This was first published April 11, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

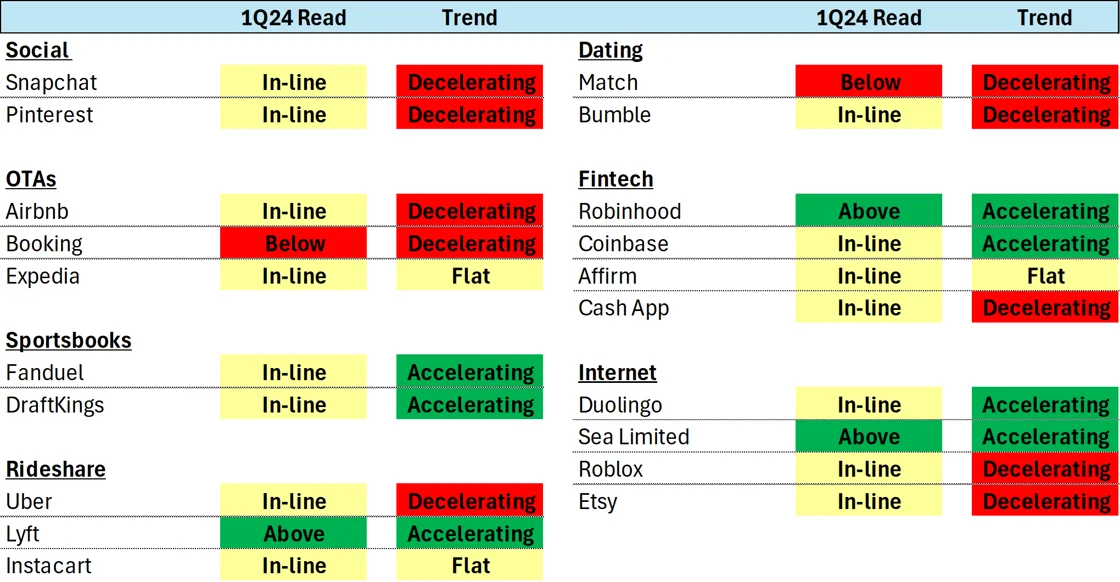

- Positive reads – Lyft’s sessions look strong, up 1% QoQ compared to expected 3% QoQ decline in Rides; Robinhood’s mobile activity spiked, up +44% YoY with growth accelerating throughout quarter; and Sea (Garena Free Fire) IAP revenue accelerated up +15% QoQ and turned positive YoY.

- Negative reads – Match U.S. DAUs down 7% YoY, dropping throughout quarter; Booking’s mobile activity decelerating with sessions to +15% YoY.

- Additional callouts – Sportsbook apps reaccelerated in 1Q (partially driven by North Carolina launch), with Fanduel looking to have gained share of DAU during the quarter.

1Q24 mobile summary

Positive reads –

- Lyft’s (LYFT) sessions look strong, up 1% QoQ compared to expected 3% QoQ decline in Rides. Trends improved intraquarter – up to +22% YoY in March.

- Robinhood’s (HOOD) mobile activity spiked, up +44% YoY with growth accelerating throughout quarter. Growth ramped throughout the quarter, up to +61% YoY in March.

- Garena Free Fire (SE) IAP revenue accelerated up +15% QoQ and turned positive YoY. IAP revenue accelerated intraquarter, up to +8% YoY in March.

Negative reads –

- Tinder (MTCH) U.S. DAUs down 7% YoY, dropping throughout quarter. Consensus sees flat year-over-year growth in Payers – Americas – decelerating growth could be below expectations.

- Booking’s (BKNG) mobile activity decelerating with sessions down to +15% YoY. Sessions are up 8% QoQ but decelerated intraquarter and U.S sessions are negative YoY in Feb/March.