Starbucks is, as the say, going through it right now. Churn is up, year-over-year, in dramatic fashion. Here’s the TLDR:

- Starbucks app users are increasingly using Dutch Bros and McDonald’s.

- Starbucks users who download McDonald’s spend more time in the McDonald’s app than their Starbucks app.

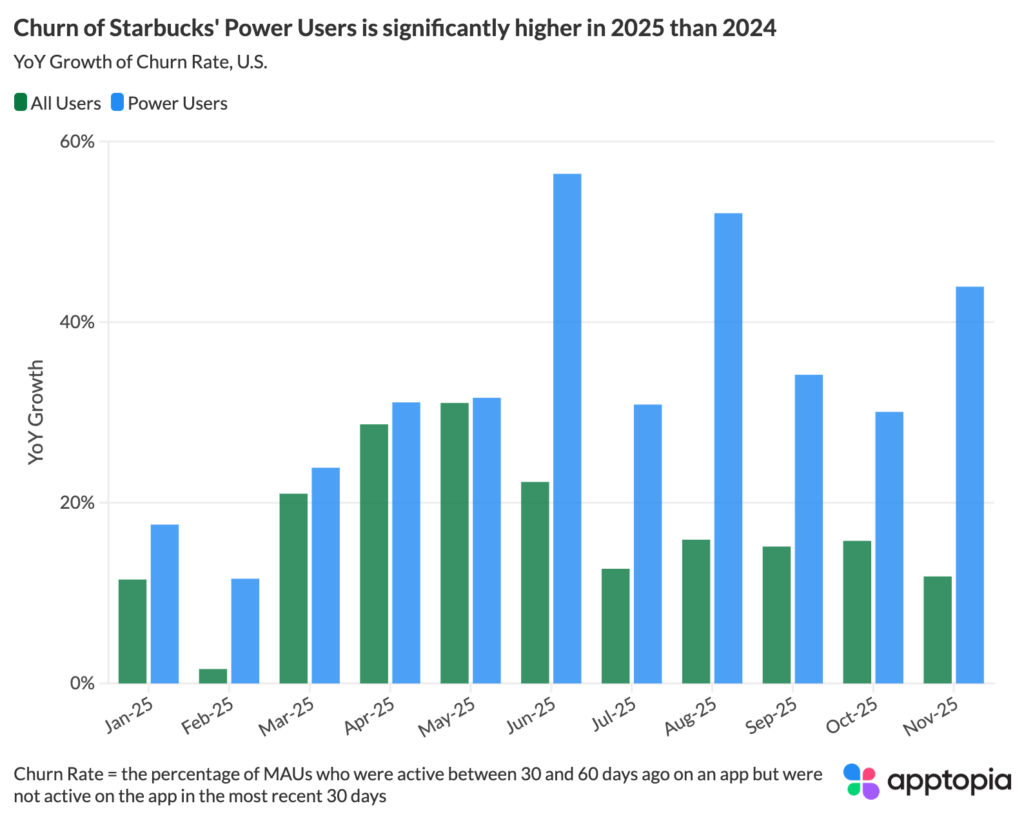

- Power User Churn is up an average of 33% this year for Starbucks.

- Starbucks is losing engagement from younger users, aged 17-25. They are down 33.1%, YTD for the app. McDonald’s has grown younger users 9% over the same time period.

While Power Users are not churning at a higher rate, year-over-year growth of their churn rate has increased much more than All Users over the previous six months. Apptopia defines Power users as those who are in the top 10% of Time Spent for an app. We use Churn as a user behavior stat, it shows the percentage of users who have not opened the app in the past 30 days after being active.

