This was first published September 17th, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- NFLX – Ending subs strong as MAUs re-accelerate

- SPOT – Premium sub growth looks to stop decelerating

- META – DAP growth tracking ahead of consensus

Welcome to our second installment of mid-quarter previews! Click here to see the whole preview file, or just check out apptopia.com to get a mobile read on the quarter for whatever stock you like.

In this installment, we would like to call attention to some larger cap stocks whose prices have been flattish of late, but whose mobile data has not. It is always exciting to find the next CRCL or even RBLX, but large caps deserve some appreciation too.

Netflix – Ending Subs

Yes, we know Netflix does not report Ending Subs quarterly anymore. But that is what makes mobile data so useful – you can still know what is happening with users even if NFLX will not tell you. Our MPI for NFLX shows a nice acceleration this quarter, driven by its MAUs showing YoY growth around the world.

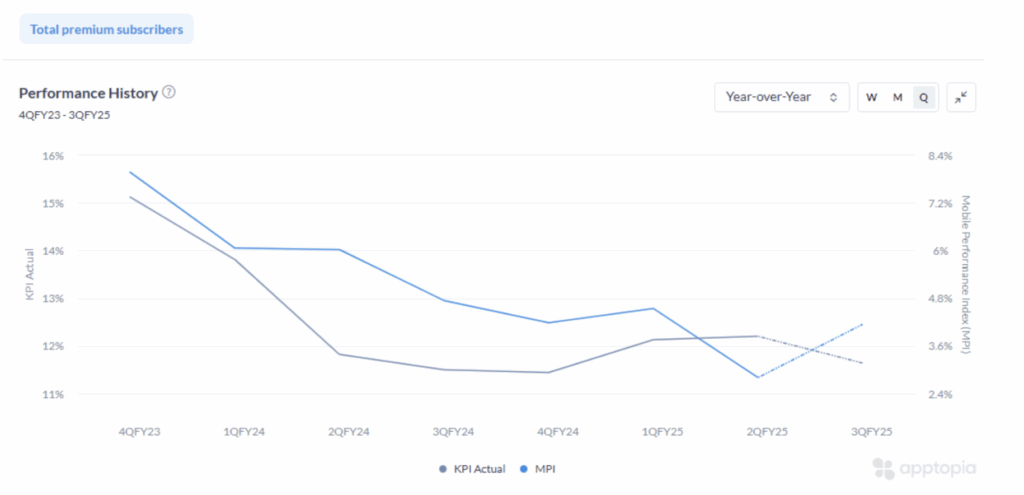

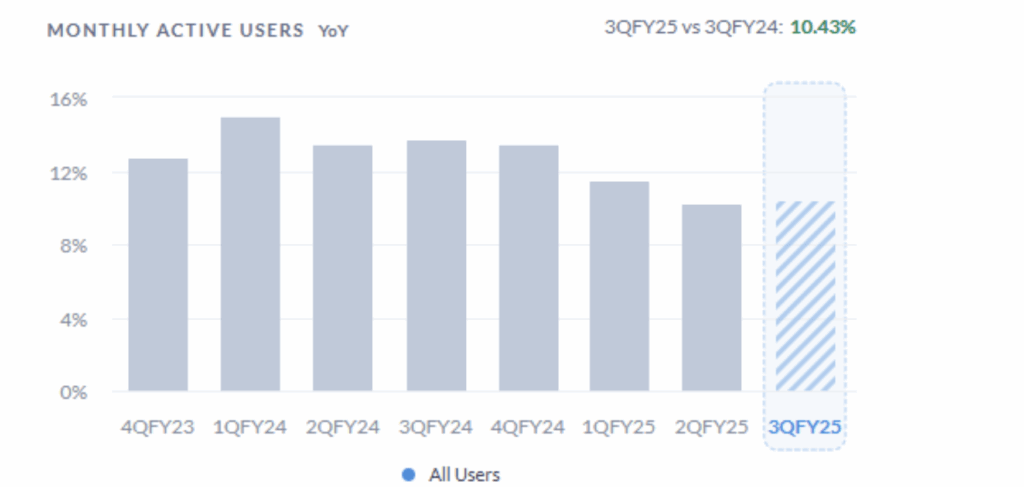

Spotify – Premium Subs

Spotify’s stock was -11% after reporting 2Q earnings. Our MPI pointed to that disappointing result last quarter, as we had a negative read heading in. However, things have turned around in 3Q. At this point, Apptopia’s mobile data is pointing to a re-acceleration in Premium Subs in 3Q (see first chart below). The key to this change is the end of decelerating MAU growth (see second chart below).

