This was first published August 13th, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- All three stocks have been amazing, meaning it is time to worry

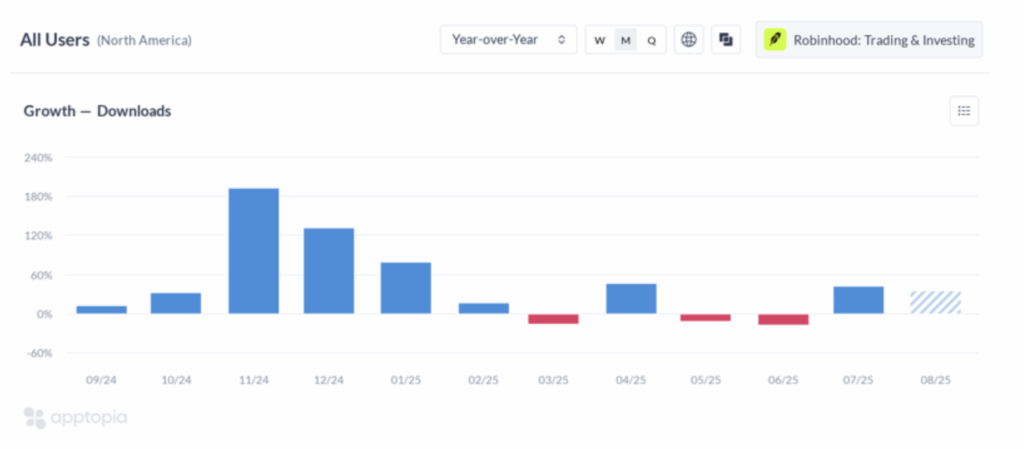

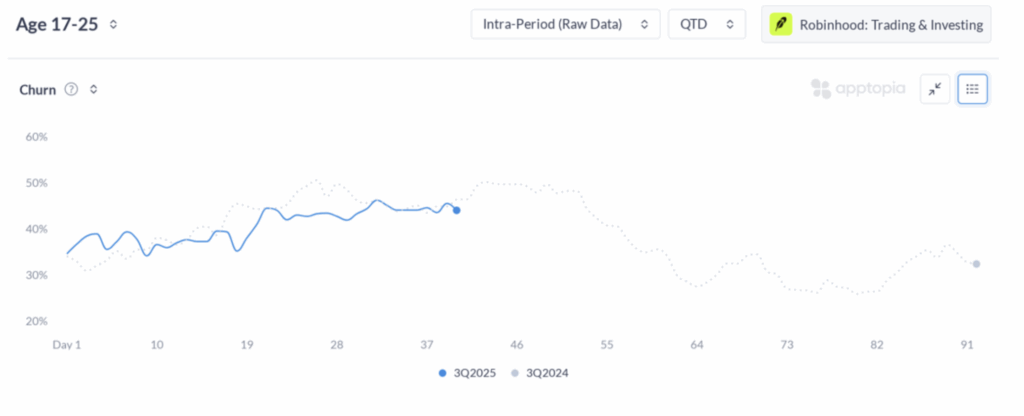

- HOOD – New user growth deceleration; Gen Z user churn inching up

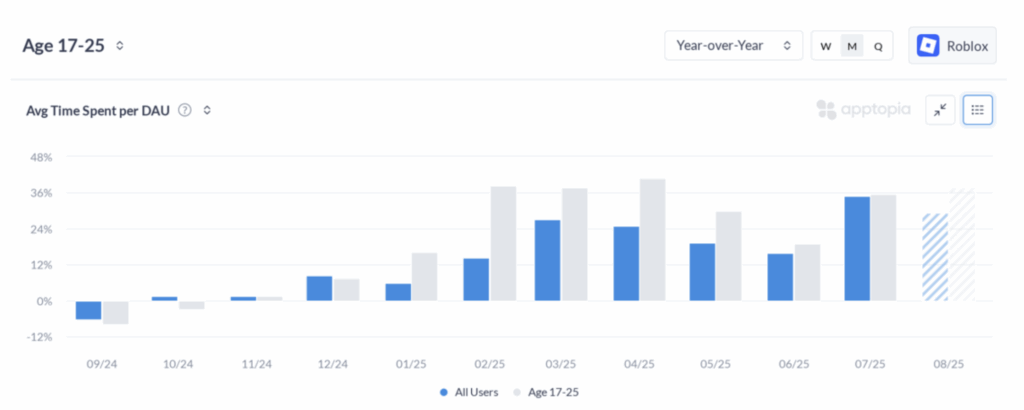

- RBLX – Gen Z engagement growth peaks

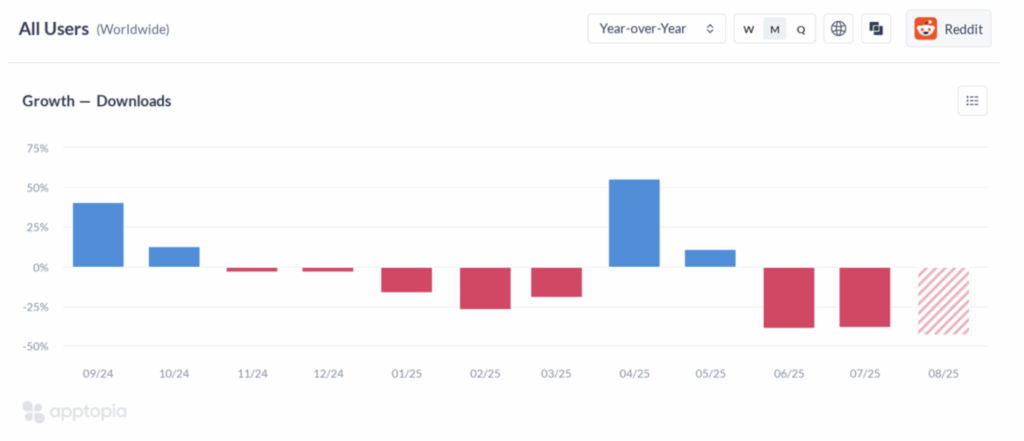

- RDDT – New user growth is down; US engagement decelerates

Congratulations to those of you who have owned HOOD, RBLX, and RDDT this year. It is a great feeling to recognize early when a business is doing well and then be able to trade the stock accordingly. Similarly, however, it is important to recognize early when cracks begin to form in a business. Fortunately, Apptopia’s data is real-time and can give us early warning signs.

Before we go too much further, I would like to be clear – all three of these companies’ apps still look healthy. Our goal is to identify data points that indicate areas of concern before they escalate into visible problems. With that in mind, let’s begin with Robinhood.

HOOD

Robinhood’s -3% move on earnings was only a mild pause on its journey to new highs. As mentioned above, the app still looks quite healthy. At this point, we mainly wonder: 1) can it keep adding new users; and 2) is its key demo still engaged. To track that, we looked at new user growth in North America, and user churn among Gen Z. In the charts below, you can see that new user growth has started to decelerate in the US in August (+36% QTD) after a strong July (+42%), and that user churn for people aged 17-25 is inching up from 35% to 40% QTD. While neither of these are bad at the moment, they are showing a switch from acceleration to deceleration.

