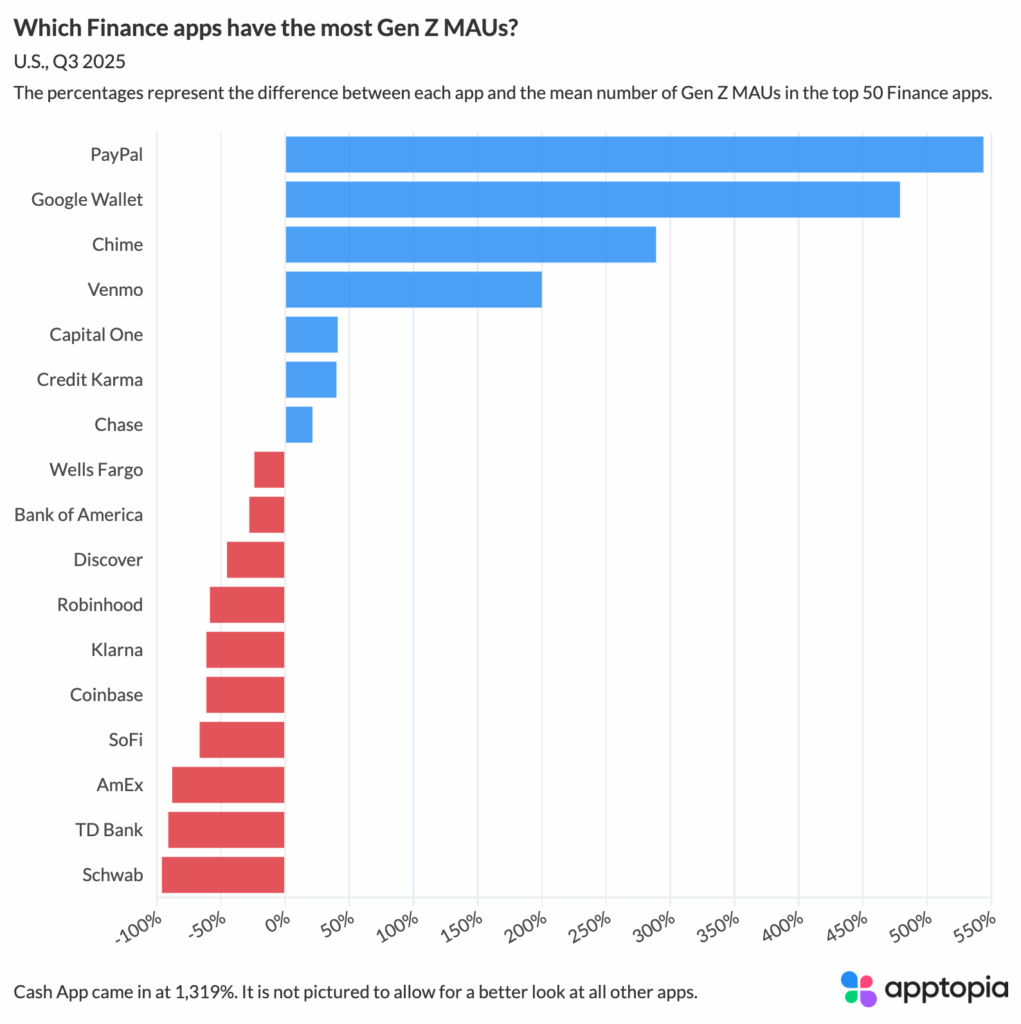

Our latest data on the top 50 US finance apps (by Q3 2025 MAU) shows Cash App dominating Gen Z engagement by an absurd margin. It came in at 1,319% above the category average for the number of Gen Z monthly active users. Yes, Cash App has a massive user base and so it is likely to have more of any age grouping. The app also had the highest percentage of Gen Z MAUs at 22%.

For absolute numbers, PayPal, Google Wallet, Chime, and Venmo round out the top five, all having at least 3x more Gen Z users than their peers.