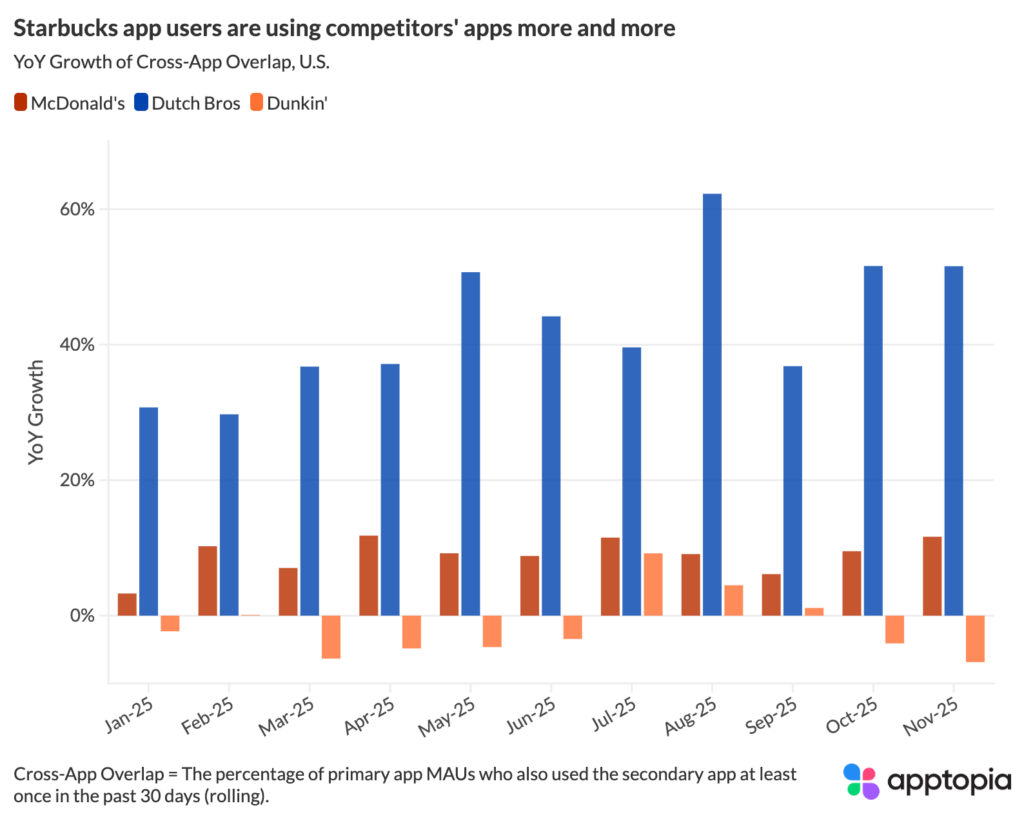

Starbucks is also under competitive threat. Cross-App Overlap is increasing with Dutch Bros as it expands across the United States. McDonald’s use is also growing among Starbucks users, as people look to trade-down their coffee and breakfast routine.

Additionally, Starbucks is losing engagement from younger users, aged 17-25. They are down 33.1%, YTD for the app. McDonald’s has grown younger users 9% over the same time period.

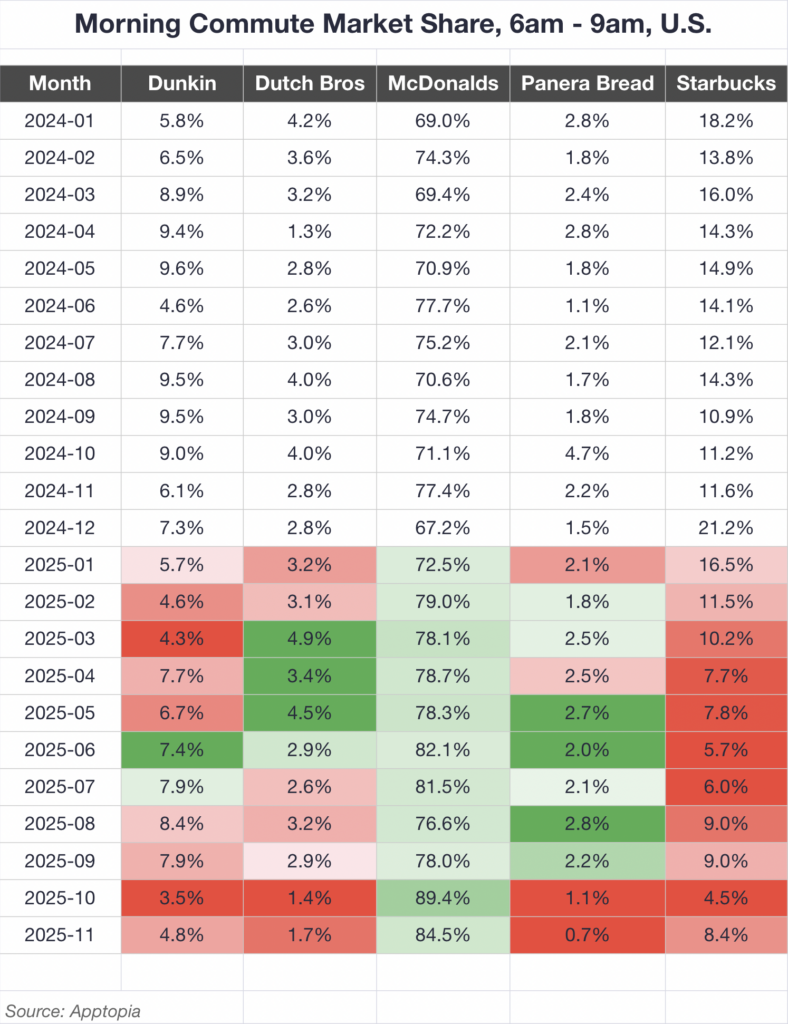

Let’s zoom in to the daily habit and look at the all-important 6am-9am window for morning coffee and breakfast. Market share for Starbucks has dropped from 18.2% in January 2024 to just 8.4% in November 2025. Dutch Bros, Dunkin’, and Panera Bread have all also lost share.

