Apptopia provides best-in-class mobile consumer data to the investment community. For over a decade, our data has delivered positive ROI to more than 200 financial institutions. More recently, however, we have been using Apptopia’s 15M+ user panel to deliver device-level insights that help quickly spot trends and arm analysts with deeper understanding. In this case, we employed our panel to understand an inflection point in ChatGPT’s usage.

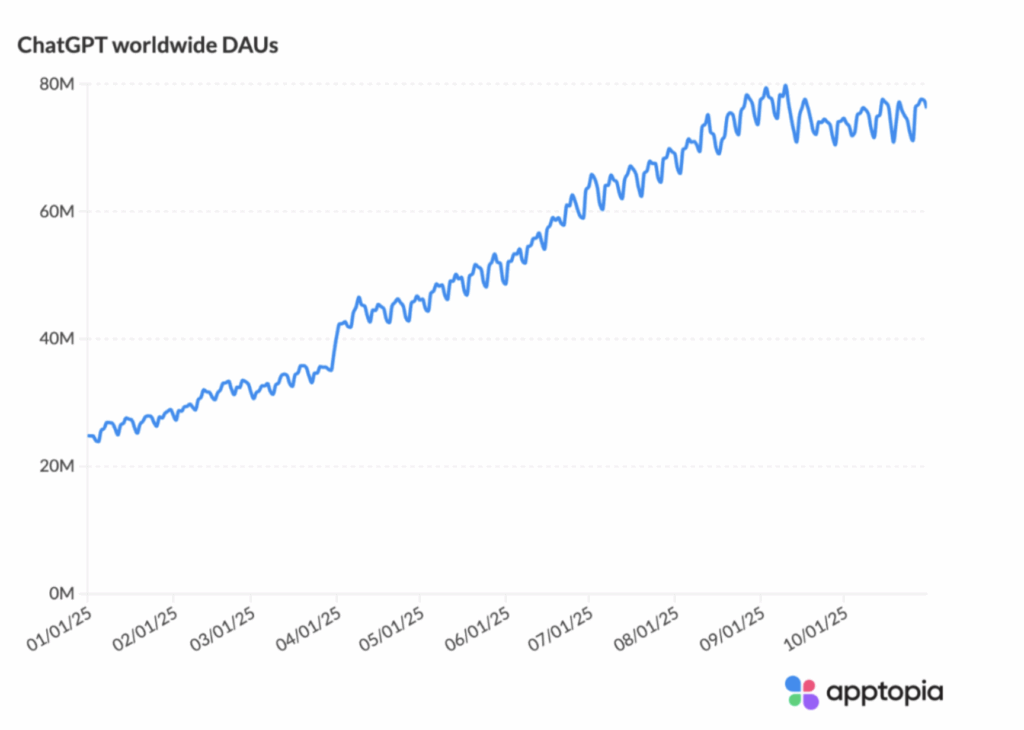

When analyzing top-of-mind sectors like AI, Apptopia’s data delivers insights beyond the hype. While the capex spending announced by AI companies captures headlines, the actual user behavior on ChatGPT, Copilot, Grok, and the like, will determine whether or not the AI buildout is meeting demand or in a bubble. After strong growth in its DAUs for two years, ChatGPT hit a plateau in early September 2025. Since September 10th, 2025, ChatGPT’s worldwide DAUs are actually slightly lower:

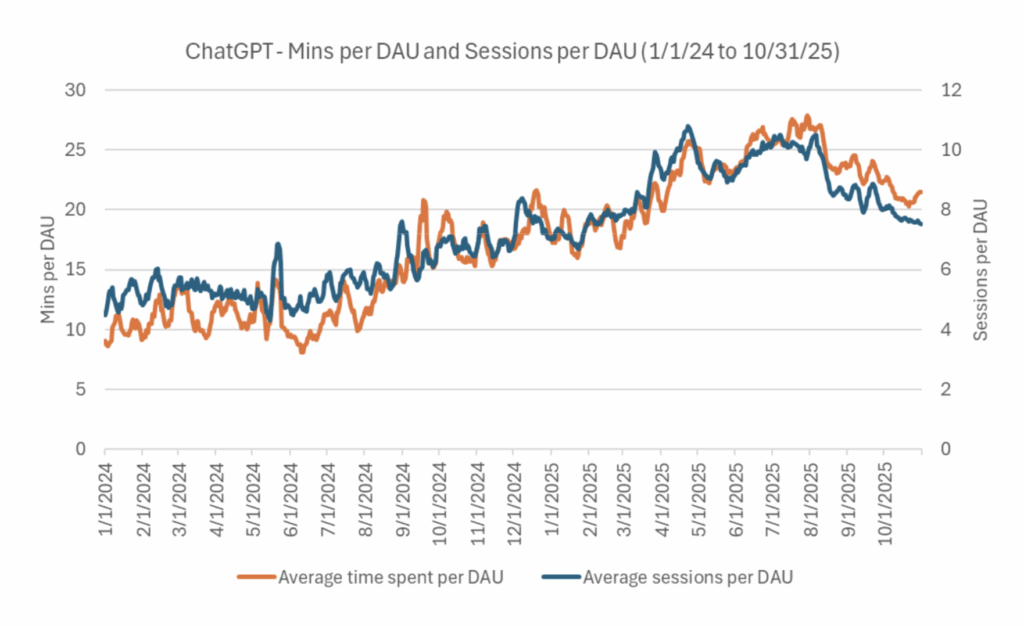

Stalling user growth, in and of itself, is not necessarily a problem. After all, ChatGPT saw its DAU growth flatline from mid-December 2024 to mid-January 2025, but then return to growth thereafter. However, if these same users are also engaging with the app less, then there is more reason for concern. In the chart below, we show that users are both spending less time on the app per day (left axis), and opening it less often each day (right axis):

