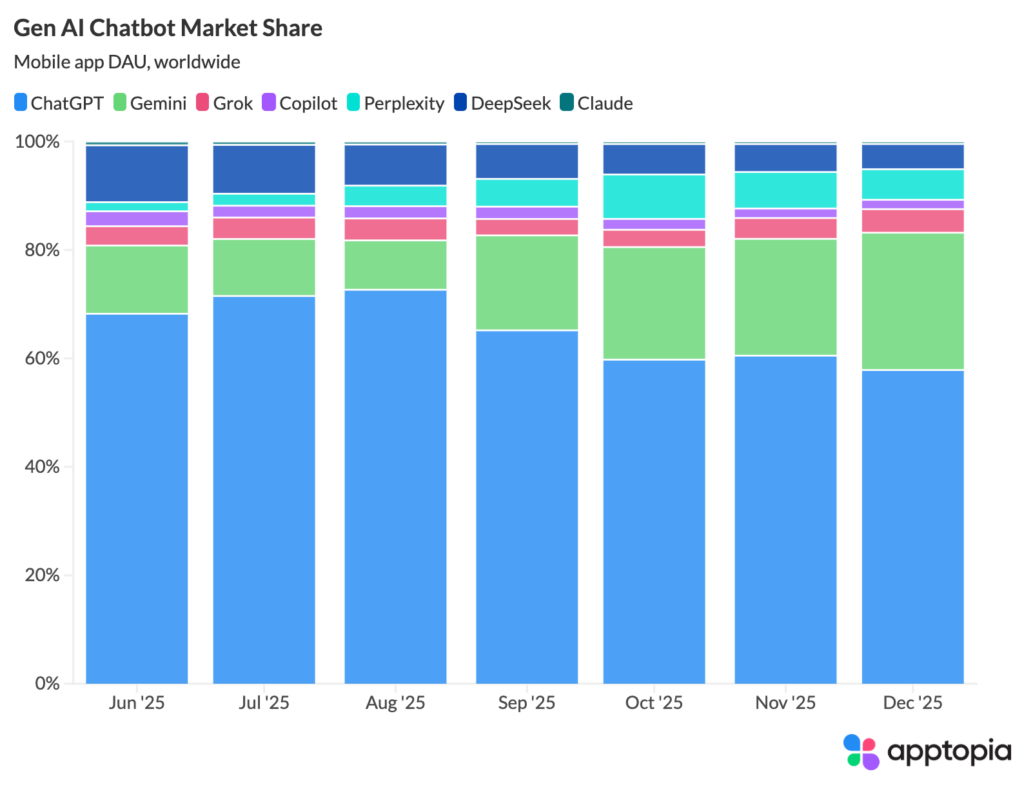

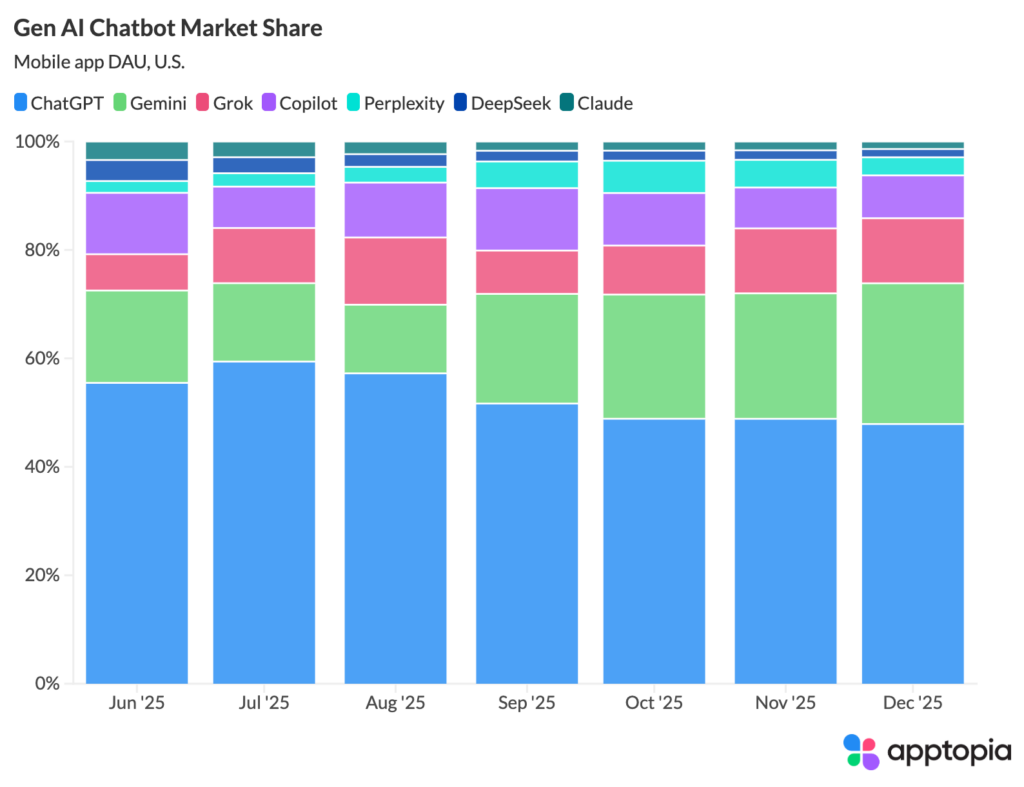

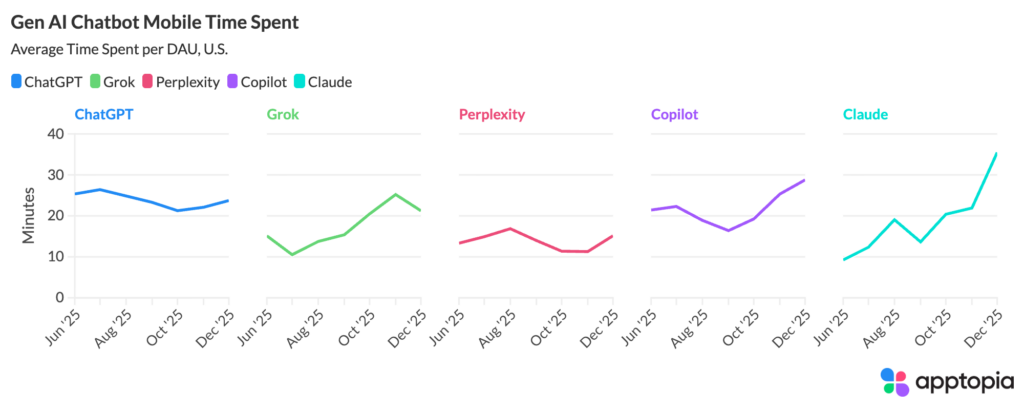

ChatGPT maintains category leadership with approximately 35% DAU market share domestically and close to 50% worldwide. The incumbent position remains secure even as the broader market expanded 81% globally from June to December 2025. However, the engagement picture over this time period reveals a more nuanced competitive dynamic: while ChatGPT users are spending modestly less time in the app (down 6.4% among all users), Claude users increased their time spent by 283%.

Among power users (defined as the top decile by time spent) Claude’s average time spent per DAU increased from 39 minutes in June to 186 minutes in December. That’s a 377% surge. For context, ChatGPT’s power users declined from 148 to 139 minutes over the same period. Both figures remain substantial, but the velocity and direction signal different product-market fit trajectories.

