This was first published July 30, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- HOOD’s product introductions have been fast and furious

- We can see the impact of Crypto and Prediction Markets in our data

- Competitive impact on DKNG / FLUT / COIN is non-zero

Robinhood (HOOD) Reports on 7/30

Robinhood has been a name to watch in 2025 (how can you not when the stock has doubled since May) and the company is far more than meme stocks and fractional shares these days. In a flurry of product launches and platform upgrades over the past year, Robinhood has added: 1) an advanced trading platform to target active traders; 2) a prediction market hub for sports fans and economic data wagers; 3) an IRA with a bonus % match; 4) over a dozen new tradeable cryptocurrencies; and much more. With so many announcements, it can be challenging to track the actual impact of individual products and features to decipher what is actually moving the needle. This is where Apptopia Advanced shines bright.

Crypto and Younger Users

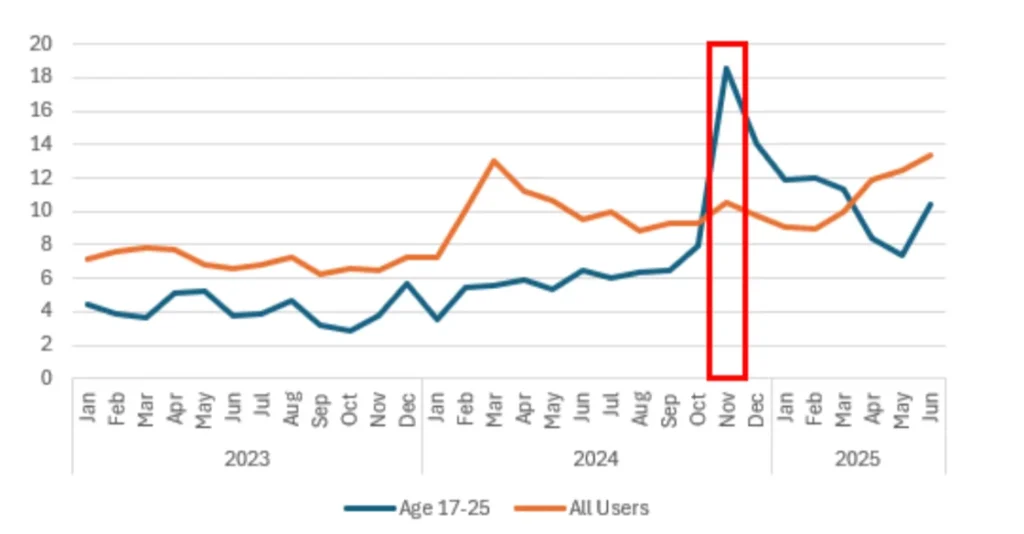

In November 2024, amidst a major crypto boom that led to Bitcoin breaking the $100K threshold, Robinhood massively increased their tradeable cryptocurrencies to try to capture some of the macro crypto tailwinds – and it worked! In that month, we observed the largest monthly increase (and absolute level) of time spent per DAU within the youngest age cohort (who are most likely to be involved in crypto) in our device-level Advanced data. While time spent per DAU normalized following the major influx of first time users, these crypto heavy investors are starting to peak their heads out again in late Q2.

Prediction Market Hub

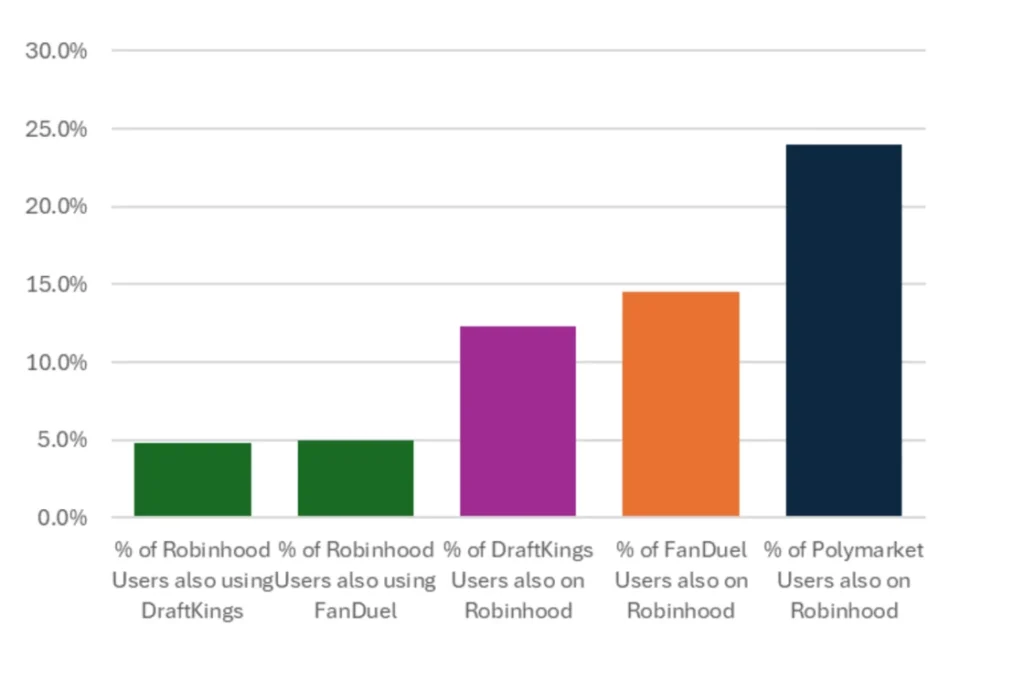

In March of this year Robinhood added a new “Prediction Market” hub in their mobile app allowing users to bet on various events related to sporting, economic data, and even political elections. This comes as we have seen a steady increase in online betting and predictions platforms like DraftKings/Fanduel for sports, or platforms like Polymarket for more broad-based prediction contracts. So is this a waste of resources or can Robinhood really carve out a space? As of June we see 10-15% of DraftKings and Fanduel users also using Robinhood on a monthly basis, and nearly 25% of Polymarket users! What’s more, Robinhood users who also use FanDuel and DraftKings dropped 19% and 31%, respectively, since the beginning of March.

Robinhood Legends, Robinhood Retirement, Index Options, Future and More

o you want to see how power users (top 10% of active users) have trended since Robinhood’s increased focus on active trading tools? Or how the older age cohorts reacted to the launch of Robinhood Retirement and their IRA match program?

This is easy to track with our data, feel free to reach out to us and we can help!

Carter Kruse

Data and Equity Analyst