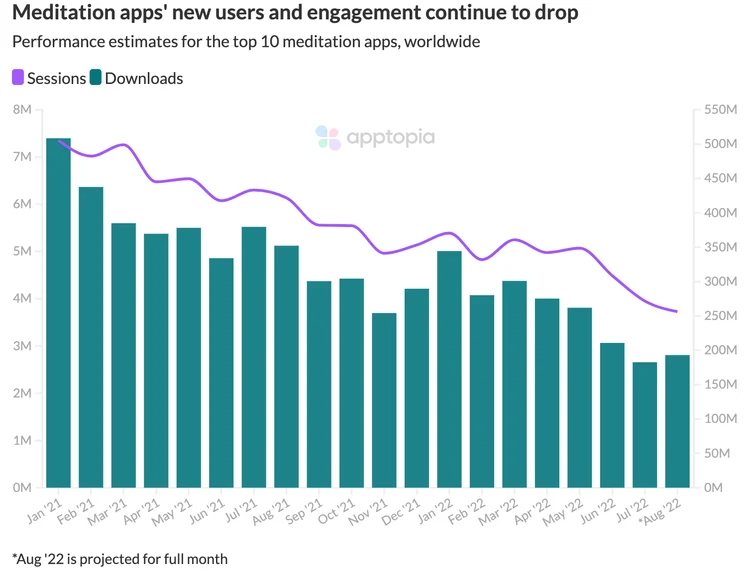

- Combined User Sessions of the top 10 meditation apps have fallen 48% from their height in Q2 2020.

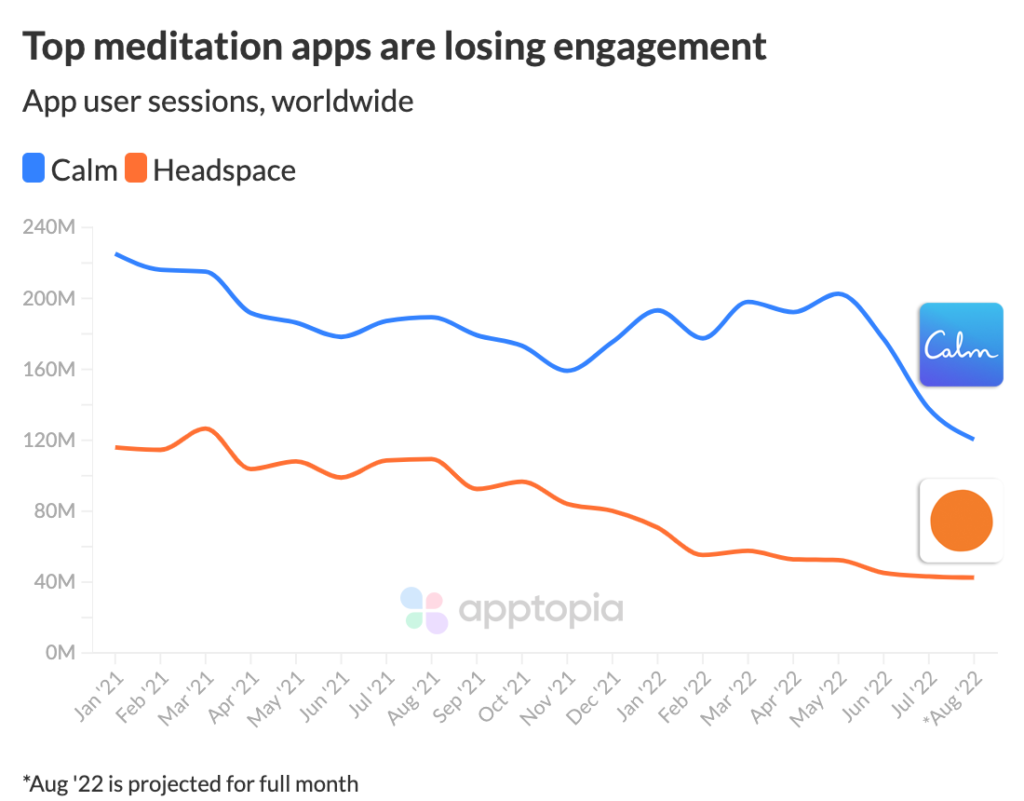

- User sessions of Calm and Headspace are down 26.4% and 60.3% YoY in July, respectively.