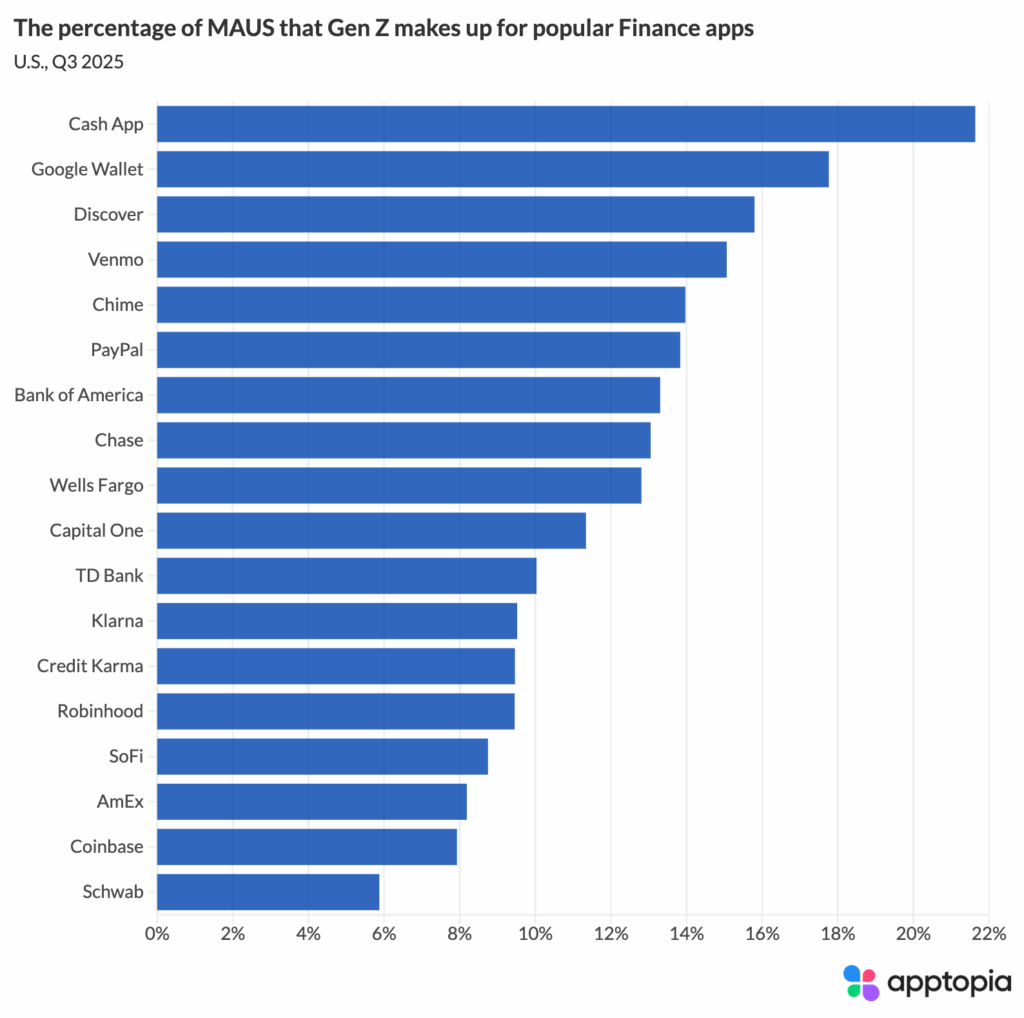

Meanwhile, the traditional banking players are lagging behind. Schwab Mobile sits at 96% below average for Gen Z MAUs. TD Bank? -91%. American Express? -88%. While Discover sits at -45.3%, it places rather high up when looking at the percentage of its users that are younger (image below). It ranked 3rd at 15.8%, just behind Google Wallet (17.8%), but ahead of Venmo (15.1%).

The pattern I expected to show in the data, did: peer-to-peer payment apps and neobanks do better with younger people than traditional banks and investment platforms. However, Robinhood was a big surprise, with Gen Z representing only 9.5% of its U.S. users.