This was first published September 11th, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- UBER – Consumer app DAUs rising, Driver app DAUs even better

- LYFT – Driver app is down YoY, creating a risk to Rides

- PYPL – Transactions growth inflecting better-than-expected

Earnings Previews are here! Check out where mobile data is saying something different from consensus. For example, in our previews we called out CHWY’s recent miss. Check out the whole file to see the 20 stocks we are calling out this quarter. Below are a couple of notable ones.

Ride-hailing and food delivery – UBER (+) / LYFT (-)

Below is our weekly view of the YoY growth of DAUs for this sector. DASH jumps out due to its strength – particularly the Dasher app – but this growth is already expected by consensus. However, our data has a better-than-expected outlook for UBER and worse-than-expected for LYFT:

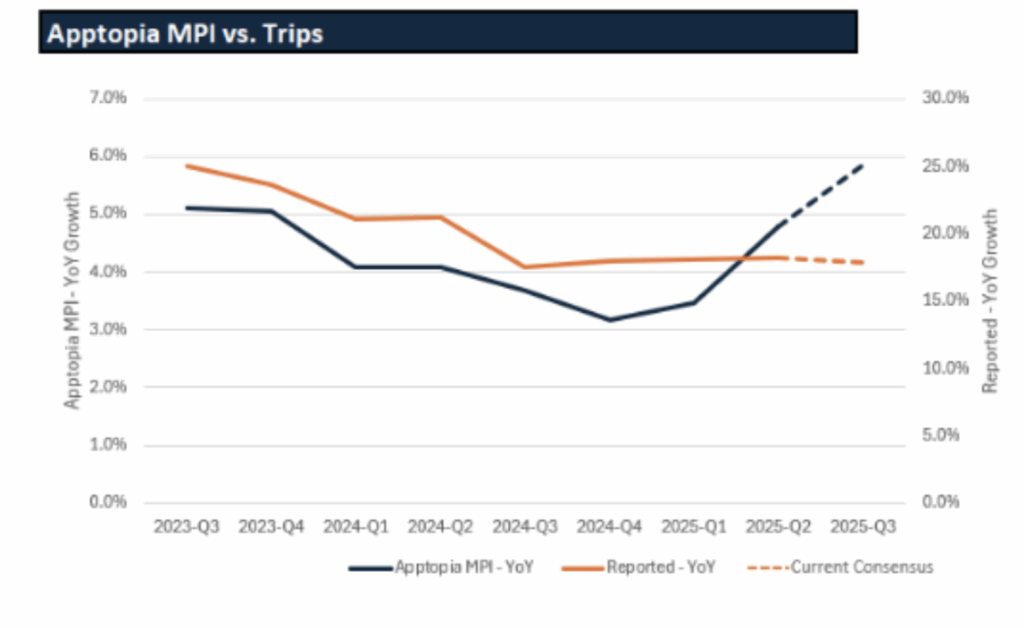

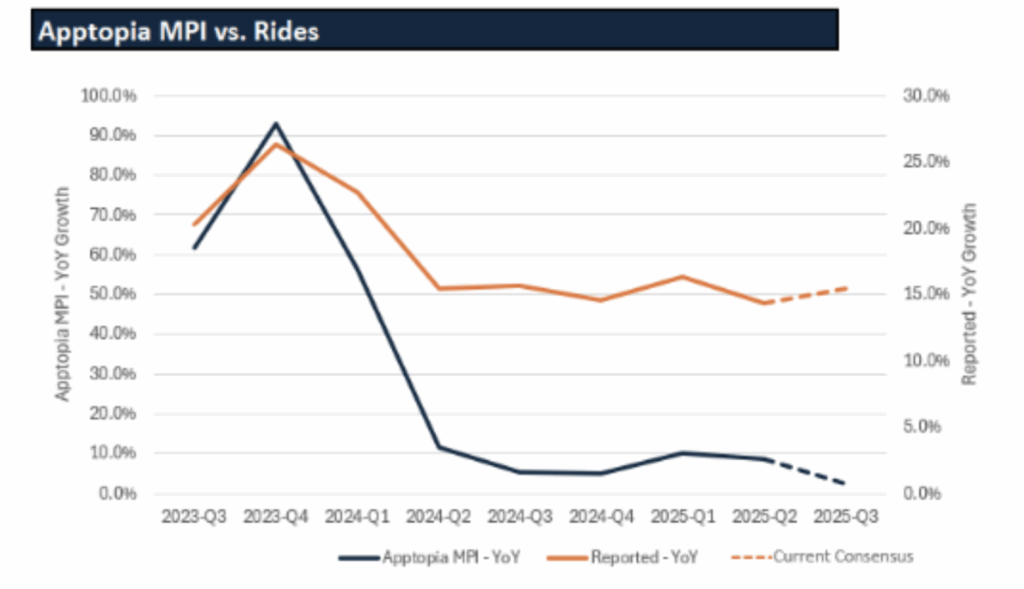

We have talked before about the importance of driver apps, and the chart above illustrates it again. Drivers are using the app for actual Trips, while the consumer app has more noise in it. With that in mind, below are snapshots of our Mobile Performance Index (MPI) for UBER and for LYFT:

