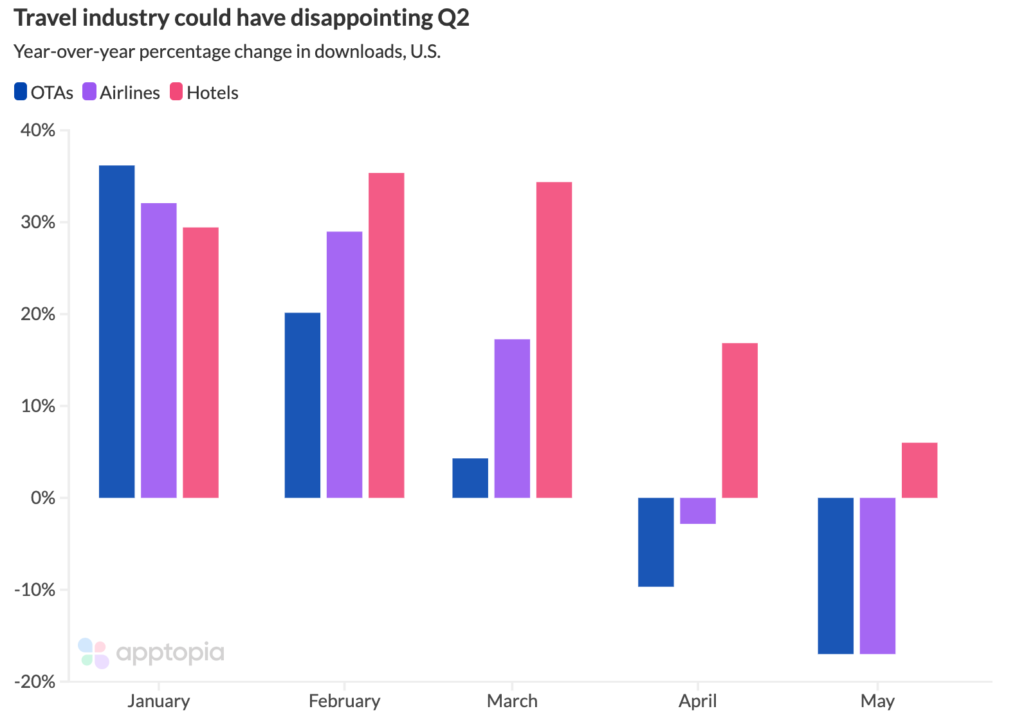

Mobile app data from Apptopia indicates a disappointing Q2 for the U.S. travel industry. Right now stock prices for companies like Booking.com, United Airlines and, Marriott are up year-over-year but their mobile app performance paints a different picture:

Downloads of the top 18 OTA (online travel agency) apps are down 10% YoY in April and are estimated to be down 17% YoY in May. Q2 is currently estimated to be down 13.5% YoY.

Downloads of the top 10 Airline apps are down 10% YoY in April, falling sharply after being +35% YoY in March. They are estimated to be down 17% YoY in May and Q2 is currently estimated to be down 15% YoY.

Downloads of the top 5 Hotel apps were +16% YoY in April but are estimated to be down 6% YoY in May. Q2 is currently estimated to be +3% YoY.

Why are we using Downloads? Because we want to understand customer growth and Apptopia estimates Downloads as new installs, essentially new users coming to a company’s mobile app.

Typically OTA apps like Booking.com and Expedia are the leading indicators for travel as they are installed for trip planning purposes. Airline and then Hotel apps then follow the trend set by the OTAs. Hotels are showing some resistance, potentially because they are a little behind OTAs and Airlines when it comes to being mobile friendly. They are putting more investment into their apps lately and encouraging guests to download the app in their customer communications.

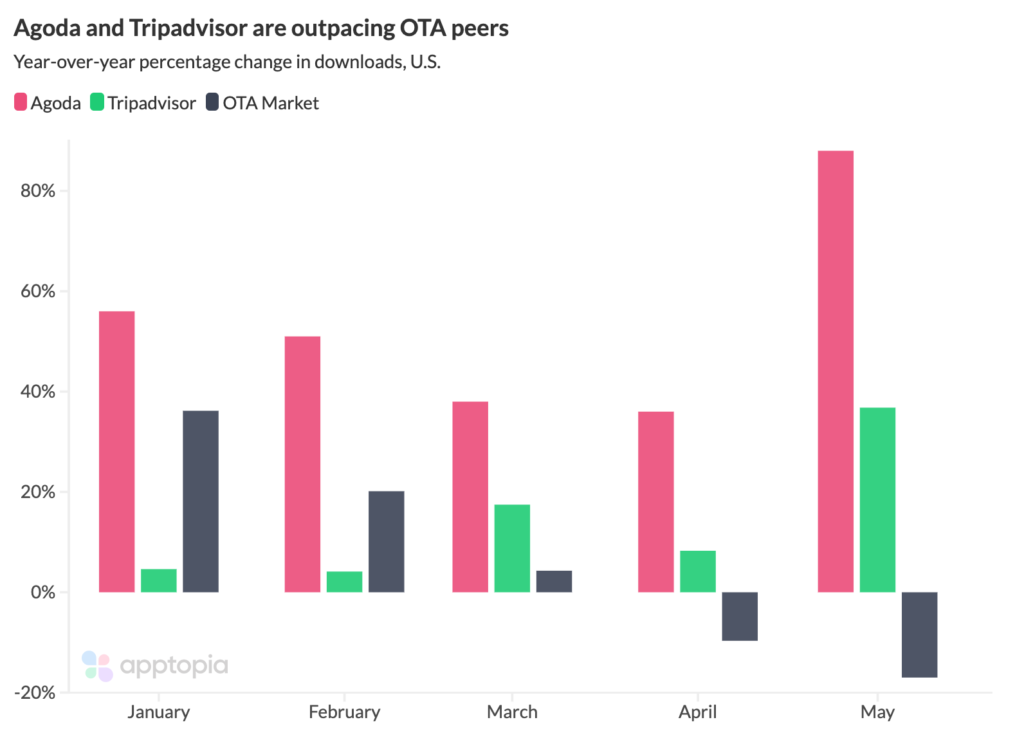

Agoda and Tripadvisor are bucking the larger trend, with each continuing to grow while the market as a whole falters. Agoda is certainly the more notable of the two and is owned by Booking Holdings. It is traditionally popular in Asian countries like India, South Korea and Indonesia but the company started spending more on mobile advertising and app store search in the United States late last year.

Q3 is typically the best quarter for travel companies. We’ll continue to monitor trends to determine where consensus estimates may differ from our own.

Explore Q1 2023 mobile growth through

the lens of UA Brand Efficiency.