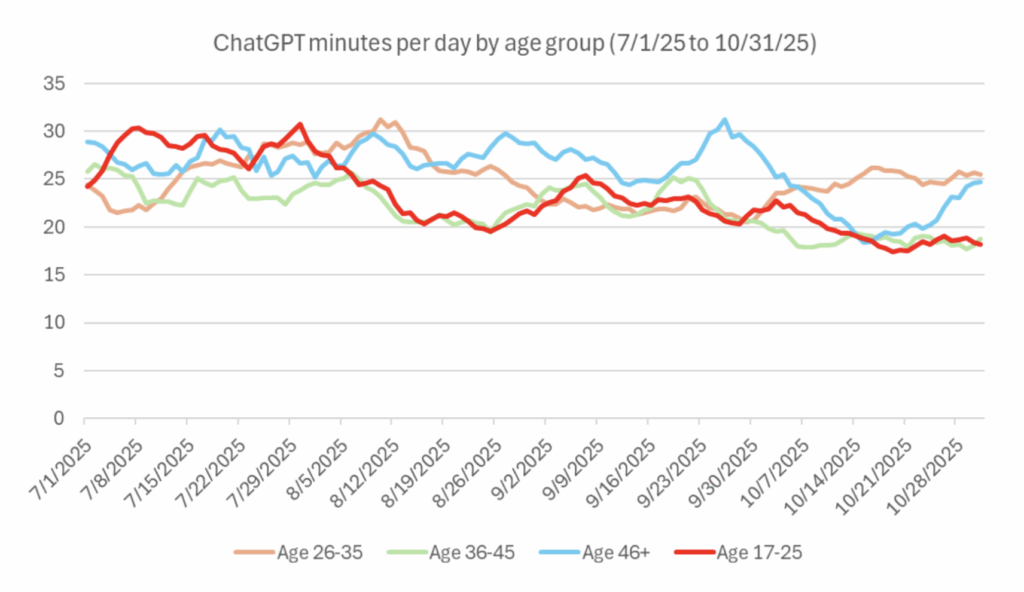

Using our panel data, we can continue to drill down into where exactly the problem lies for ChatGPT. Users aged 17-25 were the demographic that spent the most time per day on the app in July, but as of October, this age group spent the least time in the app. It appears that ChatGPT has lost the attention of Gen Z.

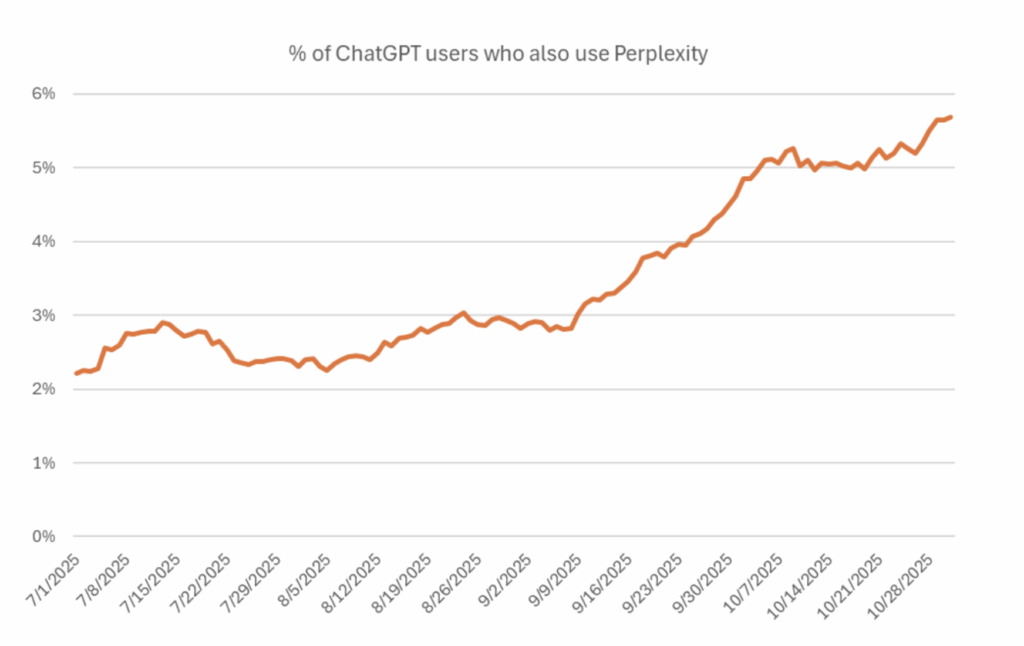

The final question we always pose to the device data is “where are these users going?” While there are many ways to answer this question, just simply seeing which apps ChatGPT users are spending more and more time on can be revealing. Indeed, the percentage of ChatGPT users who are also using Perplexity has doubled since July. While it is still a small percentage, it is a competing app and hence vital to track as this trend develops.

Apptopia’s data enables investors to track trends as they develop in real-time. By also using insights from our user panel, analysts are now armed with the tools needed to get to the bottom of why those trends are occurring.