The U.S. online sports betting industry is entering a new phase. After years of land-grab growth, 2025 mobile download data from Apptopia reveals a maturing market where the four major sportsbooks (DraftKings, FanDuel, BetMGM and Caesars) all posted negative year-over-year download growth in Q4 2025.

Yet beneath the top-of-funnel slowdown lies a more nuanced story. Both DraftKings (NASDAQ: DKNG) and FanDuel (NYSE: FLUT) are seeing meaningful improvement in Power User retention. Power users represent the top 10% of users by time spent. These are the users who disproportionately drive revenue.

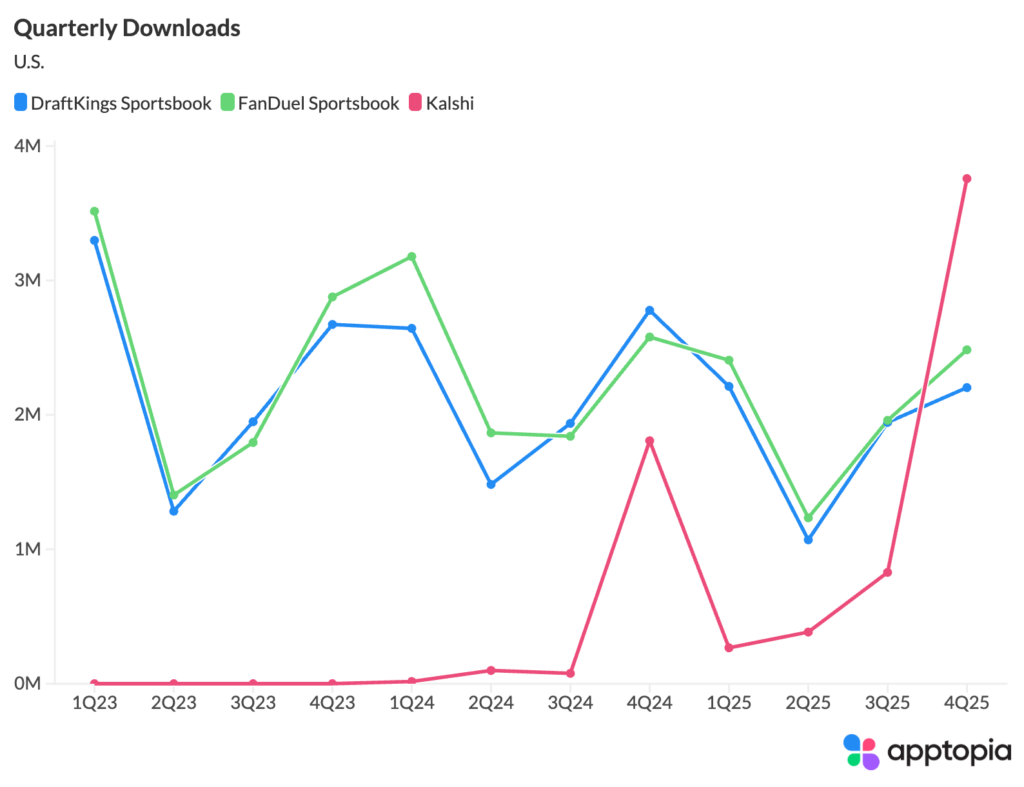

DraftKings’ Power User churn fell to 7.9% in Q4 2025 (from 9.8% a year ago), while FanDuel’s dropped to just 5.4% (from 8.3%). The whales are staying. Meanwhile, a disruptive new entrant in Kalshi, a prediction markets platform, surged to 3.8 million downloads in Q4 2025, exceeding both DraftKings (2.2M) and FanDuel (2.5M), individually.

Looking ahead to Q1 2026, Super Bowl LX provided the expected demand spike, with DraftKings logging 54,097 downloads on game day alone, a 56% surge from two weeks prior. Q1 is historically the strongest quarter for sportsbook downloads, but the key question is whether seasonal tailwinds can offset structural headwinds.

COMPETITIVE FORCES: THE KALSHI INFLECTION

Perhaps the most striking data point in this analysis: Kalshi, a prediction markets platform that allows users to trade on real-world events including sports outcomes, recorded 3.76 million downloads in Q4 2025 — surpassing both DraftKings (2.2M) and FanDuel (2.5M) individually. This represents a 108% YoY increase from Kalshi’s Q4 2024 downloads of 1.8M.

Kalshi’s trajectory has been parabolic. From just 374 downloads in Q4 2023 to 3.8 million two years later, the platform has gone from invisible to the single largest app by quarterly downloads in the sports wagering ecosystem. For context, Kalshi’s full-year 2025 downloads of 5.2 million approach DraftKings’ 7.43 million — a gap that is closing rapidly. The prediction markets model offers a differentiated value proposition: event-based contracts on sports, politics, economics, and culture, without the traditional sportsbook structure.

