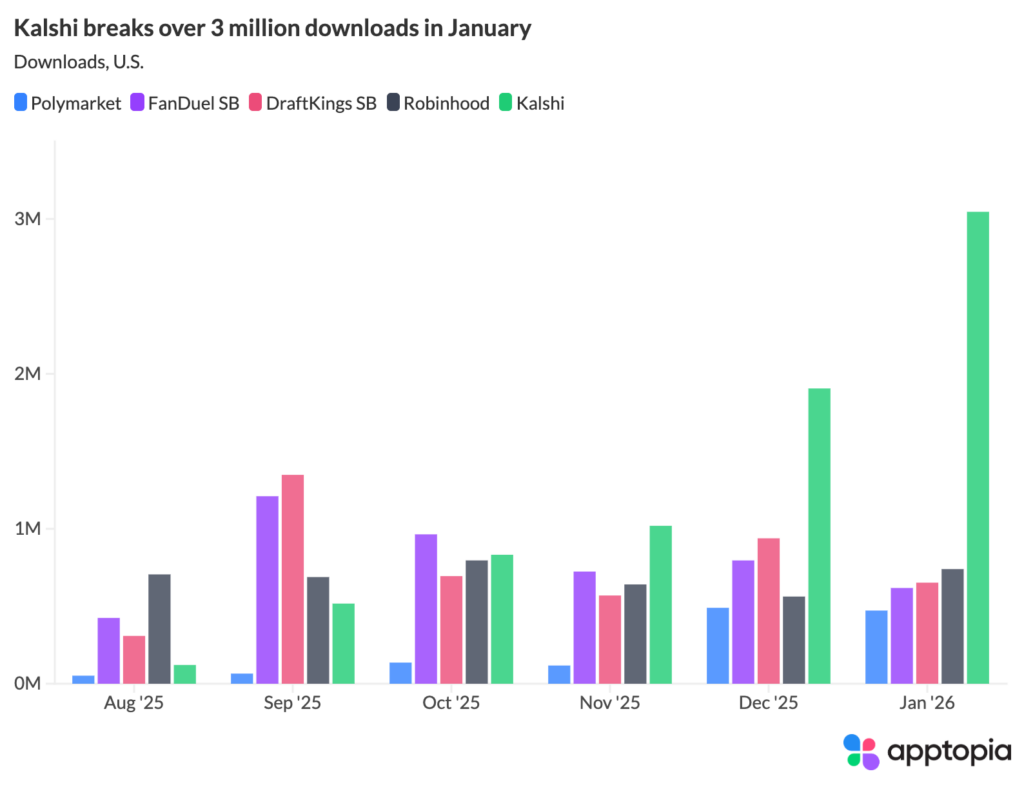

Kalshi downloads have been absolutely ripping since August. In January, the mobile app posted more than 3 million downloads in the US. This is more than DraftKings Sportsbook, FanDuel Sportsbook, or Polymarket have ever had in a single month.

