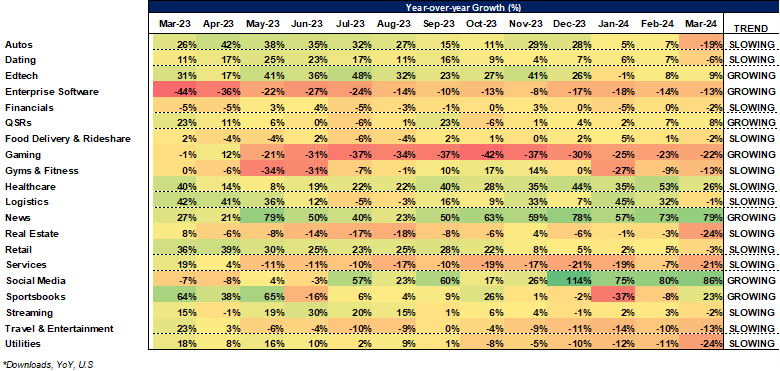

This was first published April 4, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- Travel downloads remain weak – year-over-year download growth is negative and slowed to -13% in March. Downloads for OTA apps are down 9% in March – a stable level throughout 1Q.

- Real estate/Autos fall – real estate search portal apps fell to -24% YoY and autos/auto dealers fell to -19% YoY, both slowing significantly in March.

- QSR apps growing – downloads of QSR/restaurant apps stand out on the positive side, with downloads up +8% YoY and gaining momentum in 1Q.

Mobile macro trends

Travel – Travel apps have been weak and negative YoY for 6 months, with a slowdown in 1Q. March downloads are -13% YoY. All travel subsectors are negative YoY – OTAs are -9% YoY in March but around that level throughout the quarter (ABNB remains positive at +27%). Airlines are -11% YoY and also stable in the quarter. Cruise lines decelerated to -27% YoY (RCL -30%) and Hotels decelerated to -26% YoY (MAR -15%).

Real estate/Autos – Large consumer sectors Real estate and Autos were weak in 1Q, with a leg down in March. Real estate search portals fell, led by Z (-22% YoY) and RDFN (-40% YoY). Auto dealers were also weak with CVNA, CARS, KMX all negative/decelerating in March.

QSRs – QSR apps were positive in 1Q and trended up throughout the quarter to +8% YoY in March. Standouts in the sector include WEN (+177% YoY), QSR (+31% YoY), and DPZ (+34% YoY). Smaller QSRs also outperformed while the largest QSRs are negative YoY (MCD -19% YoY, CMG -22% YoY) – potentially representing a catch up in digital engagement with customers.

Round of additional sectors – Dating app downloads slowed in March to -6% YoY in the US, with both BMBL and MTCH negative. Social media apps are up significantly in 1Q, but most of this is driven by a Facebook/META outage in March that caused a spike in downloads as users were forced to log back in to accounts, as well as Threads downloads remaining strong. Sportsbooks apps accelerated in March driven by North Carolina launch.