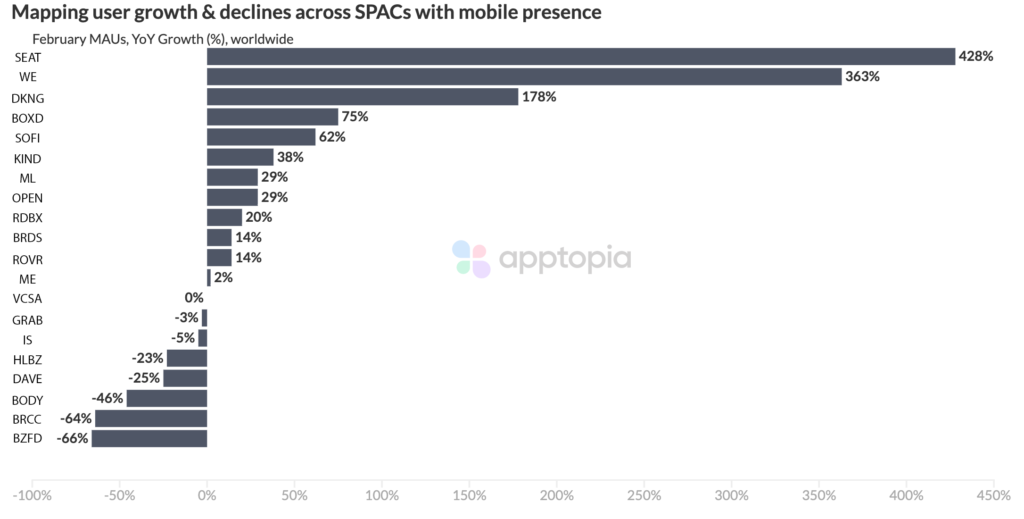

We looked into mobile trends for companies that became public via special purpose acquisition companies, more commonly known as SPACs. SPACs have a limited history of public disclosures, so having another gauge of business activity is useful.

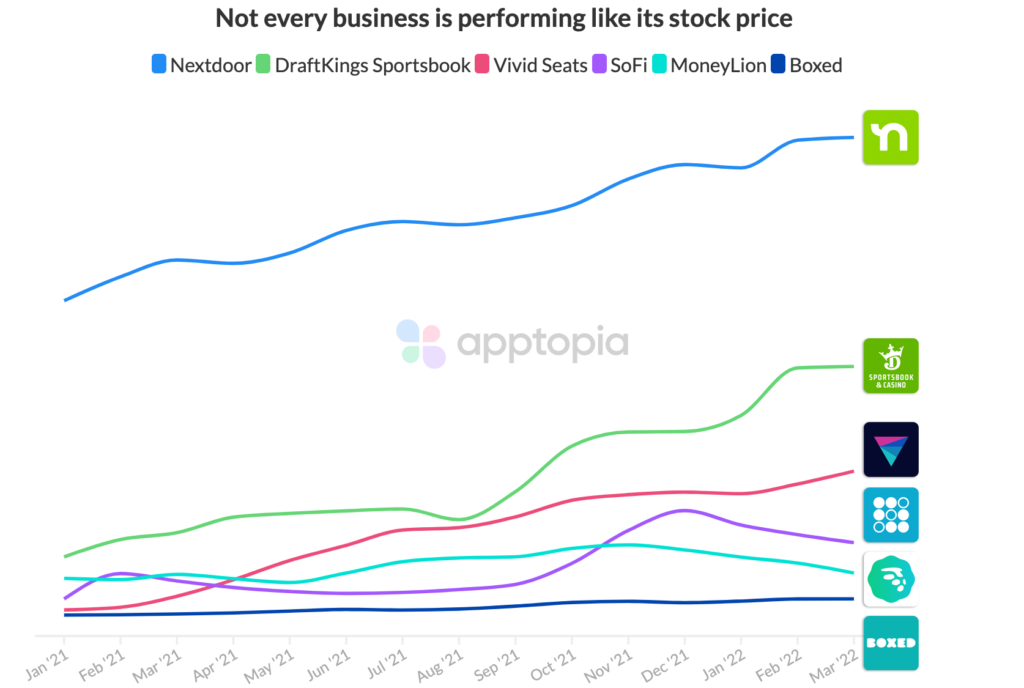

We know that investors always want ideas that the broader market might be missing. There are several companies here where the stocks have been pummeled, but Apptopia data shows that a piece of the business is doing well. When public consensus points one way and data points another, that is where opportunity lies.

The median drawdown (decline in stock price) for SPACs closed in 2021 is more than 50%! With the whole group selling off, it can be profitable to know which companies have positive business momentum and growing user-bases.

A couple companies that stuck out with strong YoY MAU growth include DraftKings (DKNG) and Nextdoor (KIND). Buzzfeed (BZFD) and Dave (DAVE) have monthly active user charts that resemble their stock charts.

Vivid Seats (SEAT) and WeWork (WE) top the list with MAU growth of 428% and 363%, respectively. Both of these companies are benefitting from COVID recovery trends. DraftKings (DKNG) growth stems from the continuing state by state legalization of sports betting in the U.S. Its MAU has nearly doubled since last February.

Dave (DAVE), Buzzfeed (BZFD) and Black Rifle Coffee (BRCC) are examples of companies that have app MAU trends consistent with share price declines. Dave is facing increasing competition from new and growing cash advance and buy now, pay later apps. Buzzfeed is being pushed to layoff its entire news staff as the company is losing money.

Dive deeper into any 5 apps of your

choosing with a free custom report