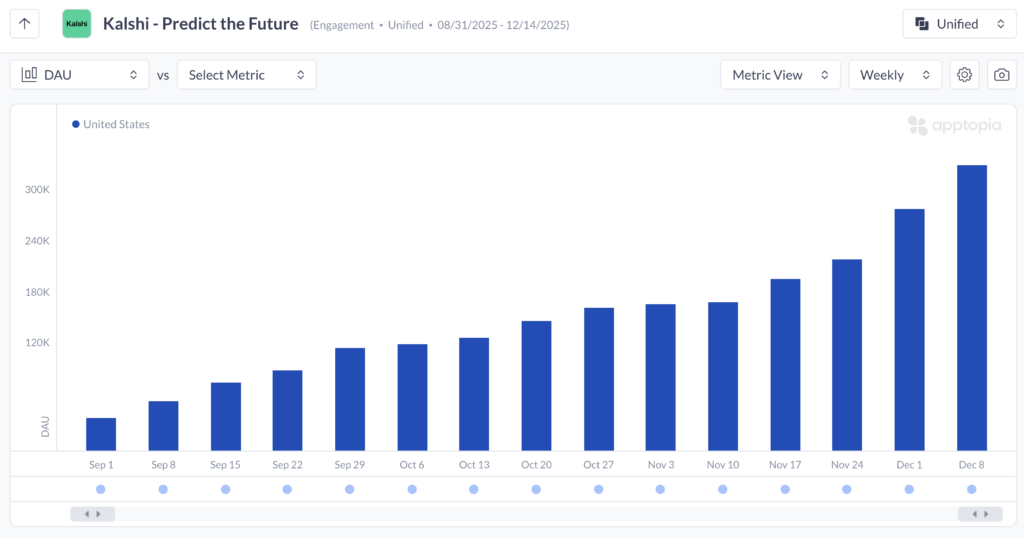

Kalshi, the predictions market platform, is growing mobile app daily active users. Giving the timing, the NFL season and College Football, have had a big impact on growth. While people love to bet on anything, betting on sports has a a large built-in audience.

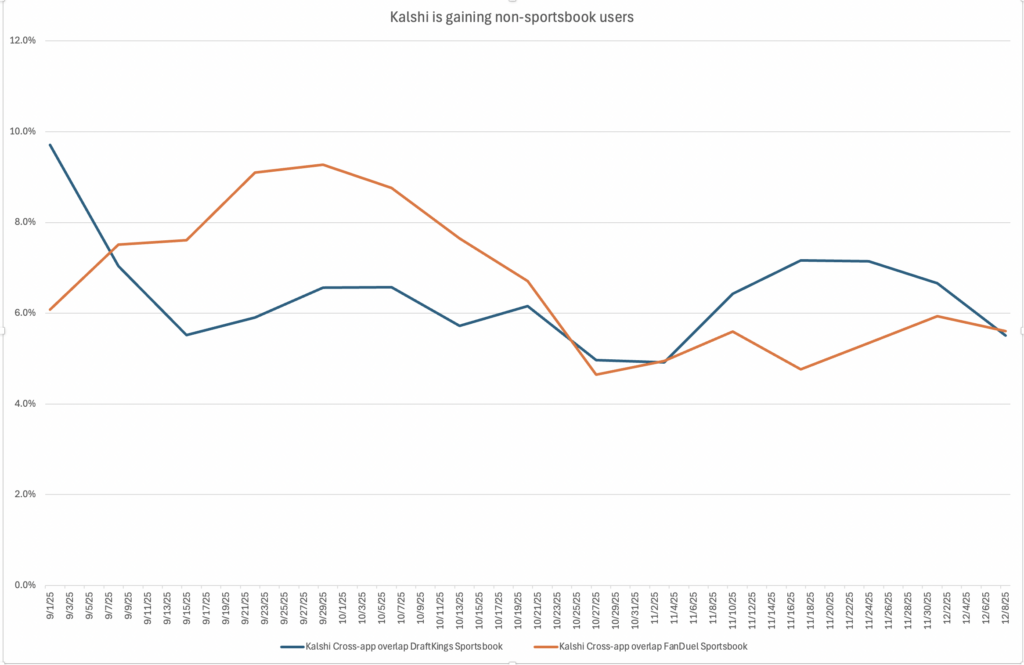

The percentage of Kalshi’s users who are also users of DraftKings and FanDuel is shrinking. Kalshi is attracting its own users, who are not users of sportsbooks. You can see that in the below visual, showing Cross-App Overlap. We define this as the percentage of primary app MAUs who also used the secondary app at least once in the past 30 days (rolling).

