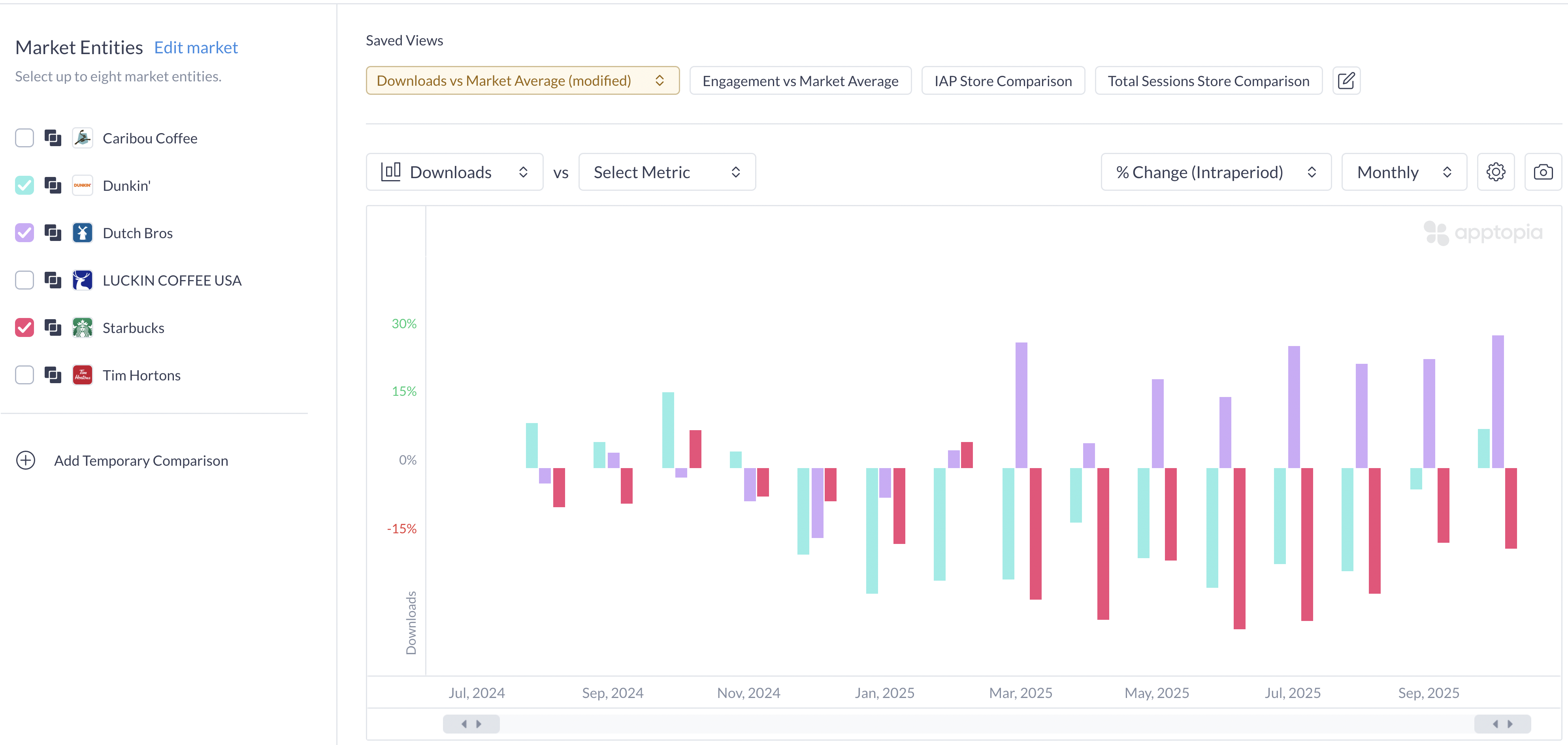

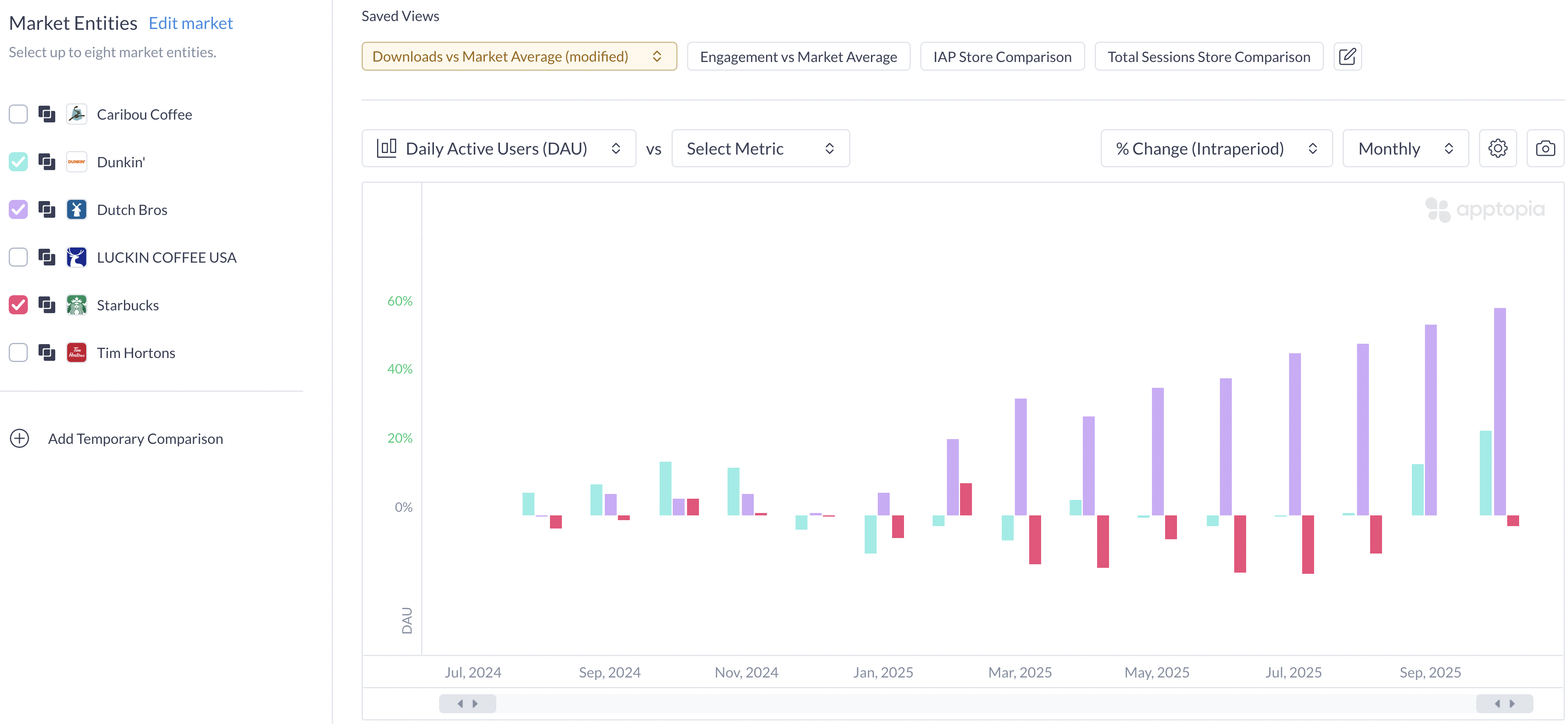

Dutch Bros is on a tear. The coffee chain’s app growth is outpacing major competitors in Starbucks and Dunkin. Starbucks has only had two months within the past 15 months with more DAUs than it had in July 2024. Dunkin has only had six.