“While new state openings are expected to be an ongoing tailwind for online sportsbetting, a new headwind has smacked this industry in the face in the form of prediction markets,” said Tom Grant, VP of Research at Apptopia. “Kalshi is significantly outgrowing the OSB apps and, due to regulatory dissimilarities, is potentially stealing future growth potential from DraftKings, FanDuel, et al.”

For DKNG and FLUT investors, Kalshi’s rise introduces a new competitive dimension. While it remains unclear how much of Kalshi’s growth is coming at the direct expense of sportsbook downloads vs. expanding the overall market, the download data suggests that incremental consumer attention in the wagering space is increasingly flowing toward prediction markets rather than traditional sportsbooks. This is a trend to monitor closely heading into 2026.

Both companies face a common emerging threat in Kalshi. In January, Kalshi pulled in 3.05 million downloads, more than any sportsbook, real-money gaming, or predictions market mobile app has ever had in a single month.

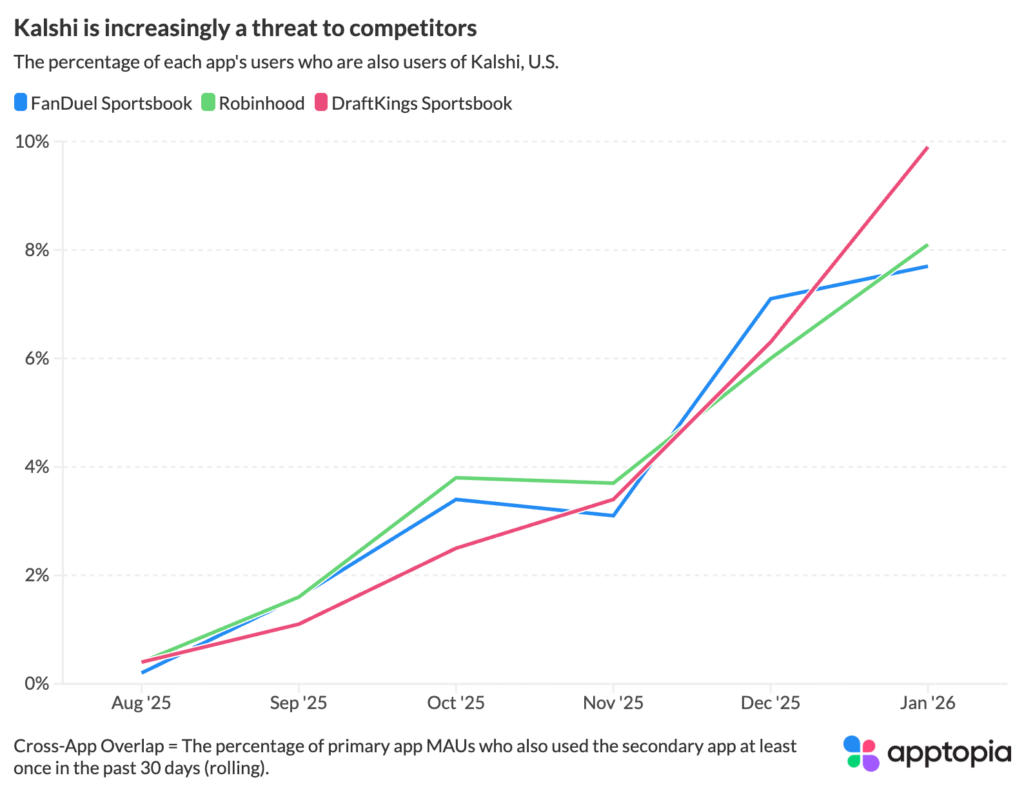

Apptopia’s consumer device panel is able to measure cross-app overlap, or the percentage of one app’s users who are also using another app. About 10% of DraftKings Sportsbook app users were also using Kalshi in January. The cross-app overlap between Kalshi and the major sportsbooks has been growing almost every month since August. The same goes for Robinhood.

Both DraftKings and FanDuel launched their own standalone prediction market apps. In its first 30 days on the market, DraftKings Predictions has been installed 43k times. When DraftKings Sportsbook launched back in 2018, it was installed 127k times through its first 30 days. FanDuel Predicts (30k) similarly did worse than its sportsbook counterpart (57k) at launch in 2018.

DOWNLOADS: AN INDUSTRY IN DECELERATION

Every major U.S. sportsbook posted negative YoY download growth in Q4 2025. The addressable market of first-time downloaders is shrinking as legal sports betting enters its sixth year of broad state-level availability. FanDuel showed relative resilience at -3.7% YoY in Q4, significantly outperforming DraftKings (-20.7%), BetMGM (-28.0%), and Caesars (-9.9%).

