Food delivery app growth and engagement declined and stagnated in 2021. A worrying trend line for the market that ended 2020 with multiple billion-dollar acquisitions and DoorDash’s $60.2B public market debut.

The top six players in U.S. food delivery are DoorDash and Caviar, GrubHub and Seamless, Uber Eats and Postmates. 2020 was a banner year with Apptopia data showing a 12% lift in total sessions, comparing January with December. During that time, GrubHub was acquired for $7.3B by European food delivery company Just Eat Takeaway, and Uber Eats bought Postmates for $2.65B.

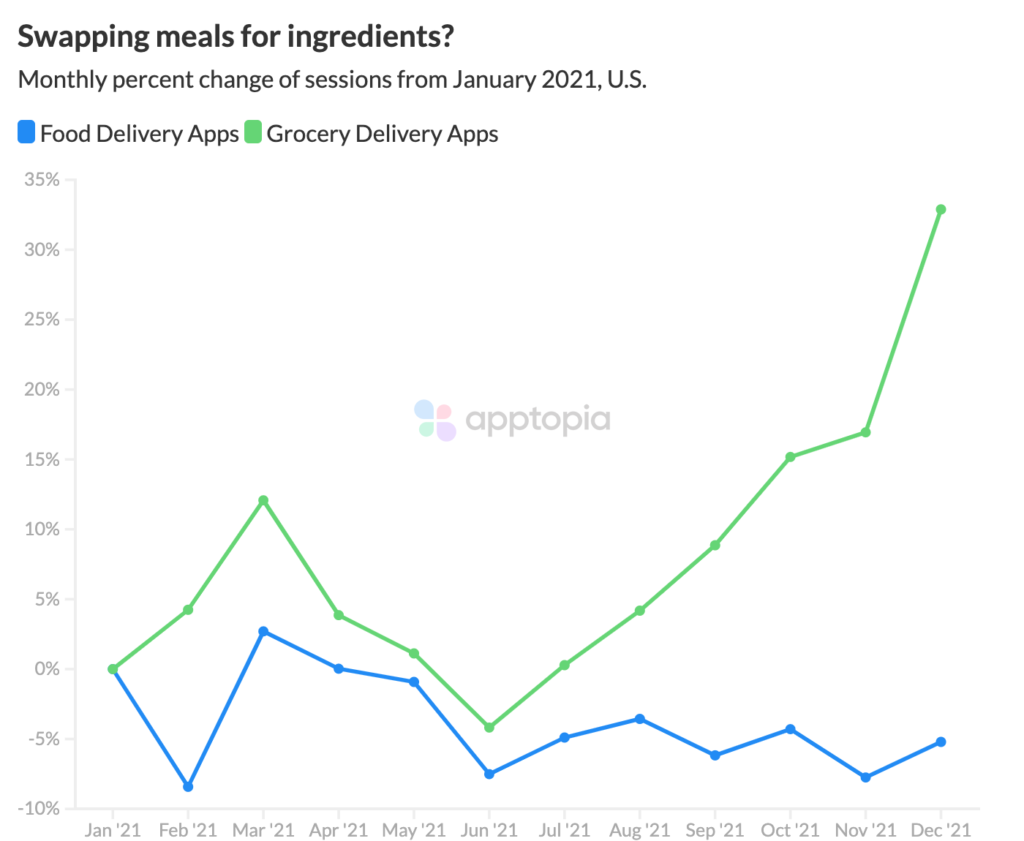

Usage will be more indicative of consumer interest for an established market like food delivery than downloads (this explains what downloads do and do not measure), so let’s zoom in on total sessions in 2021:

- During Q1 2021, total sessions increased 3% and peaked for the year in March.

- By the end of Q2, total sessions fell 10% from March.

The rest of the year shows no real gain. The majority of business for these companies is restaurant delivery, so are consumers hungry for another type of food delivery? We noticed positive growth in the grocery delivery market – in performance data and number of companies in the market – and we were not the only ones.

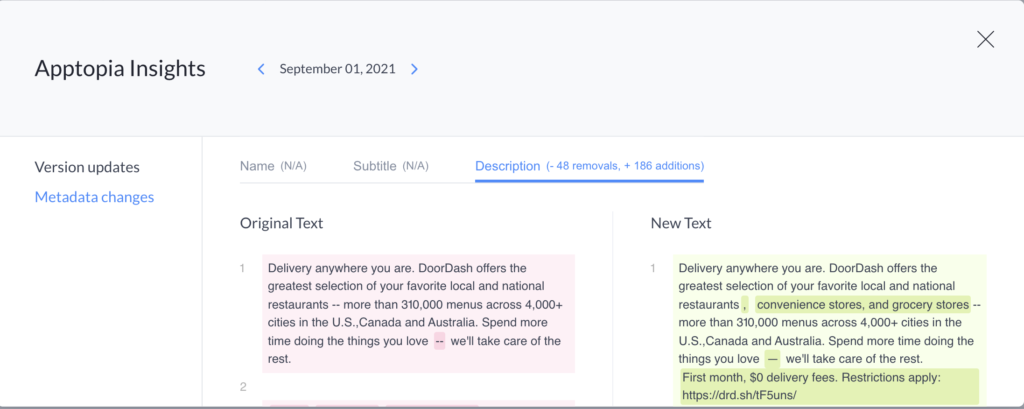

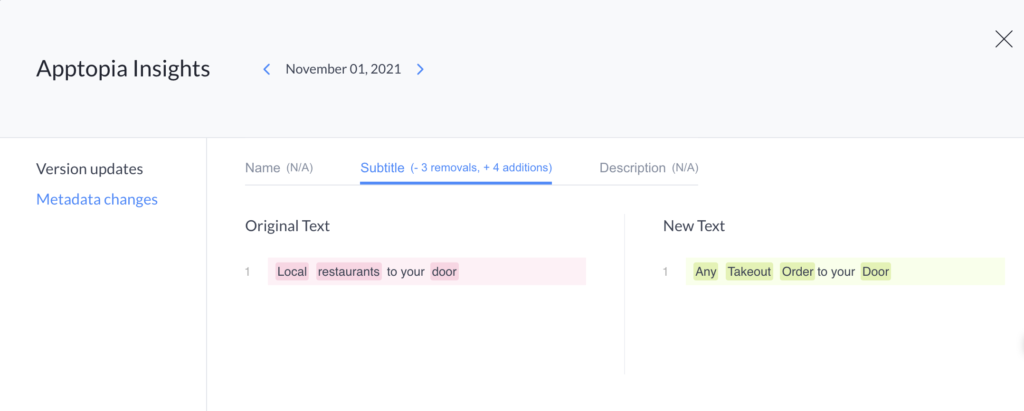

In September, DoorDash added delivery from “nearby grocery and convenience stores” to its app description. In November, Uber Eats deleted the word “restaurant” from its app title, opting for “Any takeout order to your door”.

In December, grocery delivery apps posted a 20% increase in downloads from November.

DoorDash and Uber Eats are the market leaders in food delivery apps, respectively, so it’s not surprising that they spotted the trend and are acting on it. Uber Eats’ change from “Local restaurants to your door”, to “Any takeout order…”, may seem too subtle to be indicative of a strategy change. But remember, it has to be clever with its entry to compete in convenience and grocery delivery considering it owns Postmates… While its app description does not use the words “grocery” or “convenience store”, its first featured image in the App Store advertises both.

Dive deeper into this market, or any other, with a free custom report