This was first published in our weekly newsletter, Apptopia Insight. To receive insights like this weekly, sign up here.

- DraftKings (DKNG) wins new user acquisition, but total downloads for Thursday through Monday are down -9% YoY. FanDuel (FLTR LN) grew 14% YoY for the period.

- Fanatics Sportsbook competes with BetMGM (MGM) for third in market share. Fanatics grew 133% week-over-week following NCAA Football kickoff, more than any other app. DKNG grew +121% followed by BetMGM +116%.

- Caesars Sportsbook (CZR) declines -66% YoY during NFL kickoff weekend and trails the market in total downloads.

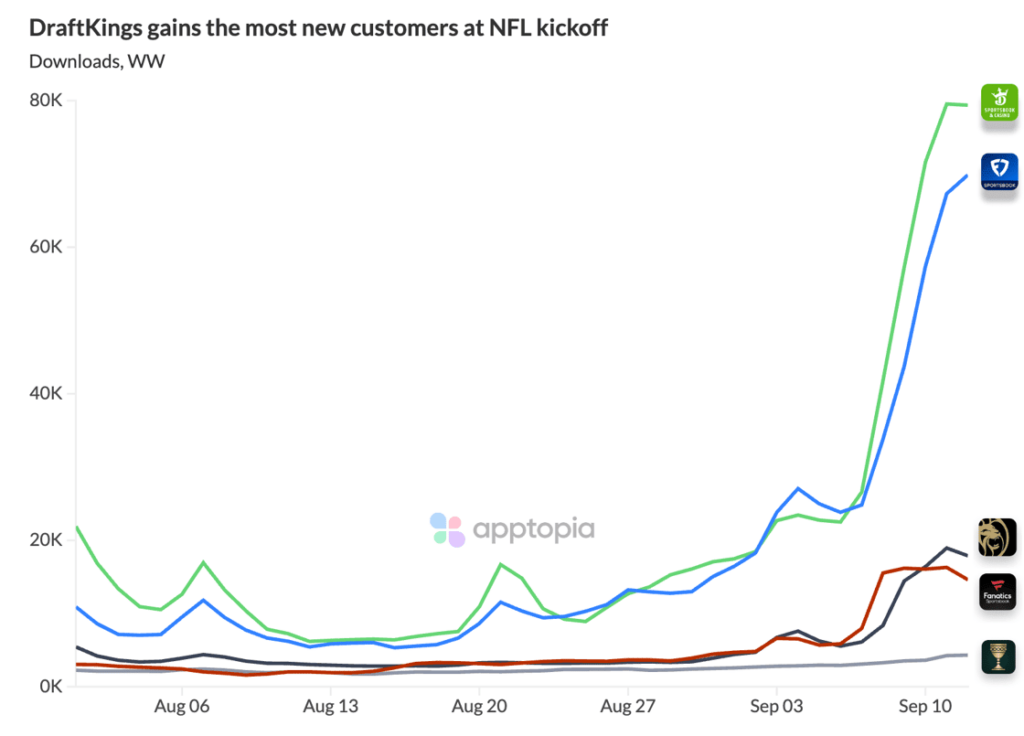

Sports betting apps accelerate every September in the U.S. as football starts. This year, the download ranks over NFL week one look similar to last: DraftKings won the most new customers again, FanDuel was a close second, BetMGM in third, and Caesar’s lagged. Notably, Fanatics Sportsbook entered the competition after its acquisition of PointBet.

Though DraftKings’ start was strong, our app data shows that after it won last year’s kickoff weekend, FanDuel ultimately emerged as market leader for the NFL season with market share rising to 42% in January 2023 compared to DraftKings at 35%.

As Caesar’s lagged considerably (it prioritized advertising heavily in 2022 as it opened in major markets like New York), BetMGM is now rivaling Fanatics for third in market share. Under Fanatics leadership and brand (last valued at $32B in December 2022), it will be fascinating to see how the private market competitor further solidifies its place as a leader among sports betting apps.

Kentucky recently became the 35th state to legalize active online betting, preceded by Ohio and Massachusetts earlier this year. This expands TAM for the market; however, year-over-year trends for the first NFL weekend were negative on the whole (DKNG -9%, BetMGM -1%, Caesars -66%) with the exception of FanDuel (+14%) and obviously newcomer Fanatics Sportsbook.