This was first published October 9th, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- Exciting news! Apptopia data is now on Maiden Century

- Maiden Century leverages multiple modeling frameworks to generate accurate, real-time forecasts

- Spotify is lined up to beat Consensus, according to Apptopia’s data in Maiden Century’s platform

We here at Apptopia are very excited about our new partnership with Maiden Century that launched last week. Maiden Century does an incredible job of consolidating alternative data into a clean, consistent view. In fact, the Apptopia Research team is already using Maiden Century’s web tool for analysis on our own data! Apptopia has multiple mobile data offerings – Base, Advanced, and MPI – and you can compare them all seamlessly through Maiden Century.

What has us even more intrigued right now, however, is Maiden Century’s KPI forecasting tools. We have been using our app data to preview earnings beats and misses for years now, but with Maiden Century, we can now have access to a specific point forecast to compare to consensus. These are high quality forecasts – for the top 100 Internet names, Maiden Century’s MAPE with Apptopia data averages 1.4%. Below is an example showing how our data and Maiden Century’s forecasts are lining up to show a beat on Premium Subscribers for SPOT.

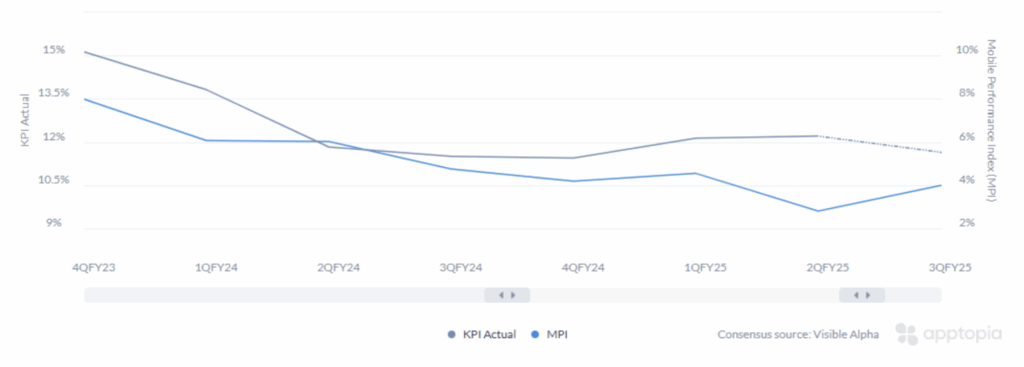

Apptopia’s MPI for Spotify is showing a slight acceleration in YoY growth in 3Q25, while consensus expects a deceleration.

SPOT – YoY Growth in Apptopia MPI vs Total Premium Subscribers

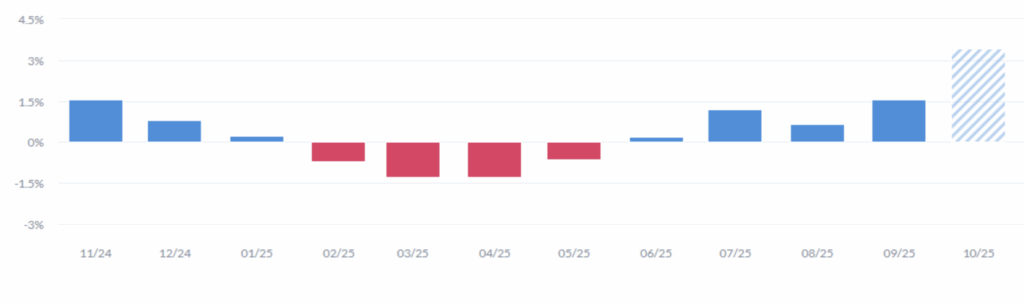

Going one step further down, we can see that North America DAU growth turned positive in each month in 3Q, a positive sign for Spotify’s highest ARPU region:

SPOT – YoY Growth in Apptopia North America DAUs

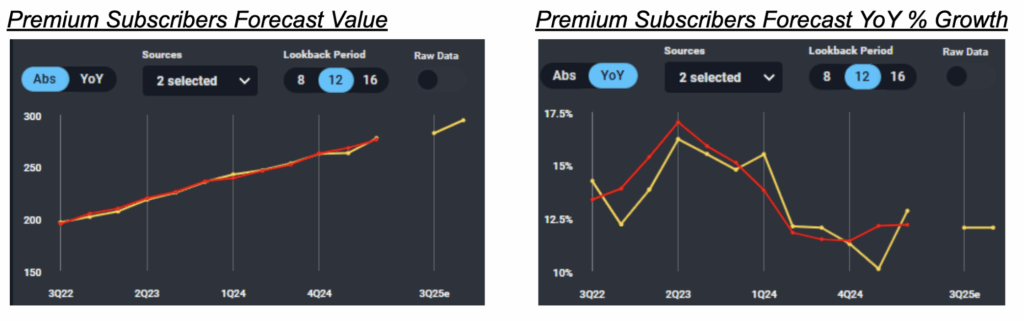

Now this is where Maiden Century’s forecasting tools are super useful. I have shown you above our MPI and DAUs, which give a good sense for what is happening with SPOT. Maiden Century, however, will then specifically translate those (and other) Apptopia data points into a forecast for Premium Subscribers.

SPOT – Maiden Century Premium Subscriber Forecast

Consensus expects YoY growth of 11.6% in Premium Subs, but Maiden Century’s forecast using Apptopia data expects YoY growth of 12.1%. While this is not a huge beat, for a stock that has slid in an upward trending market, any kind of better-than-expected result in 3Q would be welcome.

We invite you to check out more of Apptopia’s data on Maiden Century’s platform. We certainly are! In that light, get ready for our Earnings Previews next week, where we will highlight more opportunities like SPOT.