This was first published September 7th, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- Robinhood compares favorably to other trading apps QTD

- Robinhood’s app data suggests above-consensus users and transactions in 3Q

- Robinhood’s user engagement, especially in younger users, is strong

- Roblox – Gen Z time spent per DAU continues to fall

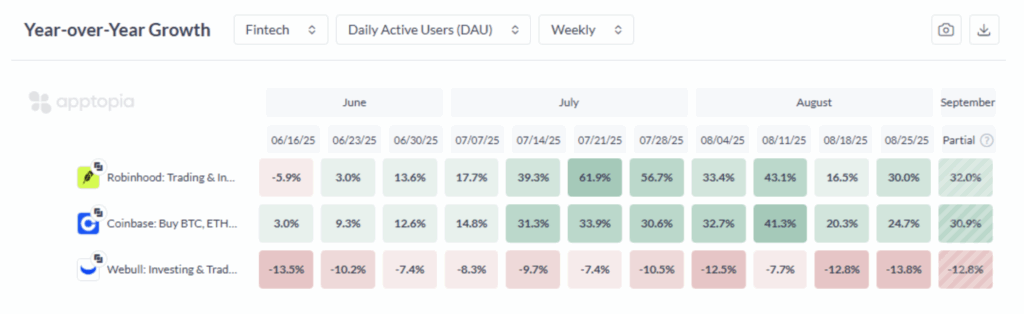

While we need to wait until Monday to see if Robinhood’s new college and NFL prediction markets resulted in any change in user behavior, we can see right now how Robinhood is stacking up QTD versus other trading apps:

The year-over-year growth for Robinhood’s DAUs remains very strong, having grown >30% each week except for one over the past seven weeks. This compares favorably to Coinbase, and is way better than Webull’s US app, which is shedding DAUs. This strong growth for Robinhood is reflected in our Mobile Performance Index (MPI) for HOOD, which is predicting above consensus acceleration in growth this quarter:

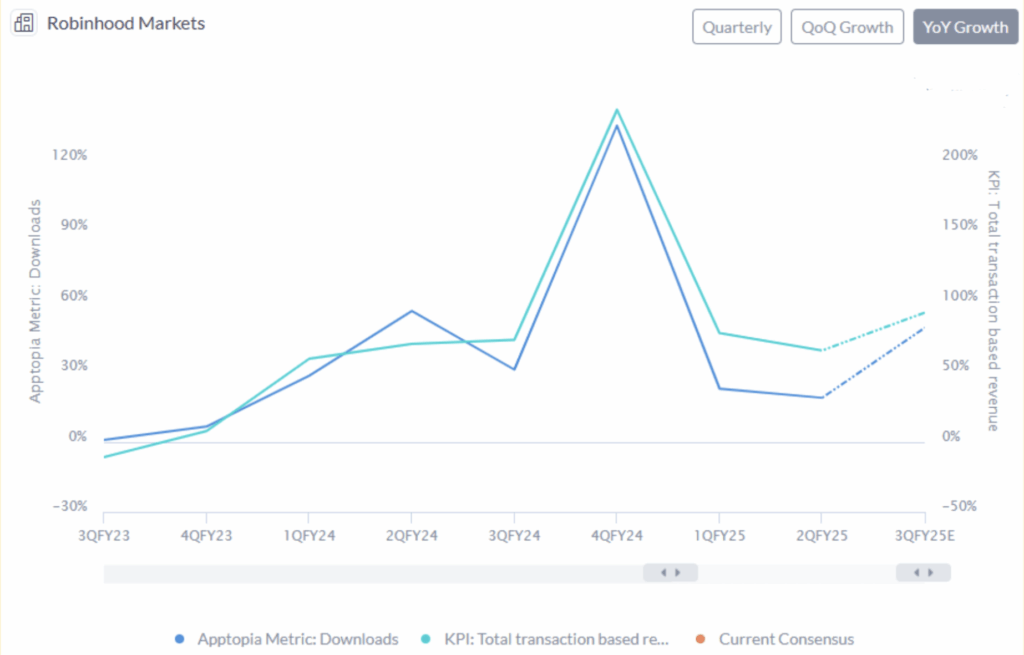

In addition, Robinhood’s downloads (iOS only) have historically tracked well with Transaction-based Revenue. Here we also see YoY growth picking up faster than consensus expects:

