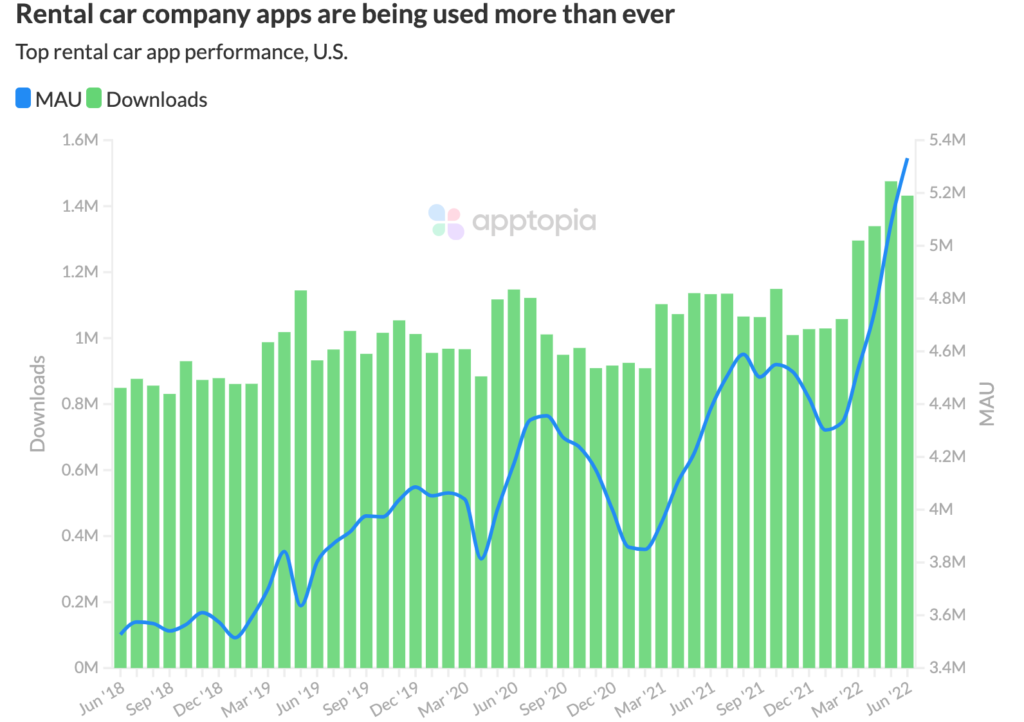

Even with gas prices rising, people have the travel bug. New installs and monthly active users of car rental apps in the U.S. hit all-time highs in May. MAUs are projected to be higher in June but new app installs are expected to fall slightly. Clearly, there’s a lot of pent up demand as people could not or did not want to travel in 2020 or 2021.

New app installs, also known as downloads, are projected to increase 27% YoY in Q2 2022, while MAUs are expected to increase 19.4%. Enterprise (39.6%), Hertz (36.8%) and, Turo (34.3%) are growing MAUs the fastest, YTD. Enterprise launched ReadyPass in May, a new feature enabling app loyalty users to bypass the airport counter and get their rental vehicle quicker.

