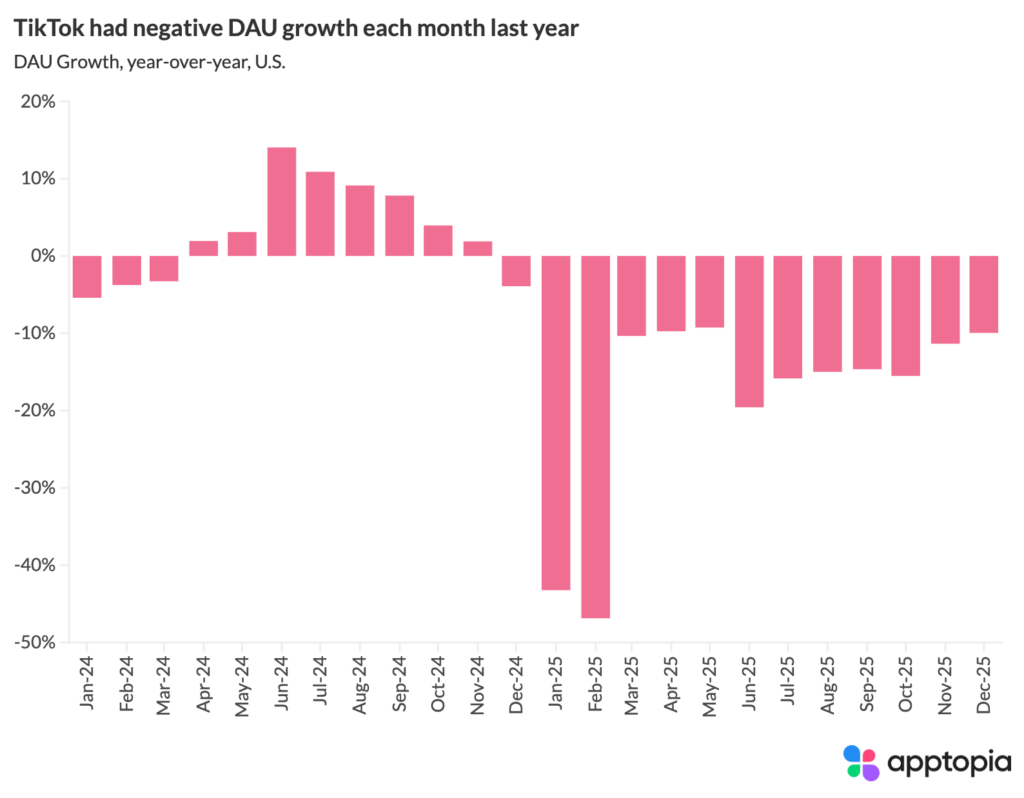

TikTok had negative YoY DAU growth in the US every month of 2025. MAU growth is relatively flat though. This leads one to believe that while some DAUs are churning altogether, many are checking the app less frequently, likely staying as WAUs and/or MAUs.

You can see the drastic drops in January and February, 2025. This was when the app was not available for download in the U.S. (from Jan. 19 to Feb. 14) due to due to a federal law targeting apps owned by foreign adversaries over national security concerns. Existing users could not update their app during this time period and sentiment was that it was likely the app would be banned.

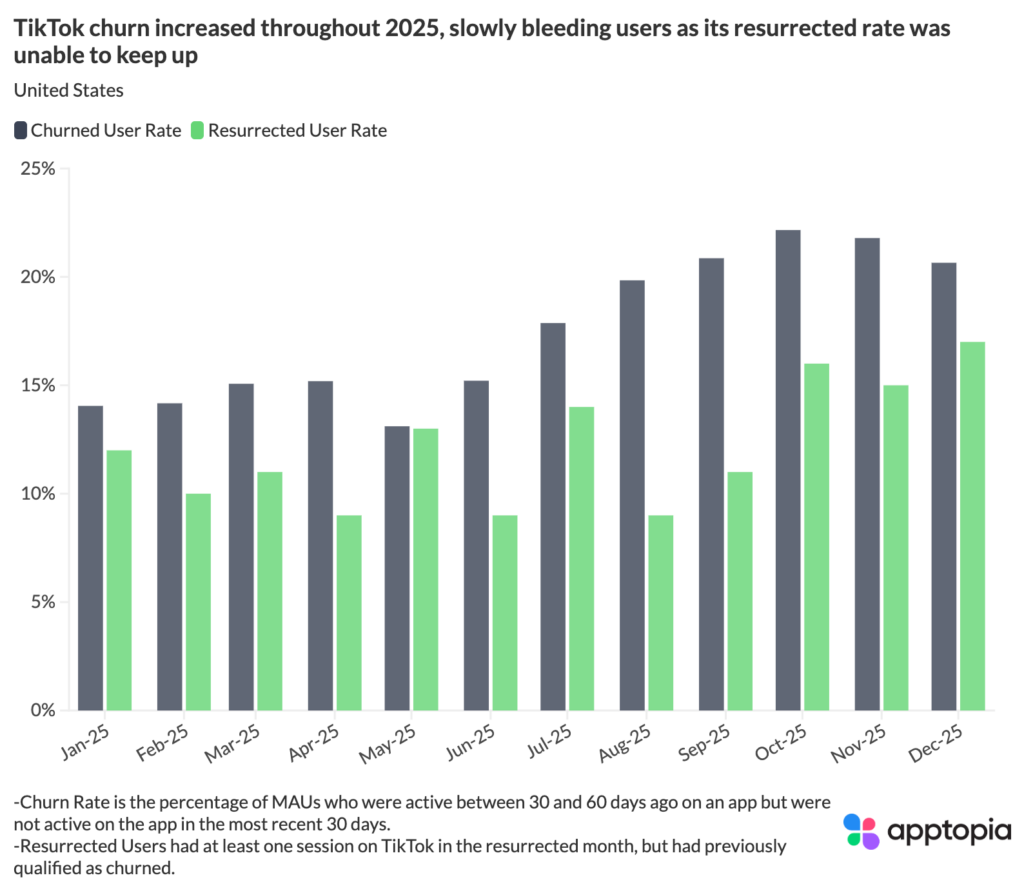

Churn in 2025 is up dramatically, by 47%, when comparing January ’25 to December ’25. But because monthly US MAU growth in 2025 averaged -0.7%, we assume there are resurrected users at play. These are users who churned from the app but later found their way back to it.

