This was first published in our weekly newsletter, Apptopia Insight. To receive insights like this weekly, sign up here.

Instacart (CART) went public yesterday, CART priced at $30 and opened for trading at $43, above expectations. Not only is Instacart one of two tech companies to IPO this year, it also stands out as a consumer tech company that had high growth during the pandemic.

Since the COVID boom (and subsequent decline), Instacart has gone through a number of changes, most of which Apptopia’s data shows as positive. After a period of consolidation, competitive dynamics seem to be stable with an opportunity to continue to grow, at least on the mobile side.

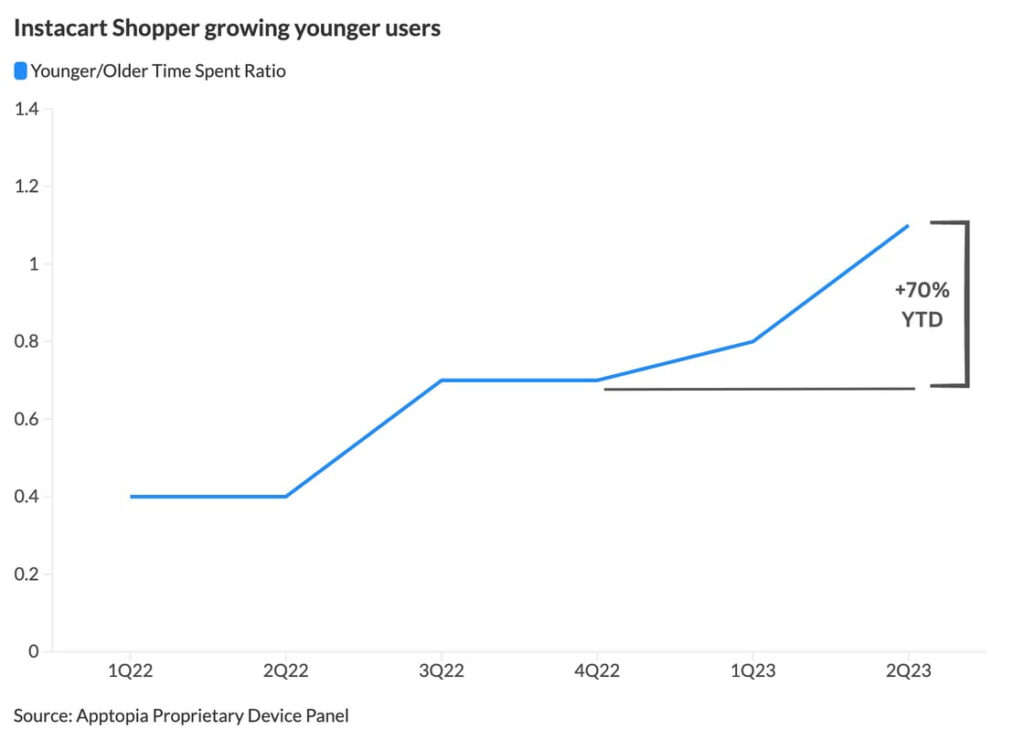

Notably, Instacart is making headway into the highest-value customer segments, namely, female users and young users.

Below, we summarized the top line data points from our Instacart Primer for an investment thesis on Instacart. The full research report analyzed customer app usage and competitive dynamics over the past 1-3 years and is available for download below.