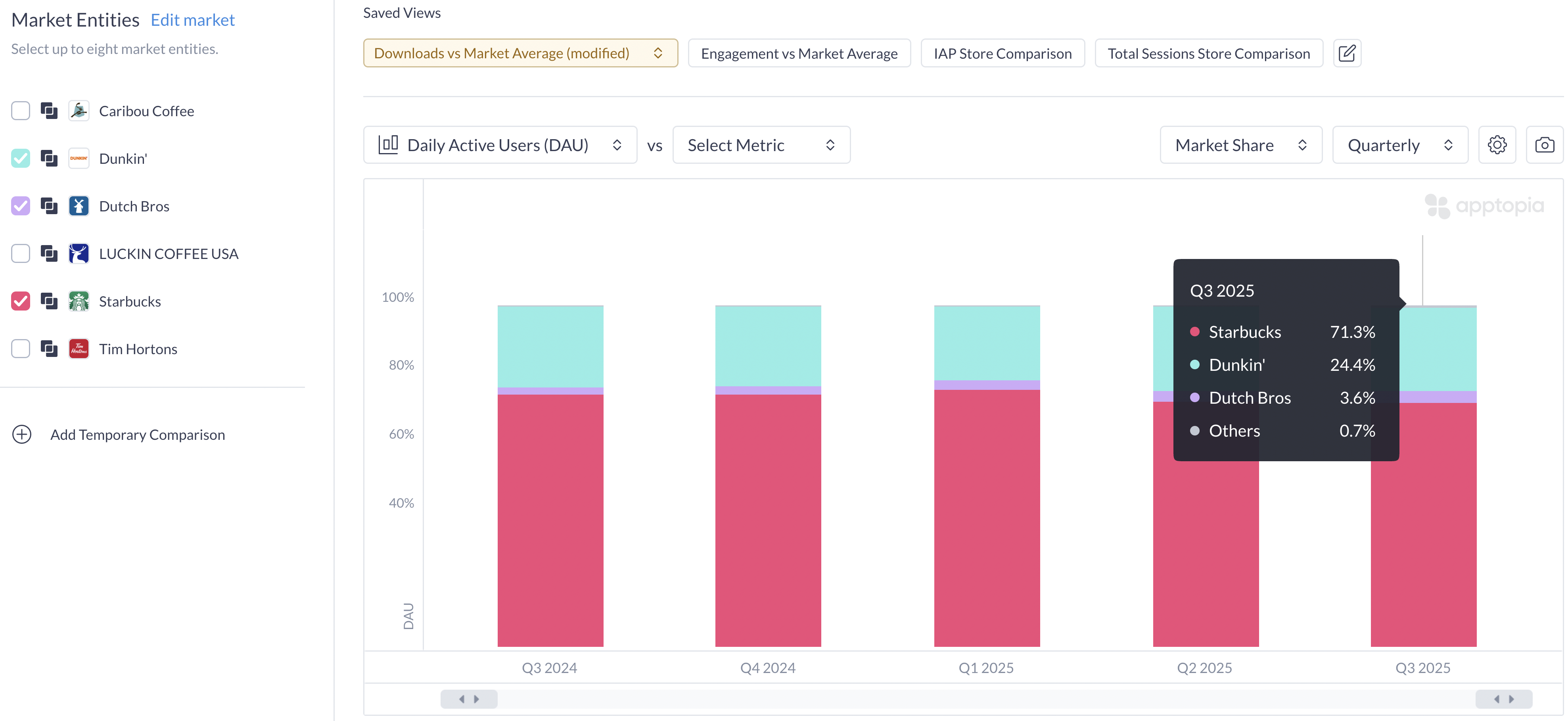

But how much of a threat is Dutch Bros to these entrenched players? You can see below that its market share is still very small and Starbucks remains the top player by a healthy margin.

