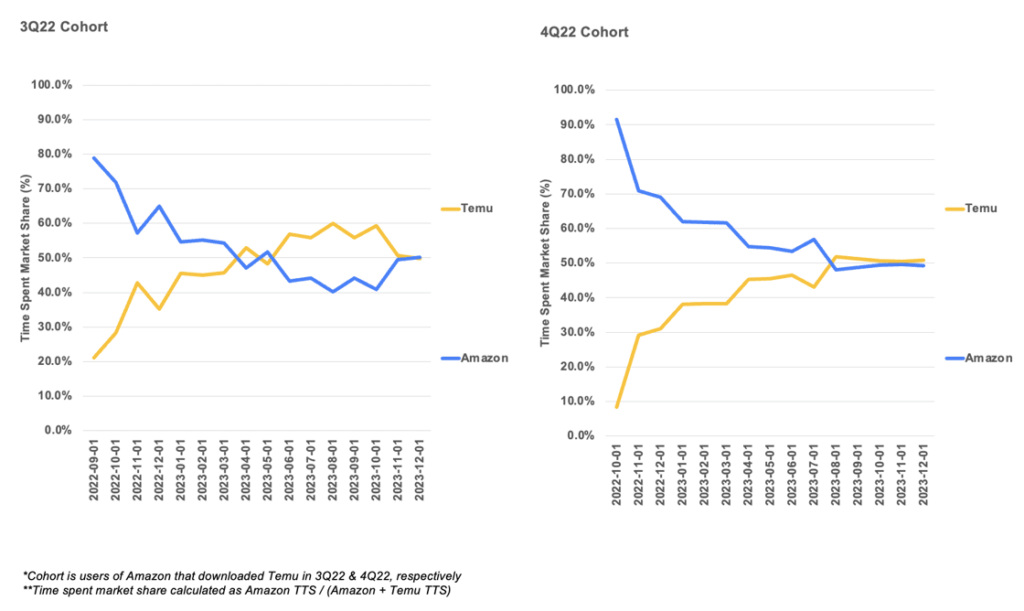

- Temu’s early adopters, who installed the app in 3Q22 or 4Q22, quickly outpaced Amazon (AMZN) in time spent. However, by 4Q23, the competitive pressure on Amazon looks to have eased.

Temu DAUs fall in February

Following strong growth in Monthly Active Users (MAUs) in 4Q23, Temu’s user expansion is showing signs of moderation in 1Q. In February, Daily Active Users (DAUs) experienced a sequential decline, leading to Temu’s rank hitting its lowest point since its app store debut. However, Temu’s six Super Bowl ads sparked a rebound, and downloads surged by +34% on Super Bowl Sunday compared to Saturday, marking the highest day-over-day growth since November. Nonetheless, total downloads from Super Bowl Weekend witnessed a -9% drop compared to last year, suggesting a potential deceleration in Temu’s growth despite its substantial advertising investments.

Competitive pressures between Temu and Amazon have notably eased, especially post-holiday season. For Temu’s earliest adopters (downloaded in 3Q22 or 4Q22), time spent rapidly gained ground and surpassed Amazon. In 4Q23, this pressure eased, with Amazon pulling back in-line with Temu.

Competitive pressure on Amazon easing

As Temu continues to expand its user base, its unique engagement model—designed to captivate users for twice the average duration—remains a key distinguishing factor setting the platform apart from other ecommerce players.