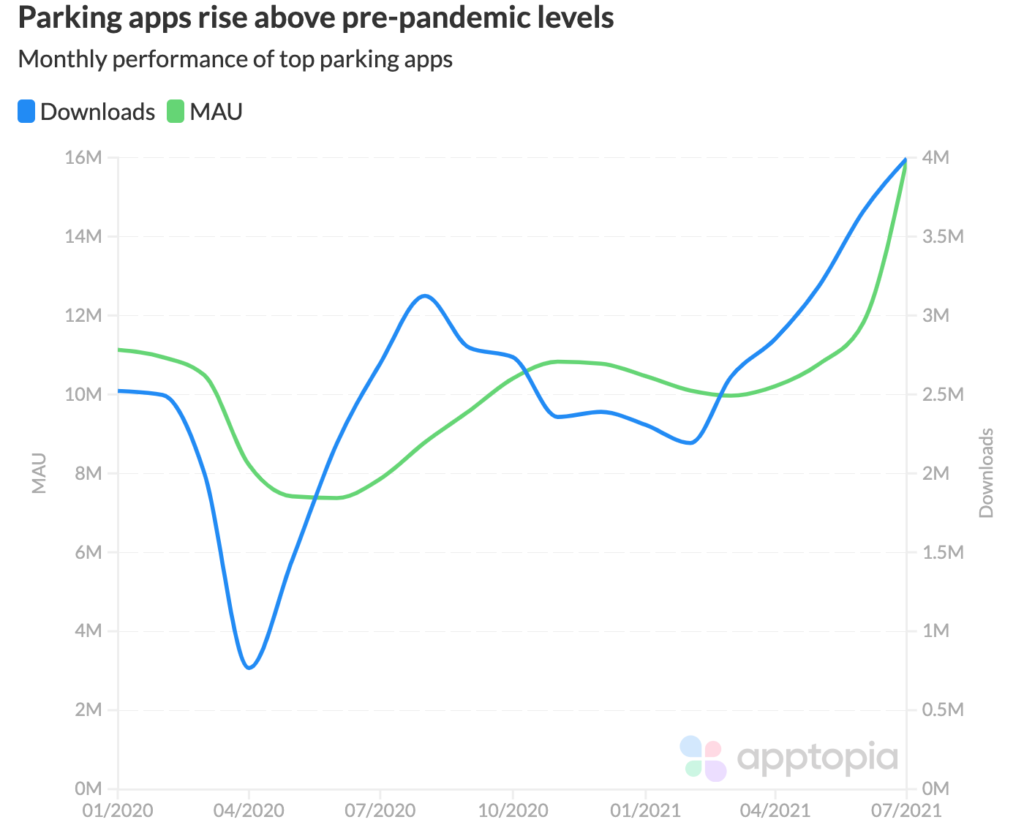

Parking app performance is popping. Both downloads (new installs) and monthly active users of the top parking apps are above pre-pandemic levels. Parking apps help users locate garages and lots in areas near their destinations, showing them the availability of spots and associated prices. The apps facilitate payment for the spot and in many cases allow users to reserve spots.

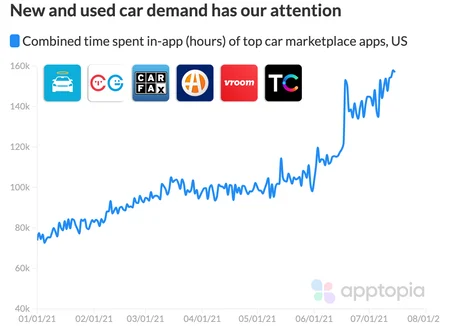

As I pointed out in my newsletter earlier this month, a lot of people moved out of cities during the pandemic. When that happens, they have less access to public transportation which increases demand for their own vehicles. Browsing time in the top car marketplace apps was up 57% YoY so far in the month of July, and has been growing strong YTD.

