Over the last year, app store changes made App Store Optimization (ASO) more competitive, particularly among App Store Search Ads. In fact, all of the #1 Most Downloaded Apps in the U.S. across each app store category were bidding for Search Ads. Moreover, these winners were doing what Apptopia Search Intelligence rates as playing offense and playing defense.

Click to learn 5 strategies used by

top apps to acquire, engage, and

retain users.

Click to learn 5 strategies used by top apps to acquire, engage, and retain users.

Playing Offense v. Playing Defense

Playing Offense is what Apptopia defines as advertising on keywords that the app is NOT in the top 20 search results for. Playing Defense means advertising on the top 20 keywords that the app ranks for organically in search. For example, the app’s own name, several misspellings to account for typos, and direct competitors’ names.

Put another way, Search Ads Defense is your bottom-of-funnel fight with your direct competitors, so they don’t score with your high-intent searchers. Search Ads Offense is that hail mary pass. The one where you’ll get someone searching for “expressvpn” to convert on an Online Travel Agency app (looking at you, Expedia).

Both matter in the competition.

Aligning Product and Marketing on Defense

To build a strong defense, other players must be involved beyond the Search Ad. Take the example of Expedia:

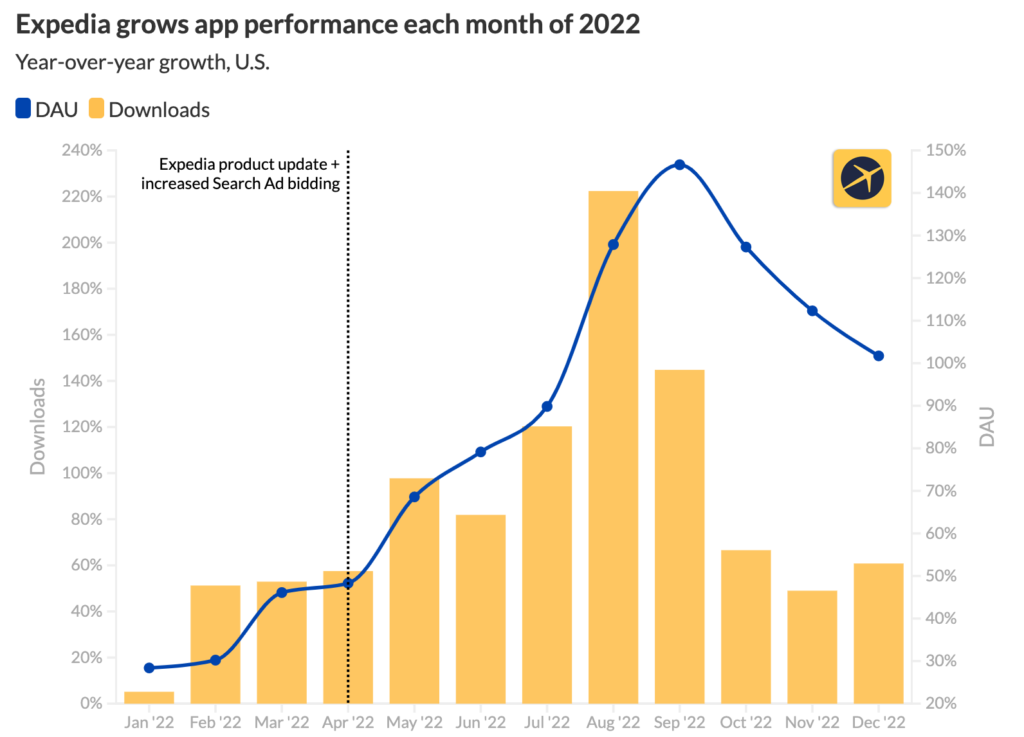

In 2022, Expedia grew new installs 87% year-over-year in the U.S., more than VRBO (68%), Booking.com (55%), and American Airlines (45%). It was a highly competitive year for travel, especially cheap travel, as gas and oil prices rose concurrently with consumer demand to go places again.

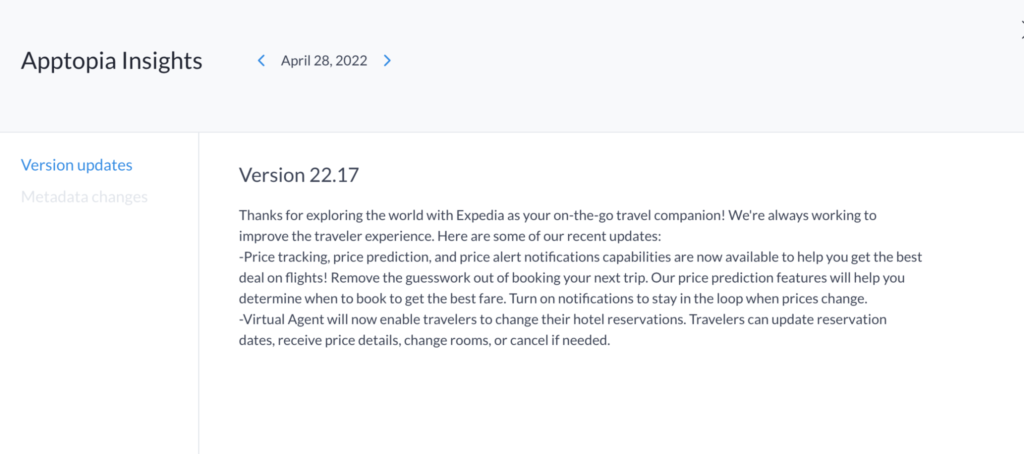

Expedia amped up its Defensive Strategy in April, bidding on words it ranked in the top 20 for, like “Spirit airlines”, “cheap flights”, “flights”, “flight status,” and more. The move was timely for two reasons: 1. April had the most flight cancellations in the U.S. so far in the year, sending high-intent searchers for these words up, and

2. Expedia had just launched a flight price prediction engine into the app.

Expedia’s growth was already positive month-over-month (MoM), but it jumped from 50% MoM in April to 70% MoM in May. The stronger defense was reinforced by an increase in mobile advertising creatives (Expedia increased the number of Ad Creatives by 161% in April), and the investment in its product, which is key.

Without building awareness about its product, how could Expedia convince someone searching for “cheap flights” that it could fulfill that promise? Because Apple and Google Play scan review keywords to ensure the service being advertised exists within the app before granting the value real estate, Expedia had to have the product in place as well.

Building a Strong Offense

Expedia increased its Search Ads from 200 to 250 by the end of August. During the month, Expedia invested more into its offensive strategy. It appeared to continue to focus on driving users toward its new flight price prediction engine (a major initiative for the company, according to the CEO in its Q3 earnings report). Therefore, Expedia bid on airlines outside of its organic reach, including “united”, “british airways”, and “lufthasana”.

This is a great example of how new mobile features present an opportunity for strengthening offensive plays. Beyond mobile feature development, market research on your ICP and what else they care about will reveal keywords to place bets on – not too different than studying your competitors on film!

In new upcoming ebook, “How App Download Leaders are Winning,” we share more about playing offense, playing defense – and the cost of sitting out on Search Ads. Plus, the report features four other strategies contributing to the Worldwide and U.S. Download Leaders’ success in acquisition, engagement, and retention. Hit the button below to get the report.

Click to learn 5 strategies used by

top apps to acquire, engage, and

retain users.