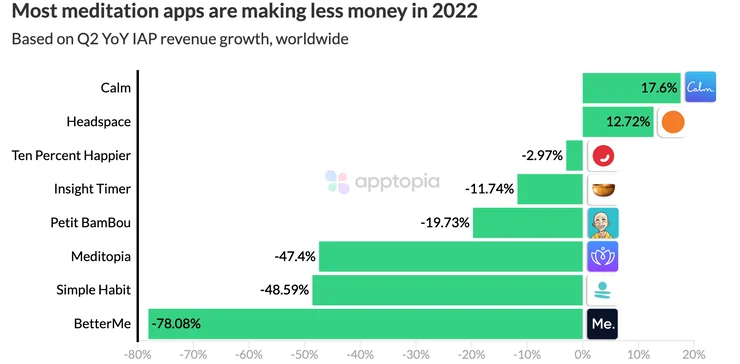

- While in-app purchase revenue is down for their competitors, Calm and Headspace have grown Q2 IAP revenue by 17.6% and 12.7%, YoY, respectively.

Calm just announced it is laying off 20% of its staff. The top two meditation apps have had a steady downward trend for engagement metrics since January 2021. User sessions of Calm are down 26.4% YoY in July, and Headspace is down a whopping 60.3%. As you can see in the graphic below, Calm did get a bump at the beginning of the year when almost all health & fitness apps have their best few months, but it started to decline dramatically shortly after Memorial Day.

All top meditation apps are experiencing downward trends in engagement with the exceptions of BetterMe: Mental Health and Breethe. On average, the apps in this market are seeing their sessions down 30% over the past 90 days. Over the same time period, BetterMe’s are up 12% while Breethe’s are up 55%.

With less engagement comes less revenue, unless you are the leaders of this market. Calm and Headspace were still able to increase revenue year-over-year in the second quarter. Interestingly enough, both actually had negative growth rates from Q2 2020 to Q2 2021.

Meditation apps were bloated with new users during the heart of the pandemic and these users are starting to churn. However, Calm and Headspace clearly did a better job of converting users to longtime, paid users. Normally I would have said this is a situation where people have stopped using Calm and Headspace but forgot to cancel their subscriptions. However, Apptopia’s X-Ray Intelligence tells us all of their top competitors also use a subscription style of monetization as well, and they are seeing IAP revenue slow.

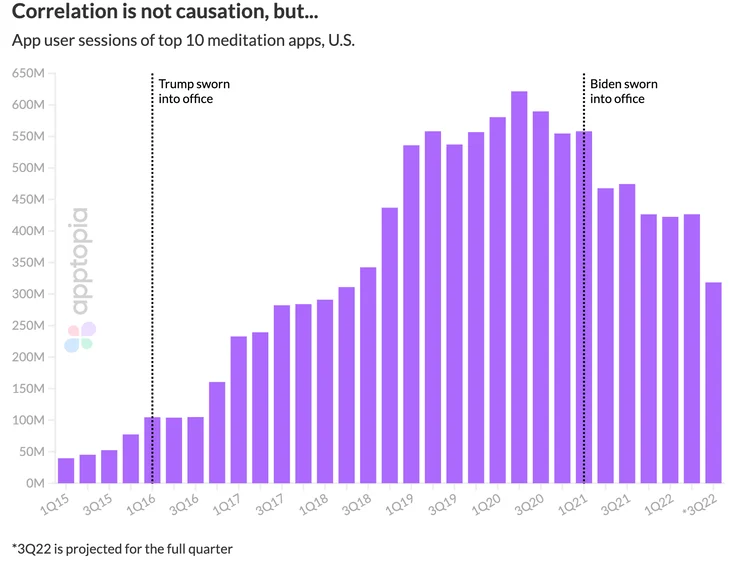

Part of the reason engagement is down may not be that people do not want to meditate but that they have or feel like they have less time to do so now that “normal” life has resumed. For example, public transit apps like MTA, BART and MBTA are almost back at pre-pandemic levels of engagement. From the U.S. perspective, which is the largest market for meditation apps, could who is president have an effect on people wanting to chill out and use meditation as a tool? I think the timing of the chart below is more coincidence than not, but I still wanted to provide this annotated view of meditation app engagement over time:

After reviewing this data, you may want to dive deeper into mental health, exploring professional therapy apps like BetterHelp or Talkspace, or maybe apps more focused on anxiety & depression like Sanvello or Wysa. You can get your custom free report on these apps or any others by clicking the blue button below.

Dive deeper into mental health apps with a

free custom report