McDonald’s on the other hand has steadily grown, from 69% in January 2024 to 84.5% in November 2025. Trade‑down behavior is real; both McDonald’s and Starbucks management have highlighted that lower‑income customers are under pressure and are cutting back, including by making coffee at home or seeking cheaper options. Check out their average prices:

- Coffee

- McDonald’s medium coffee: $1.00-$1.89

- Starbucks tall brewed coffee: $2.95-$3.25

- McDonald’s McCafé latte: $2.99-$3.99

- Starbucks tall latte: $4.95-$5.75

- Breakfast Sandwiches

- McDonald’s: ~$0.19-$0.38 per gram of protein

- Starbucks: ~$0.28-$0.52 per gram of protein

McDonald’s has leaned hard into “reliable everyday value,” capturing higher‑income and middle‑income consumers trading down during inflation and economic uncertainty, with coffee and breakfast central to that strategy. It appear to be working for mobile customers.

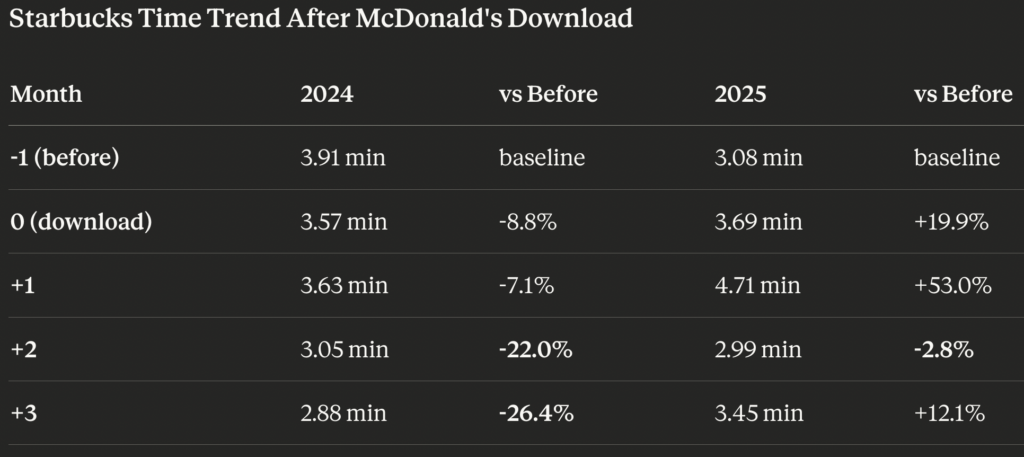

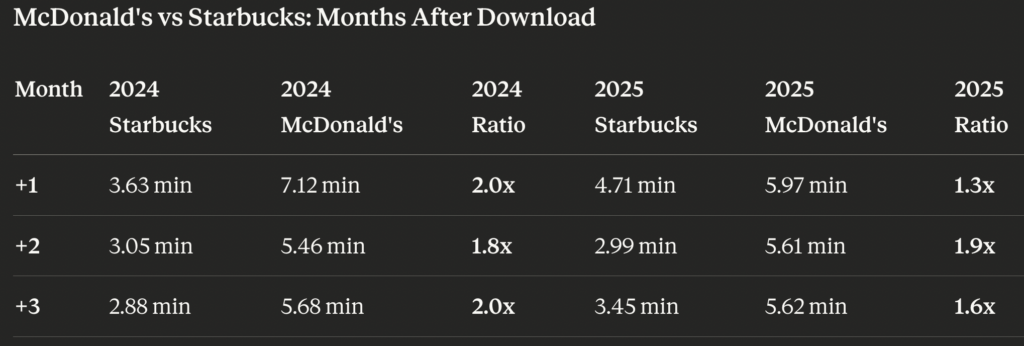

Being more interested in the interplay between Starbucks and McDonald’s, we decided to cohort Starbucks users who downloaded McDonald’s to look at their Time Spent on both apps before and after downloading McDonald’s:

While time did decrease on Starbucks in 2024 after downloading McDonald’s, it actually increased in 2025. However, in both years, Starbucks users ended up spending more time in the McDonald’s app than they were in the Starbucks app. It seems it is providing more value to them as a consumer.

Questions on the underlying data included in this analysis?