For the full year 2025, DraftKings downloads fell 16.0% while FanDuel declined 14.6%. FanDuel’s Q3 2025 was a notable bright spot, posting +6.4% YoY growth, the only positive quarter across any sportsbook in H2 2025.

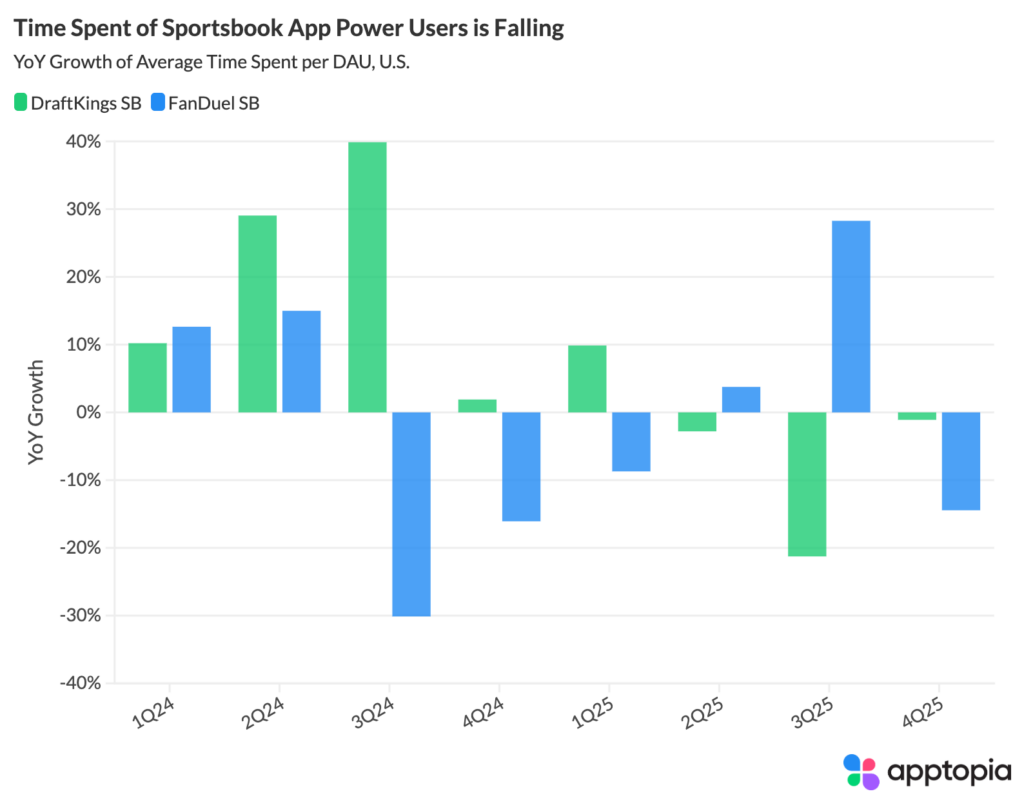

ENGAGEMENT: DRAFTKINGS HOLDS STEADY, FANDUEL FADES

Average time spent per daily active user is a critical proxy for user stickiness. In Q4 2025, the two market leaders diverged meaningfully on this metric. DraftKings held engagement essentially flat YoY, with All Users averaging 31.8 minutes per day in Q4 2025 vs. 32.0 minutes in Q4 2024 (-0.9% YoY). Power Users averaged 174.6 minutes, also roughly flat (-1.1% YoY).

This stability in a declining-download environment suggests DraftKings is doing well to retain and engage its existing base even as fewer new users arrive. FanDuel tells a less encouraging story. All User time spent fell to 24.3 minutes per DAU in Q4 2025, down 15.5% from 28.8 minutes in Q4 2024. Power User time spent declined even more sharply to 134.1 minutes, a 14.5% YoY drop from 156.7 minutes. This is a sequential deterioration: FanDuel Power Users spent 184.7 minutes in Q2 2025 but have seen engagement erode in each subsequent quarter.

For FLUT investors, this warrants close monitoring. Declining engagement among the highest-value cohort could signal future revenue pressure.