The driver appears to be feature depth. Anthropic’s recent product releases—including computer use capabilities, enhanced coding functionality, and improved multimodal support—are translating into measurably deeper engagement patterns. When power users are logging three hours per day, you’re probably looking at workflow integration.

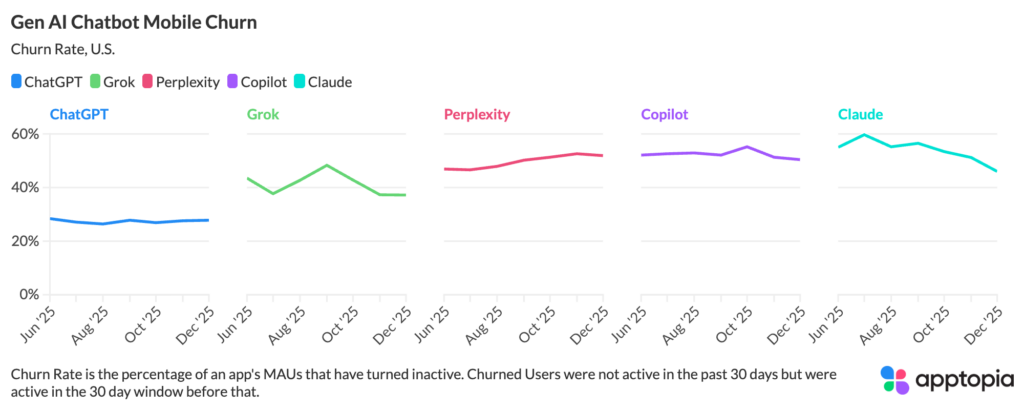

The retention data reinforces this narrative. Claude’s 30-day churn rate compressed from 55% to 46% for all users, and more significantly, from 38% to 20% for power users. That represents an approximate 50% reduction in power user churn over six months. Compare that profile to Perplexity, which achieved impressive top-line growth with DAU up 410% worldwide, but saw all-user churn expand from 47% to 52%. High growth paired with rising churn creates customer acquisition cost efficiency challenges.

Microsoft Copilot and Grok both demonstrated solid engagement gains (34% and 40% respectively for all users). However, neither platform is experiencing the same magnitude of power user engagement acceleration that Claude is showing.