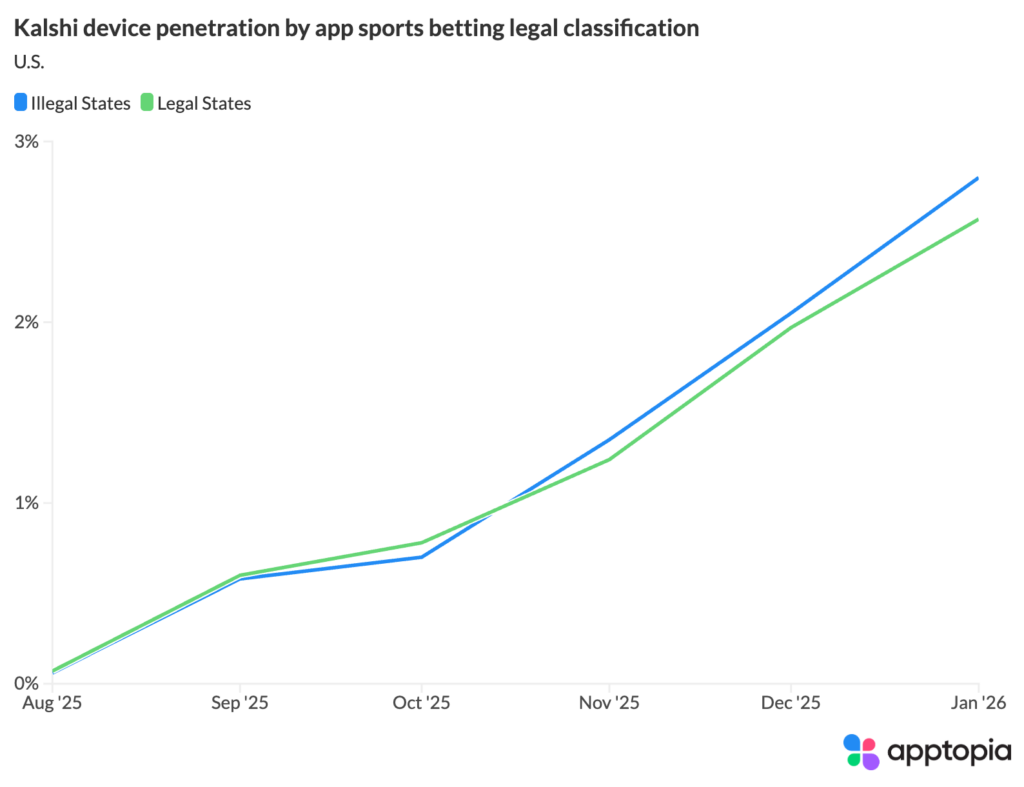

Kalshi is legal in all 50 states even though users are allowed to bet on the outcome of sports games, props and stats. As expected, it’s more popular in states where mobile app sports betting is illegal, but not by much.

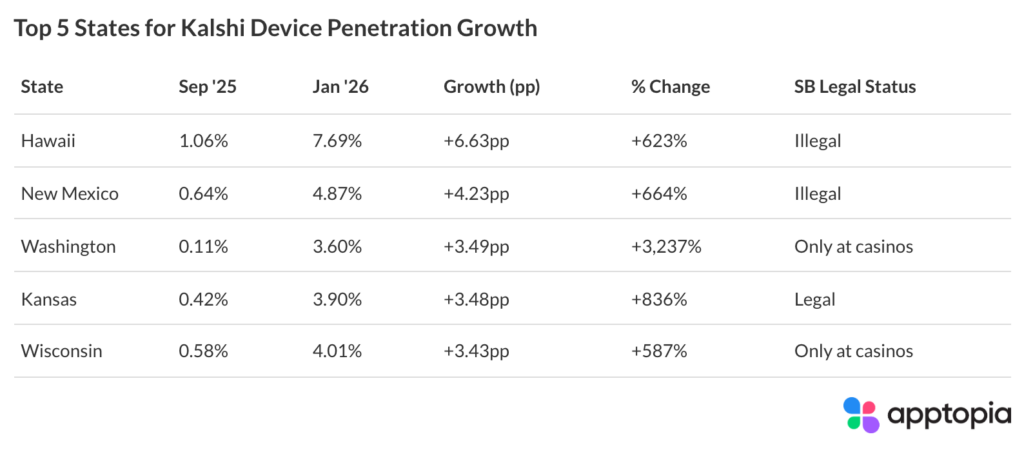

Truly, there is close to no difference. This means people are choosing to use Kalshi because they like it, not just because they cannot get their sports betting fix where they live. However, since September, the 4 out of the 5 fastest growing states for device penetration of Kalshi are states where mobile app sports betting is illegal. It’s possible the small gap we see above continues to widen.

Technically it is legal in Washington and Wisconsin but users need to be on-site at a casino. To me, this might as well be classified as illegal because of how most people interact with these apps. If they are traveling to a casino, they don’t really need to be leveraging a mobile app.