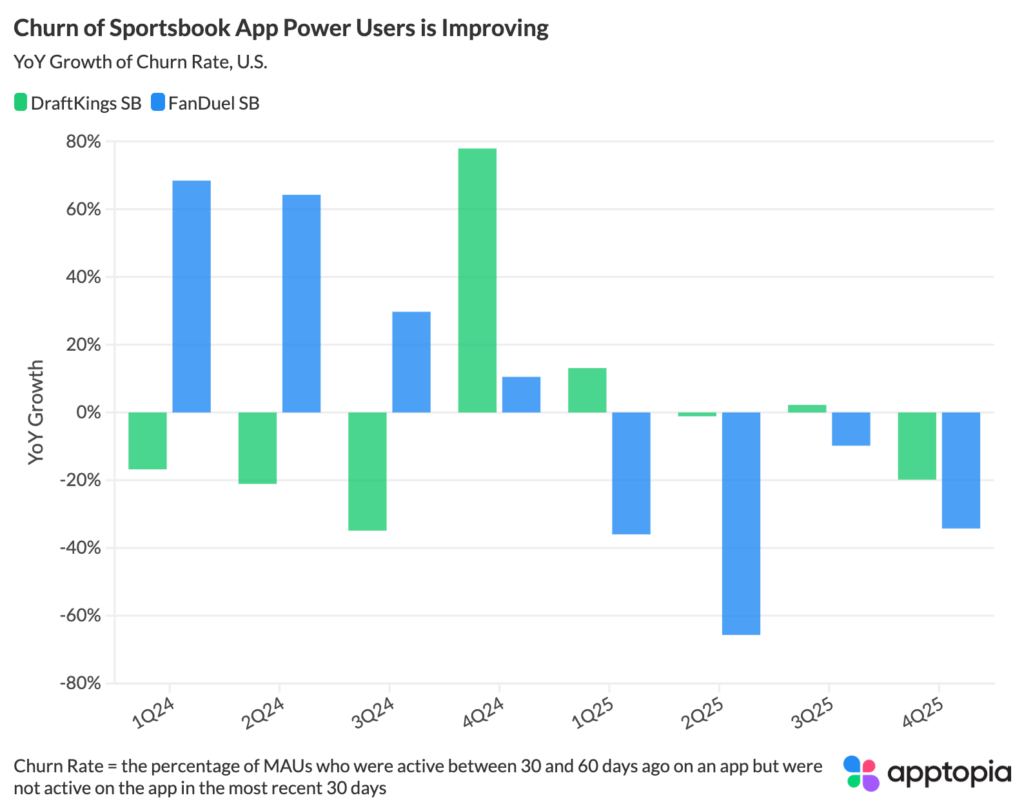

CHURN: RISING OVERALL, BUT POWER USERS ARE THE SILVER LINING

Overall user churn is trending in the wrong direction for both companies. DraftKings’ All User churn rate rose to 37.6% in Q4 2025, up from 34.2% a year earlier. FanDuel’s reached 39.9%, up from 33.8%. In a market with declining new downloads, rising churn is a double headwind; fewer users coming in and more going out.

However, the most investable signal sits within the Power User cohort. DraftKings’ Power User churn improved to 7.9% in Q4 2025, down from 9.8% in Q4 2024. FanDuel’s improvement was even more dramatic: Power User churn fell to 5.4%, down from 8.3%. At 5.4%, FanDuel is retaining nearly 95 out of every 100 Power Users quarter over quarter.

This divergence — rising mass-market churn alongside improving whale retention — is the defining paradox of the current sportsbook cycle. It suggests both companies are successfully deepening loyalty among high-LTV users even as casual bettors churn through the ecosystem.

Q1 2026 OUTLOOK: SUPER BOWL TAILWINDS, STRUCTURAL HEADWINDS

Super Bowl LX took place on February 8, 2026, and daily download data from the two-week lead-up period (January 25 – February 8) confirms the event remains the single most powerful demand catalyst for sportsbook apps. DraftKings surged to 54,097 downloads on game day, up 56% from 34,627 on January 25th. Including theScore (a DraftKings subsidiary), the DKNG ecosystem generated 59,581 downloads on Super Bowl Sunday. FanDuel posted 36,159 downloads, a 51% increase from its January 25th baseline of 23,944.

Notably, DraftKings recaptured the daily download lead over FanDuel during the Super Bowl window. On January 26th, FanDuel held a slight edge (29,557 vs. 29,974), but by February 8th DraftKings led by nearly 18,000 downloads (54,097 vs. 36,159). This suggests DraftKings’ Super Bowl marketing spend may be yielding outsized returns relative to competitors.

Q1 is historically the strongest quarter for sportsbook downloads, driven by the NFL playoffs, Super Bowl, and March Madness. In both 2024 and 2023, Q1 represented the annual peak for DraftKings and FanDuel downloads. However, Q1 2025 already showed YoY declines of -16.3% (DK) and -24.3% (FD), so the structural downtrend is well-established even in the seasonally strongest period.

The Super Bowl data provides early evidence that Q1 2026 will see a seasonal uptick, but whether it can reverse the negative YoY trajectory established in Q1 2025 remains the central question. Investors should look for management commentary on customer acquisition costs and new state launches during earnings calls as potential offsets to organic download deceleration.