UBER – MPI YoY growth vs Consensus – Trips

LYFT – MPI YoY growth vs Consensus – Rides

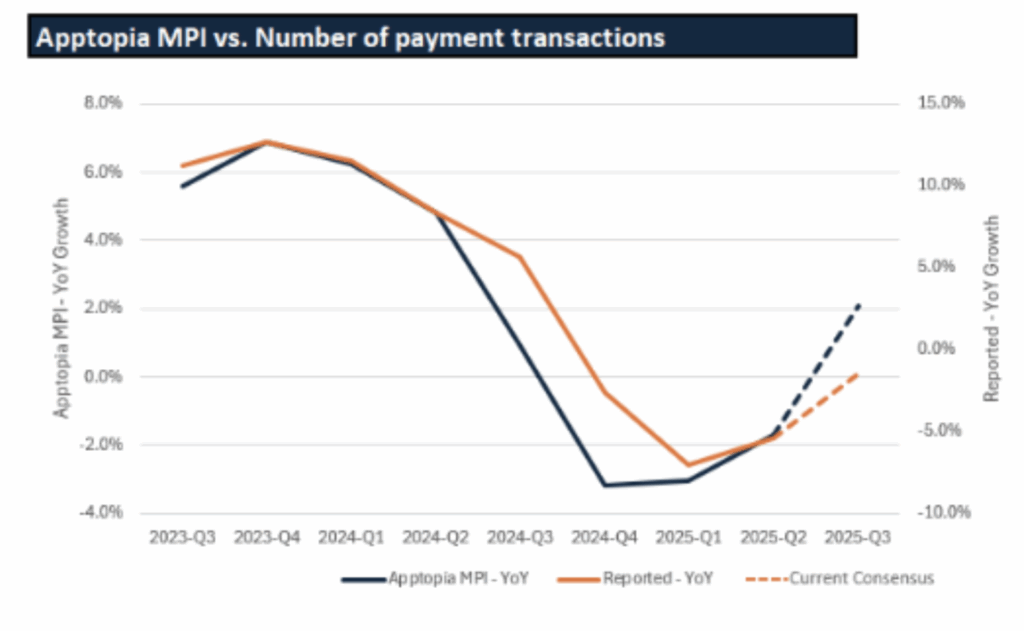

PYPL – inflecting transactions

While consensus is expecting the negative YoY growth in transactions to end, app data is showing positive growth in 3Q. Our MPI is being driven up nicely, both due to Venmo accelerating and PayPal’s deceleration bottoming out in our panel data. Not every data point is strong for PayPal – downloads and DAUs look iffy for the PayPal app – but it is enough to push YoY growth on the MPI into positive territory.

PYPL – MPI YoY growth vs Consensus – Payment transactions

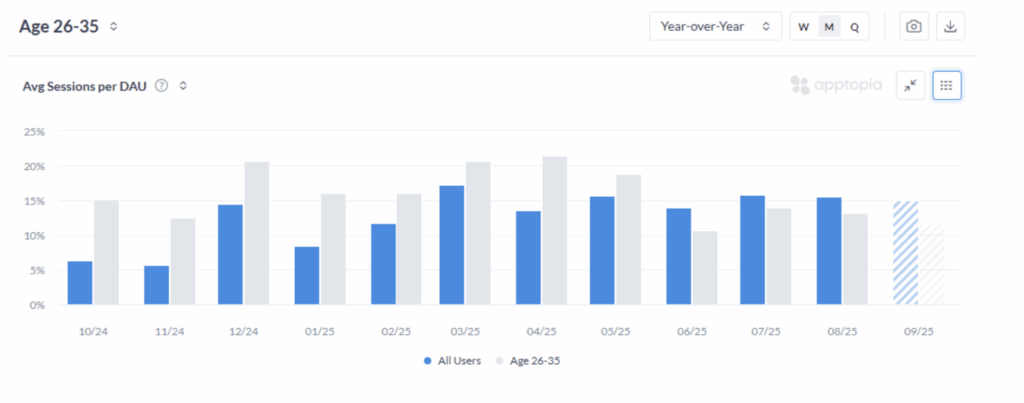

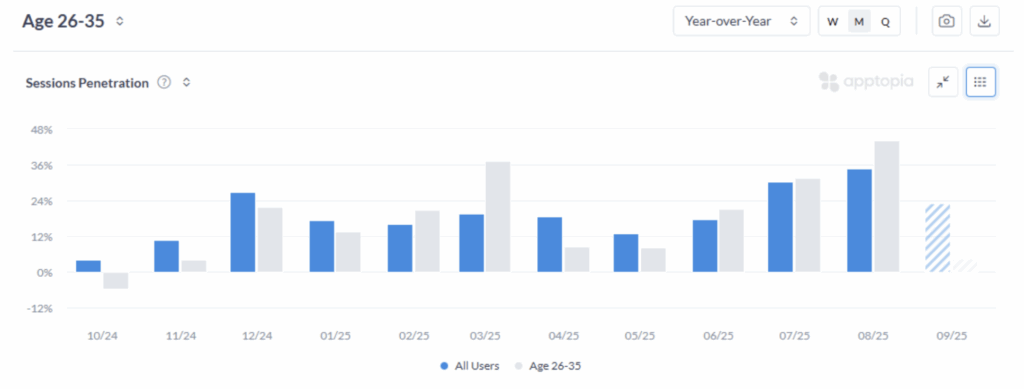

Venmo app – sessions per DAU – All users and ages 26-35 (monthly)

PayPal app – sessions per DAU – All users and ages 26-35 (monthly)