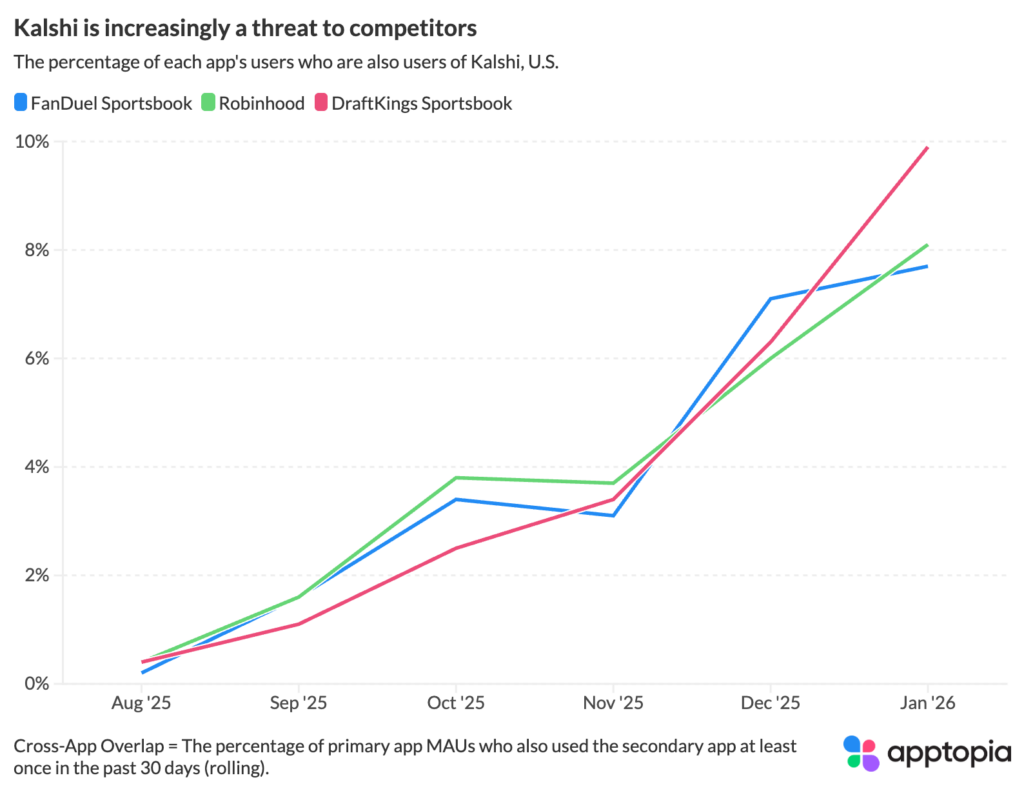

Apptopia’s consumer device panel is able to measure cross-app overlap, or the percentage of one app’s users who are also using another app. About 10% of DraftKings Sportsbook app users were also using Kalshi in January. The cross-app overlap between Kalshi and the major sportsbooks has been growing almost every month since August. The same goes for Robinhood.

“DraftKings and FanDuel are likely seeing data similar to our cross-app usage, which is why they launched their own prediction market products,” said Tom Grant, VP of Research at Apptopia.

“These companies just need users placing bets. It doesn’t really matter which product they’re doing it through. If a DraftKings user wants to bet on Fed rate decisions instead of the Patriots covering the spread, DraftKings would rather keep that action in-house than lose the customer to Kalshi. It becomes an exercise in branding and dominating search results. The standalone app strategy enables them to not have to hedge keyword strategies with a single flagship app.”

Robinhood, DraftKings, and FanDuel have all launched prediction markets late last year. For Robinhood, the product is within its flagship mobile app but DraftKings and FanDuel have launched standalone mobile apps dedicated to prediction markets.

In its first 30 days on the market, DraftKings Predictions has been installed 43k times. When DraftKings Sportsbook launched back in 2018, it was installed 127k times through its first 30 days. FanDuel Predicts (30k) similarly did worse than its sportsbook counterpart (57k) at launch in 2018.