Spotify – Apptopia MPI YoY Growth vs Premium Subs YoY Growth

Spotify – Apptopia MAUs YoY Growth

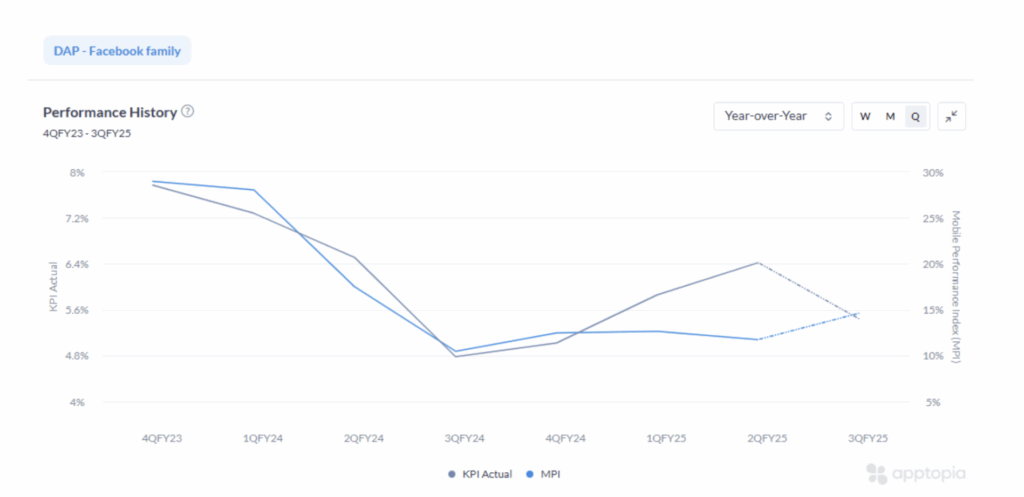

META – DAP Facebook Family

With regards to META, everyone cares about Ad Revenue now, right? However, continued user growth is key to the long-term success of META – after all, they need people to show all those ads to. While Consensus is expecting DAP growth to decelerate, our MPI is showing the opposite trend.

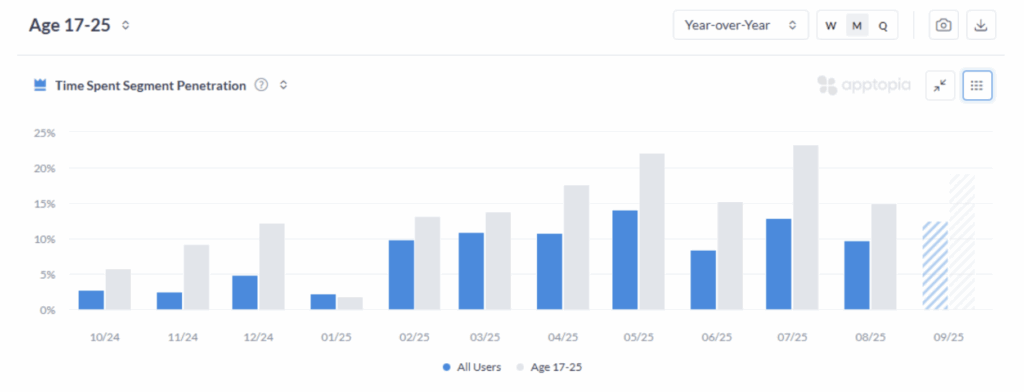

In addition, we are seeing time spent per DAU on Instagram among 17-25 year olds rising faster than for all users. Increasing engagement like this is a good sign for high-quality ad inventory growth this quarter.

META – Instagram Minutes per DAU YoY Growth – Ages 17-25 vs All Users(monthly)