Robinhood app downloads YoY growth – North America

Robinhood user churn, ages 17-25 – United States

RBLX

It is hard to find fault with Roblox, but that is why the stock has absolutely crushed all expectations this year. With that in mind, we are monitoring the segment we think matters most – Gen Z users. Their time spent on the app has increased at 30% YoY or more in five of the seven months YTD. However, if you squint, you can see that the YoY growth in time spent on the app by this demo is no longer accelerating and in fact peaked in April. While this is admittedly splitting hairs – July was a re-acceleration – it is worth noting that the fastest growth in time spent per user in Gen Z might be over.

Roblox time spent per DAU for ages 17-25 – United States

RDDT

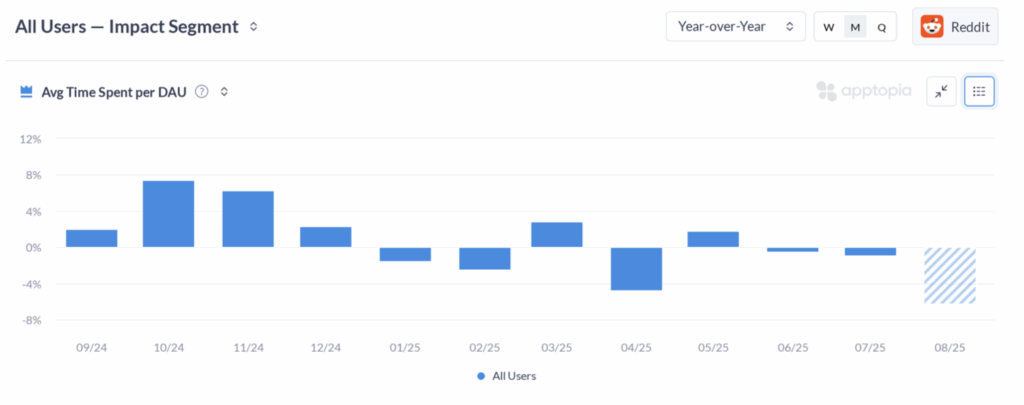

Reddit has slightly more controversy around it than HOOD and RBLX, which is reflected in YTD stock performance. App data remains fairly consistent – engagement in the US and growth globally for the app is not great. Reddit has found ways to offset it (or ChatGPT is offsetting this for them, however you want to look at it), but there are real reasons to be concerned about the app, which we are happy to discuss if you reach out to research@apptopia.com. Either way, the data is showing: 1) Worldwide, new user growth is negative year-over-year; and 2) time spent per user in the US is also falling YoY.

Reddit new user YoY growth – Worldwide

Reddit time spent per DAU – United States

If you want to dig in more, please check out our webtool here: https://apptopia.com/en/latest-release/