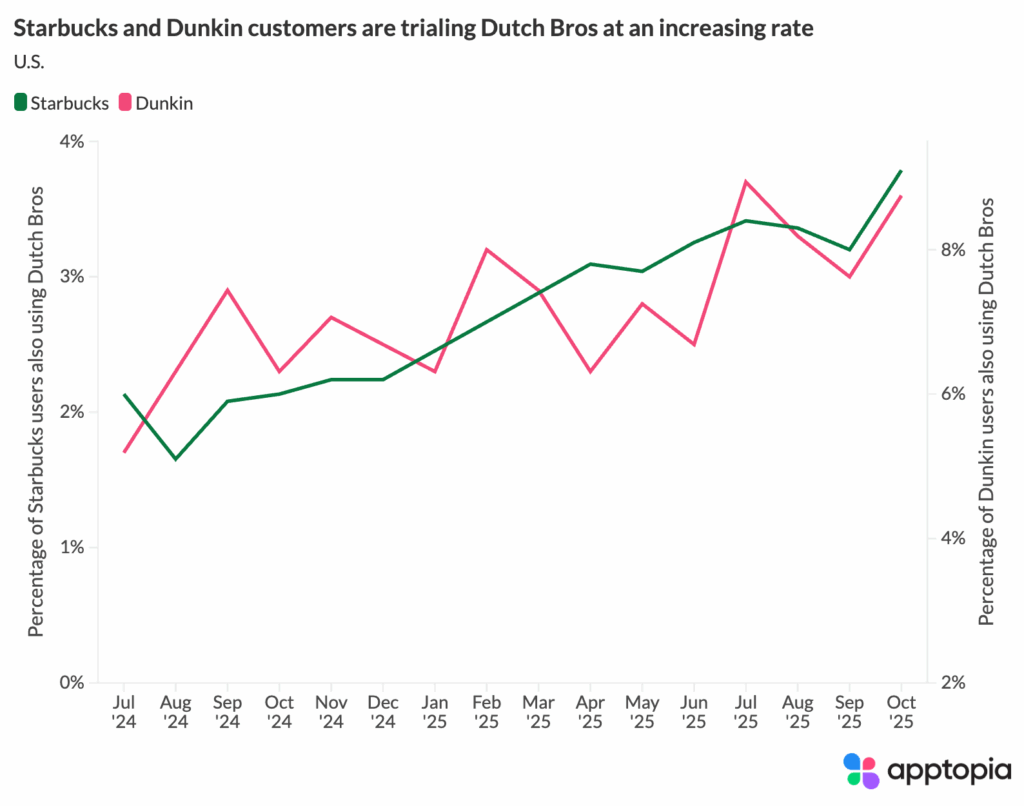

Let’s investigate further through looking at trends in cross-app usage. This tells us the percentage of Starbucks users who are also users of the Dutch Bros app, and how that percentage has changed over time. We’ll do the same for Dunkin.

It appears that customers of the competition are increasingly giving Dutch Bros a go. But is this causing them to switch, or is the number increasing because Dutch Bros is adding 150-160 stores per year?