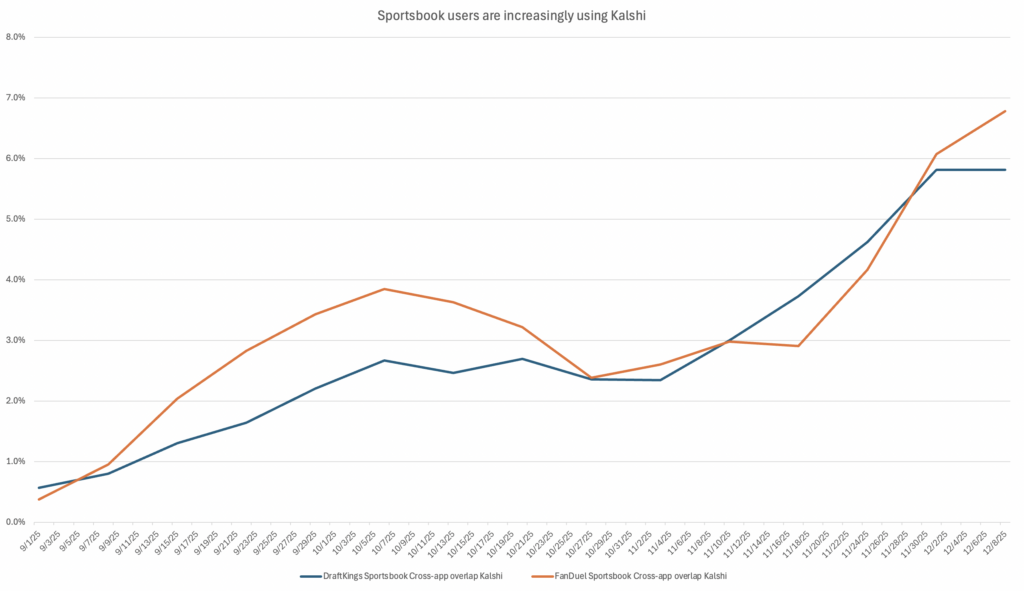

Both DraftKings and FanDuel have made it know they are working on their own prediction markets apps. It makes sense because right now their users are increasingly trialing Kalshi. The overlap has gone from almost nothing in early September 2025 to approaching 7% for FanDuel in early December.

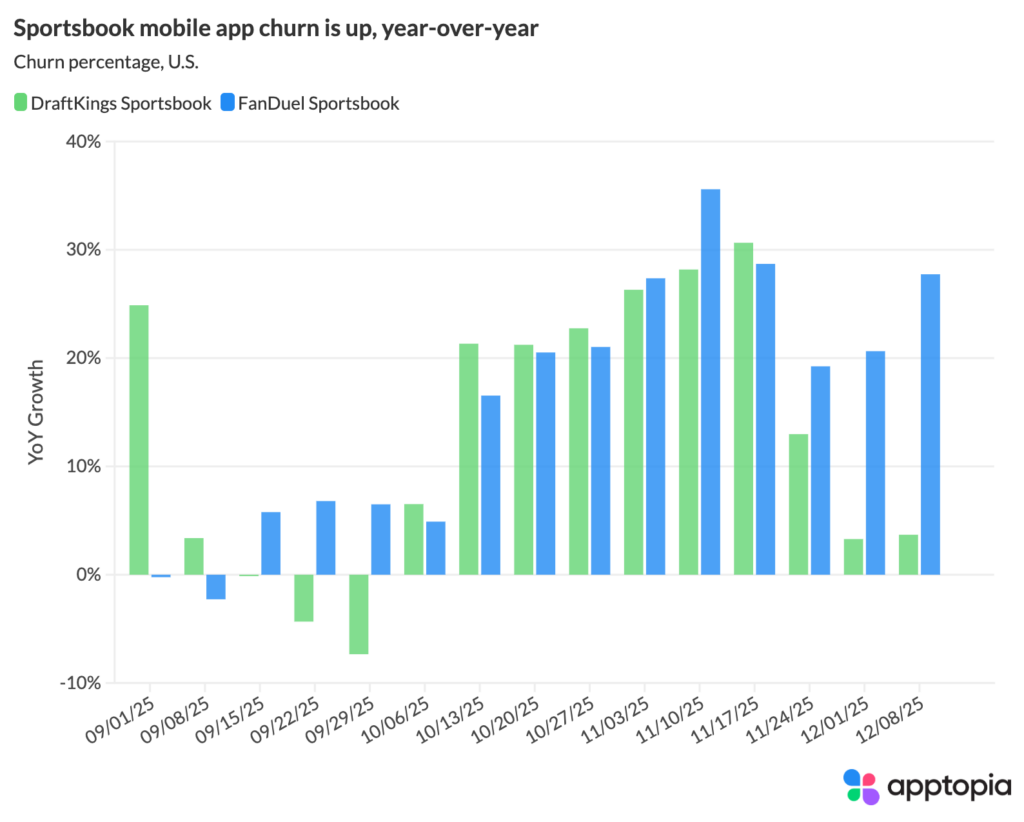

Another red flag for DKNG and FLUT would be the growth in churn. Apptopia uses Churn as a user behavior stat, it shows the percentage of users who have not opened the app in the past 30 days after being active. Both sportsbooks have increased their churn rate, year-over-year, almost every week since September.

We also looked at Cross-App Impact. This looks at a cohort of DraftKings users who installed the Kalshi app. We’re then able to look at their Time Spent on DraftKings before the Kalshi install and after to see if it impacted Time Spent on the primary app. DraftKings users, on average, actually increased their Time Spent on the DraftKings Sportsbook app. FanDuel on the other hand saw Average Time Spent per DAU decrease 22% when comparing the 10 days before installing Kalshi to the 10 days after.

Once DraftKings and FanDuel launch their own prediction market apps, we could see a loss of users for Kalshi, especially in states where sports betting is legal. Why use two apps when you could just use one?

Questions on the underlying data included in this analysis?