The $82.7 billion question hanging over Netflix’s proposed acquisition of Warner Bros. Discovery isn’t whether regulators will scrutinize the deal, but what market is Netflix actually in?

The answer determines everything. Under the Department of Justice’s 2023 merger guidelines, a combined entity exceeding 30% market share triggers heightened scrutiny. Whether Netflix crosses that threshold depends entirely on how you draw the boundaries.

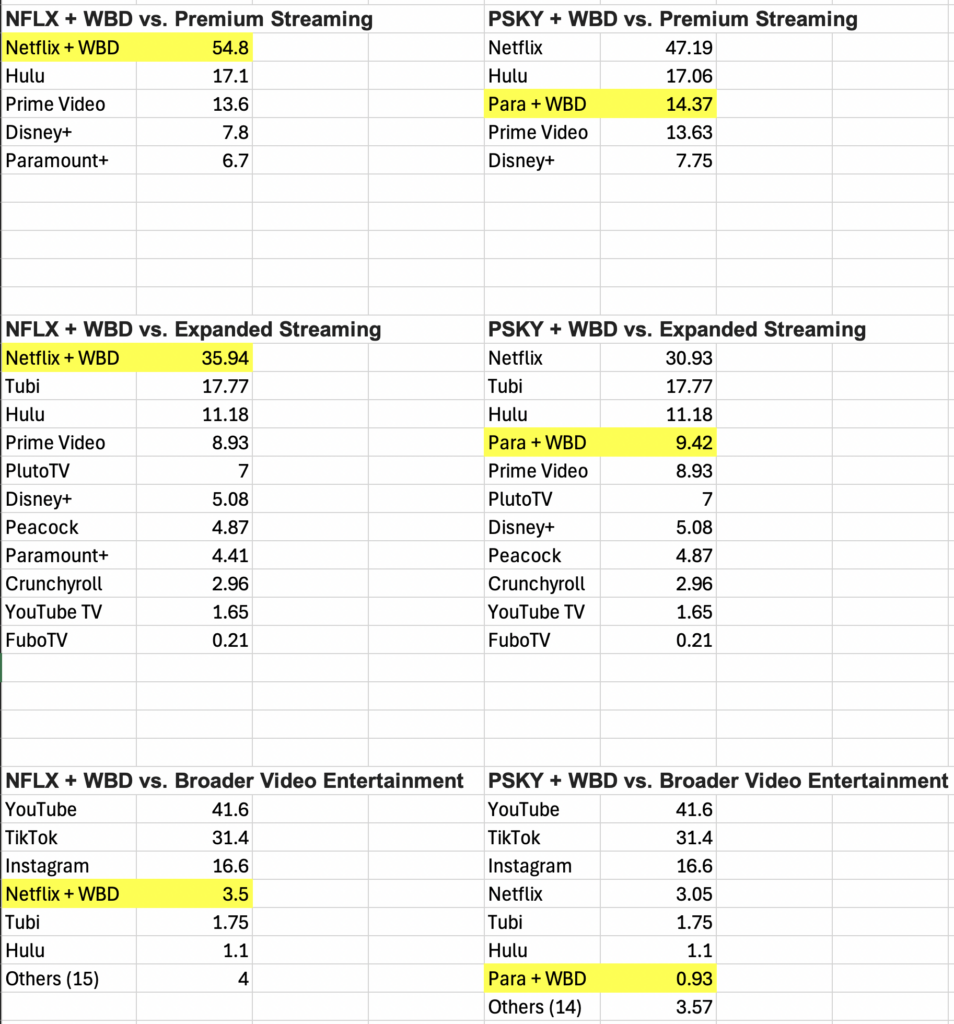

Consider three ways to define the relevant market, using year-to-date U.S. time spent data on mobile devices:

Premium Streaming Only: If you limit the market to premium subscription video-on-demand services—Netflix, Hulu, Prime Video, Disney+, Paramount+, and the soon-to-be-absorbed HBO Max & Discovery, Netflix + WBD commands 54.8% of all time spent. By contrast, Paramount Skydance would hold just 14.37% combined with WBD under the same definition.

Expanded Streaming: Here we’re adding free streaming services, ad-supported services, and live television. This now includes Tubi, Pluto TV, Peacock, Crunchyroll, YouTube TV, and FuboTV. Netflix + WBD drops to 35.9%. Still above the 30% threshold, but within arguing distance. Paramount Skydance would hold just 9.42% combined with WBD under the same definition.

Broader Video Entertainment: This is what Netflix will argue for. This market includes “Expanded Streaming” plus YouTube, TikTok, Instagram, and seven more apps. Here, Netflix + WBD shrinks to 3.5% of time spent. YouTube alone commands 41.6% and TikTok takes 31.4%. Paramount Skydance would hold just 0.93% combined with WBD under the same definition.

Here’s a quick and dirty screenshot from my CSV to get a better look at the data:

Paramount Skydance understands this, which is why their hostile $108 billion bid leads with regulatory certainty as a selling point. Netflix, meanwhile, is making a bet that the broader definition will prevail.

Either way, the market definition question will echo far beyond this deal. The streaming wars have always been a fight for attention. Now the government gets to decide what that fight actually includes.

Questions on the underlying data included in this analysis?