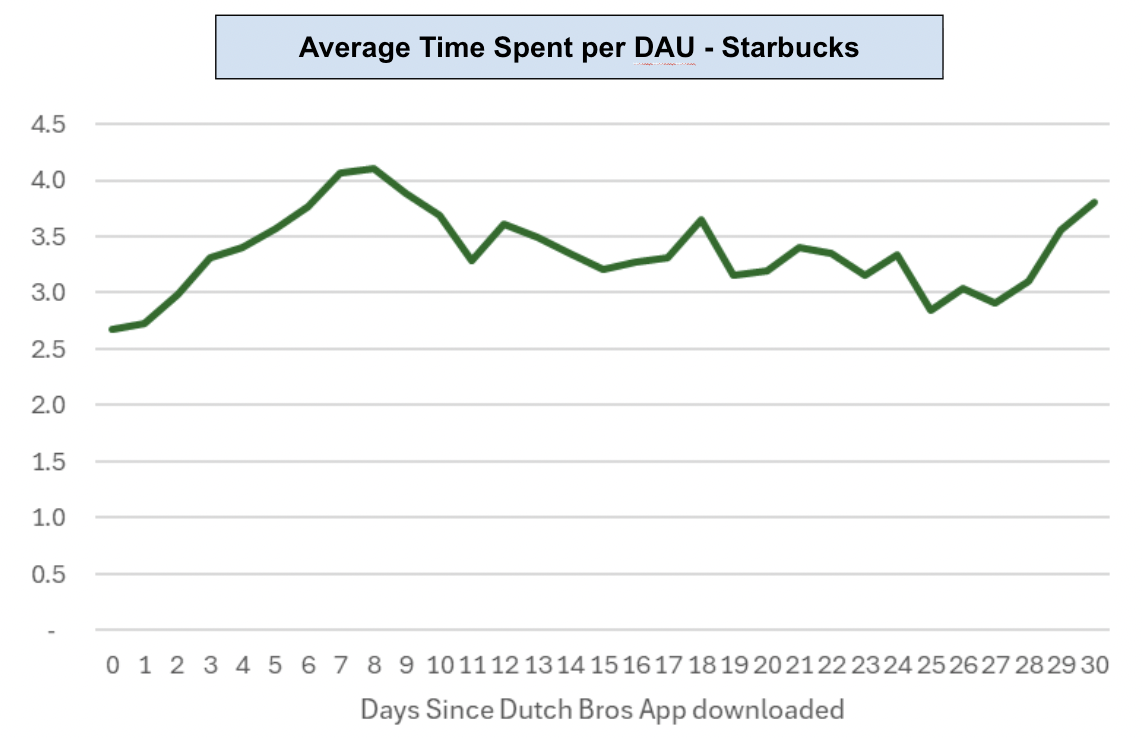

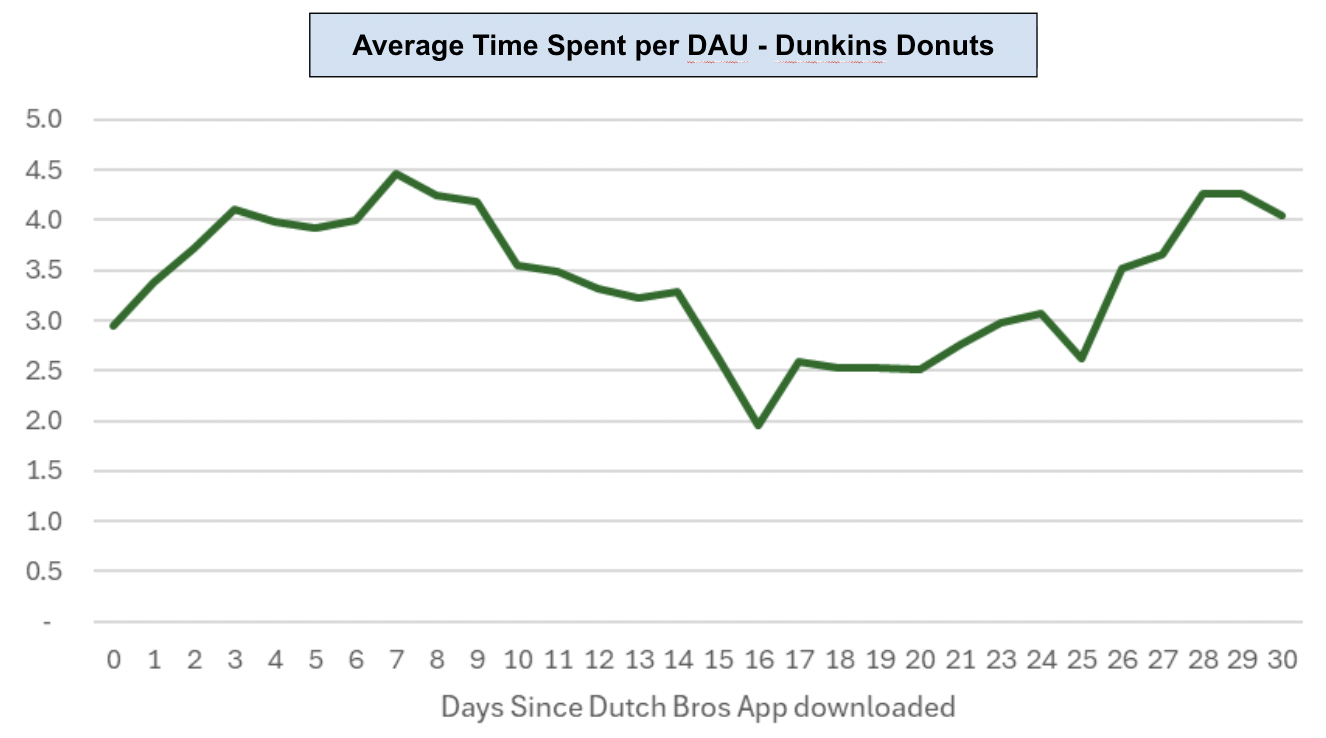

Above we’re looking at the impact downloading the Dutch Bros mobile app has on engagement for the Starbucks and Dunkin apps. In both cases, it looks like customers try Dutch Bros and then go back to their regularly scheduled programming. Maybe Dutch Bros isn’t the threat is appears to be based on its growth.

Starbucks still has cause for concern. Coffee apps as a whole are a bit stagnant to down lately. DAUs of the market are down 4.5% YoY in Q3 2025 and Starbucks churn has spiked 5.7 percentage points from 30.9% (Jul-Dec 2024) to 36.6% (recent 4 months). In comparison, the metric is concerning as competitors have remained stable or even improved slightly.

But who exactly is churning from the app? To find out, we bucketed users by age groups. We also created a cohort for “Power Users,” which are users who are in the top 10% for Time Spent on the app.

We averaged monthly churn for July through October of 2024 and did the same for 2025. Comparing these two time periods, churn for Starbucks’ Power Users has increased 36%. Bad. Adults aged 46+ saw the second largest churn increase at 19.9%. This feels largely driven by economic concerns, with the assumption that people are either drinking less coffee, or more likely, making it at home.

As Dutch Bros continues its growth, one cohort to watch is Younger Users (ages 17-25). This is where Dutch Bros has increased its MAU penetration most in our panel and the age group where the company has reduced its churn most. There’s lots more to investigate and keep an eye on. If you’re an Apptopia customer, pour yourself a cup of joe and dive into the data.