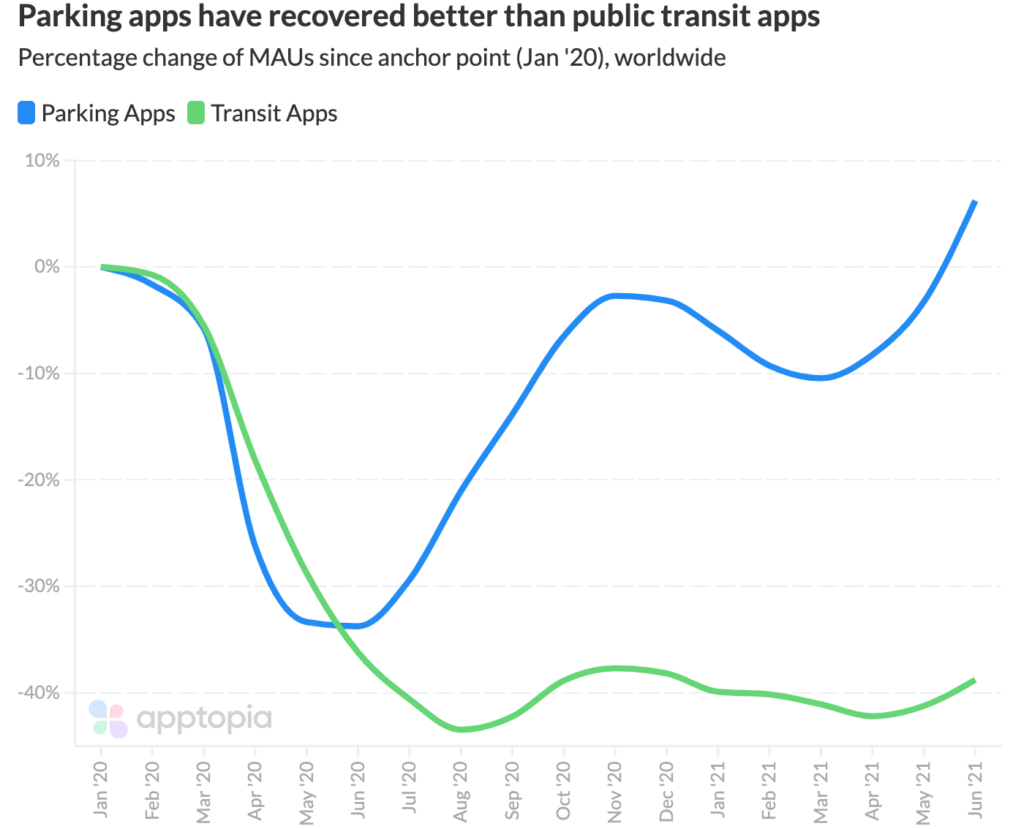

Both parking apps and transit apps dipped significantly in usage at the onset of the pandemic. Transit apps show schedules and times for public transportation options like trains, subways and buses. While parking apps have fully recovered (6.2% above January 2020 levels), transit apps are still lagging behind (38.7% behind January 2020 levels). Transit app usage has been rising consistently since April, but slowly.

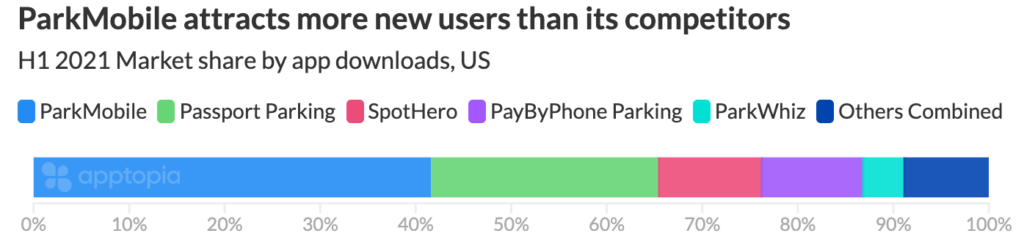

BMW owned ParkMobile and Volkswagen owned PayByPhone are both top parking apps as judged by downloads in the US for the first half of 2021. If you were to compare the below market share chart to H1 2019 (skipping over the pandemic), you would still see ParkMobile as having the largest share but its percentage was slightly lower at 39%. SpotHero was in the number two slot with PassPort Parking right behind it.

Year-to-date in the US, the three fastest growing parking apps as judged by monthly downloads are ParkMe Parking, SpotHero and RinGo Parking with rates of 565%, 281% and 179%, respectively. As people continue to take precautions associated with virus transmission, paying via your smartphone rather than a publicly used machine or an attendant will remain popular.

Apptopia + Foursquare examine

transportation trends in the U.S.