Apptopia defines churn as a usage metric. It is the % of MAUs who were active between 30 and 60 days ago on the app but were not active on the app in the most recent 30 days. Their usage has churned. They have not necessarily deleted the app or cancelled their subscription. Resurrected users are those who qualified as churned but then opened the app again at some point.

In the chart above, resurrected users increased as churn increased, but still lagged behind, leading to our negative DAU growth we saw initially.

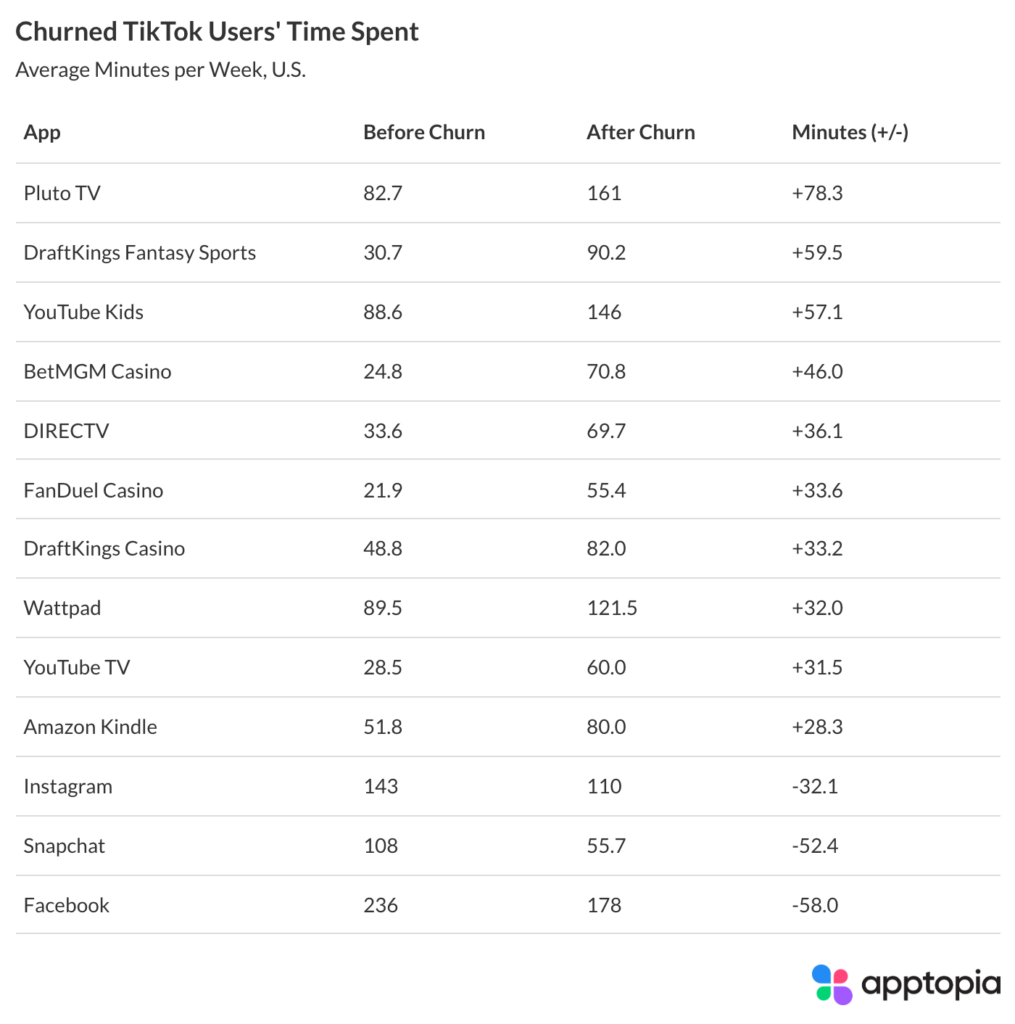

We isolated the users who have recently churned from TikTok (and were not resurrected) to understand where their time went now that they aren’t using TikTok. Below is a chart showing the top 10 apps where Time Spent increased the most in terms of absolute minutes. We removed any mobile games because games were found throughout the data pull, just as likely to show up as apps with reduced time spent as with gained time spent.

Many would have thought users were eschewing TikTok for a competitor. This is not the case. The users churning from TikTok are reducing their time spent on Instagram, Snapchat and Facebook. We’re seeing users spend more time in other forms of entertainment such as Pluto TV, YouTube Kids, DIRECTV and more. Also interesting is the strong showing for real money casino apps with DraftKings, FanDuel and BetMGM.

This analysis could go on forever, diving into which users (age, gender, etc.) or profiles of users (students, parents, corporate workers, etc.) are churning and then spending more time in which apps. For now, we know TikTok’s DAU growth is decelerating and it’s being displaced by video entertainment and gambling, not competitive social apps.