This was first published January 31, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

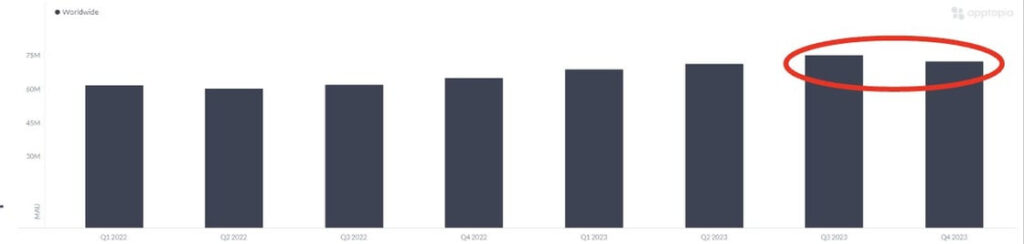

- Amazon Prime Video Monthly Active Users (MAUs) are DOWN QoQ in 4Q – despite Thursday Night Football.

- The last time usage trends were down QoQ was 2Q22.

- MAUs/DAUs tracks Amazon’s subscription services revenue closely; moreover, it represents advertising revenue potential.

Monthly Users for Prime Video Decline QoQ for first time since 2022

Amazon revealed this week that Prime Video will now go ad-supported (AVOD) by default, unless users opt for a monthly subscription fee. This strategic move to expand its advertising business places the majority of the 200 million Prime subscribers into the advertising ecosystem. However, it’s at a unique inflection point in performance across its subscription apps:

- Amazon Prime Video MAUs are DOWN QoQ in 4Q despite Thursday Night Football. Prime Video MAUs/DAUs tracks Amazon’s subscription services revenue closely, so this seems like a potential weakness in 4Q.

- Amazon Shopping app sessions are down year-over-year (YoY) in 4Q, contradicting strong retail shopping numbers for the same period.

- When we look at what other Amazon apps that Amazon Prime Video app users use, we see that over time the trend is down. Instead of Amazon building its moat of app usage, it appears to be weakening.

Making the ad-supported version of Prime Video the default for all users positions Amazon for greater profitability but also seeks to engage a broader audience, potentially helping to grow the user base and active users after the weakening in Q4. As the streaming landscape becomes increasingly competitive, the proliferation of ad inventory among numerous streaming platforms puts ad pricing at risk.