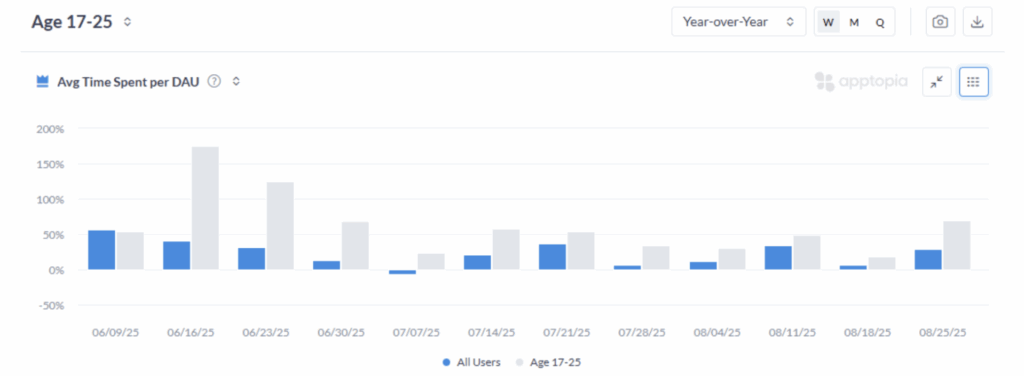

Another positive development for Robinhood is the growth in time spent per DAU, especially among Gen Z. This is an important customer segment for HOOD and our panel data shows their engagement growing faster than the engagement for all users:

This all suggests that even without a boost from prediction markets, Robinhood is on track for a strong quarter.

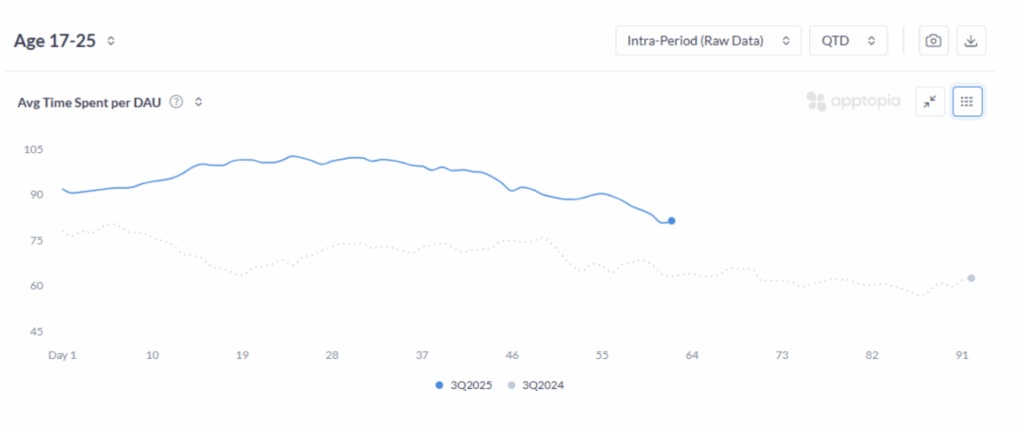

Roblox – time spent per DAU peaked (still)

Last week we pointed out that, while app data for Roblox remains quite strong, there is one data point that raises a yellow flag. Time spent per DAU among those aged 17-25 peaked back in late July and has been declining since. While it is normal for time spent on RBLX to drop when kids go back to school/college, this is a more dramatic fall than the same time last year (dotted line in the chart below). We think it is important for investors to keep an eye out for any potential weakness with this stock, and this could be one.