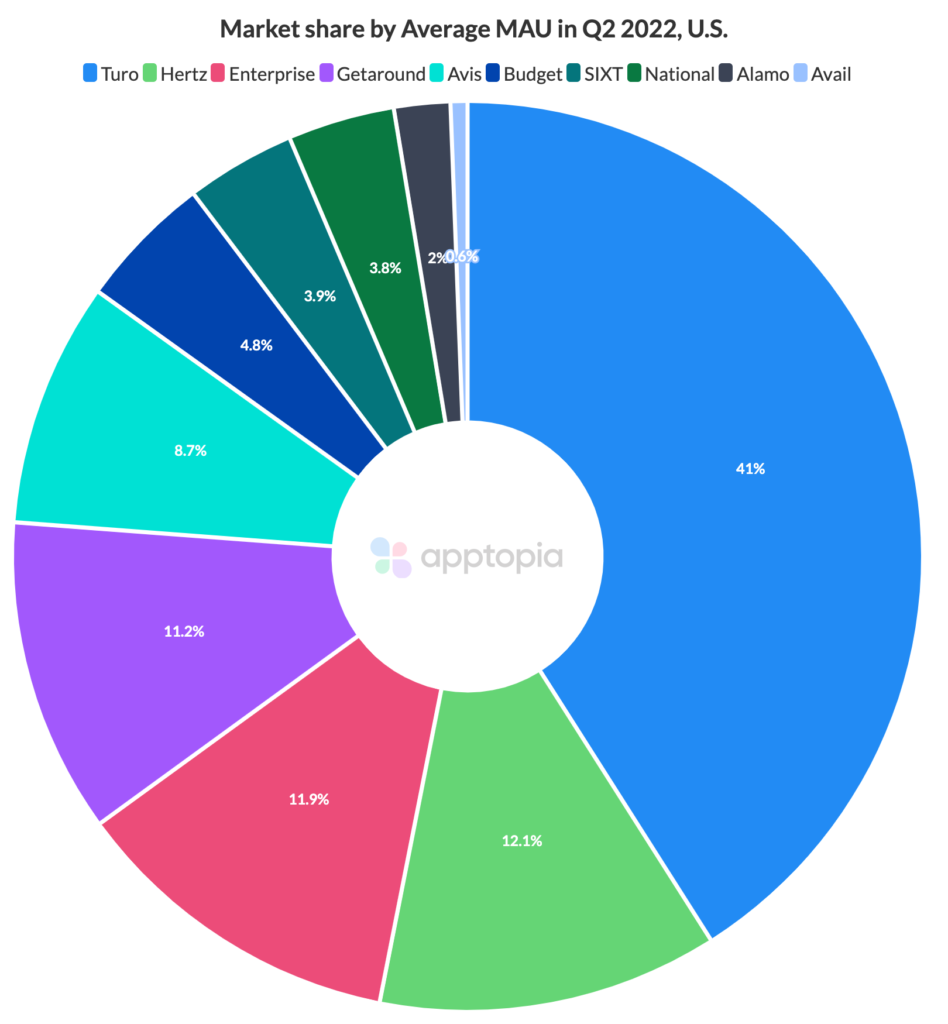

Turo is the clear market leader, remarkably owning the top spot, by way of MAU, since October 2016. Turo and a few other players operate a little differently than the traditional car rental companies in that Turo does not hold any inventory, giving it a massive financial advantage in certain situations. Turo operates like Airbnb, enabling hosts to rent their cars to travelers.

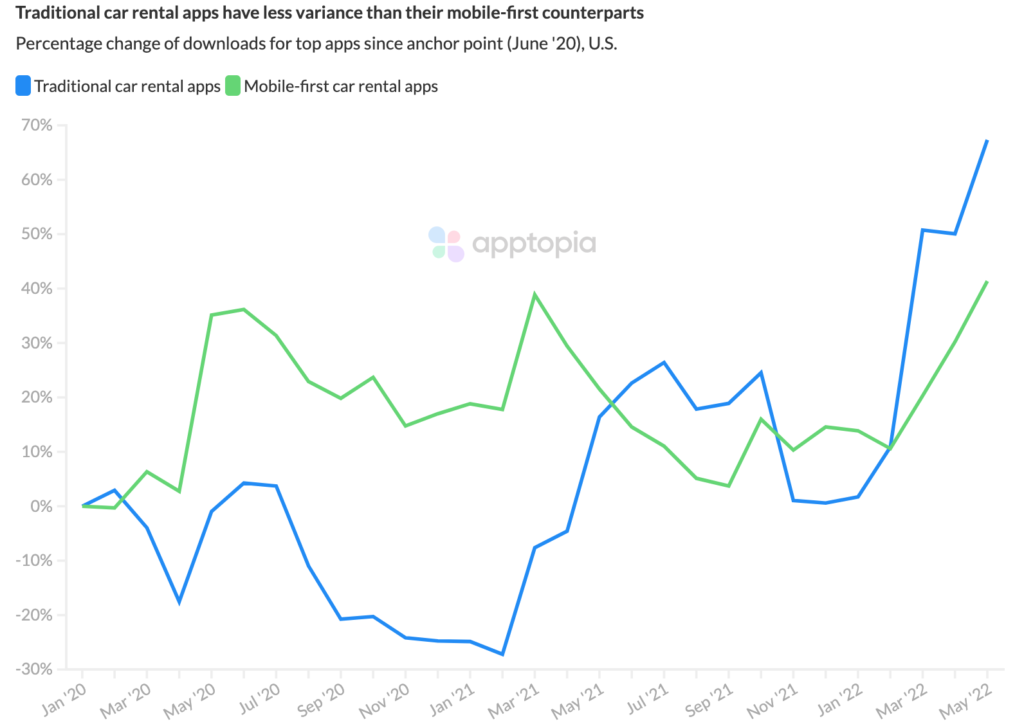

Many car rental companies are very old; Sixt was founded in 1912 and Hertz was founded in 1918. All have innovated and enabled customers to bypass lines via their mobile apps but we still wanted to put the traditional players against the mobile-first ones like Turo, Getaround and Avail. While both traditional and mobile-first players are currently rising rapidly, mobile-first companies are doing so much more sharply. However, they were hurt significantly more during the pandemic, leading me to believe customers were more trusting of companies, rather than “hosts,” to provide sanitary car environments.

The travel industry is experiencing great intense consumer interest accompanied by rising fuel prices and understaffing. Stay in the loop by downloading our free travel report below and/or creating a free custom report of your own.

Your next destination: