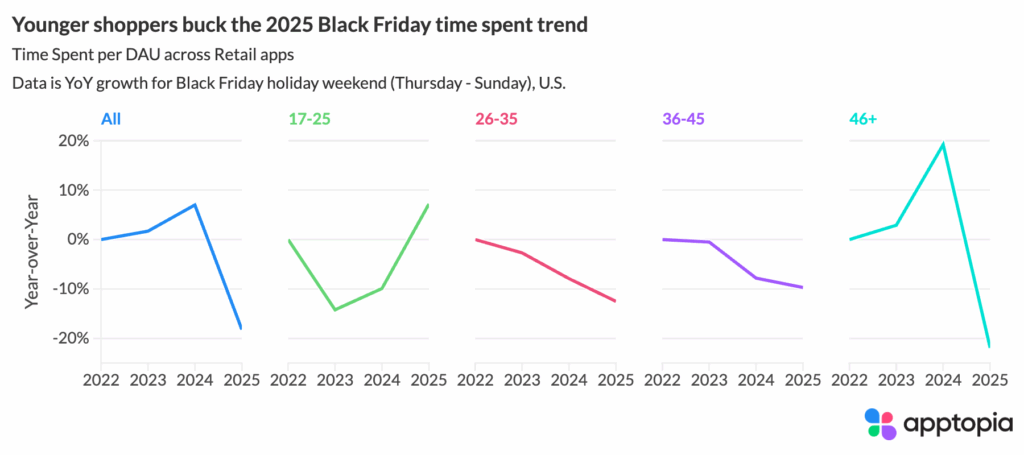

- Black Friday Downloads of retailer mobile apps increased 10% YoY while Time Spent per DAU dropped 18.2% YoY

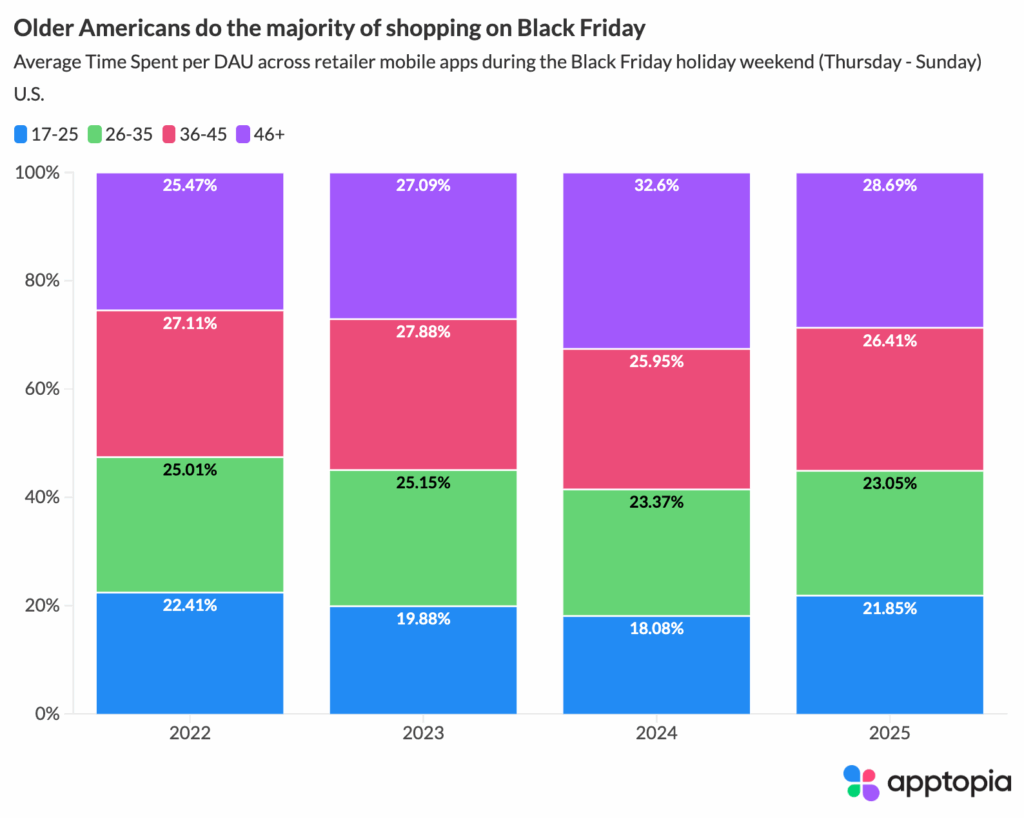

- Gen X+ continues to spend the most time in retailer mobile apps this Black Friday

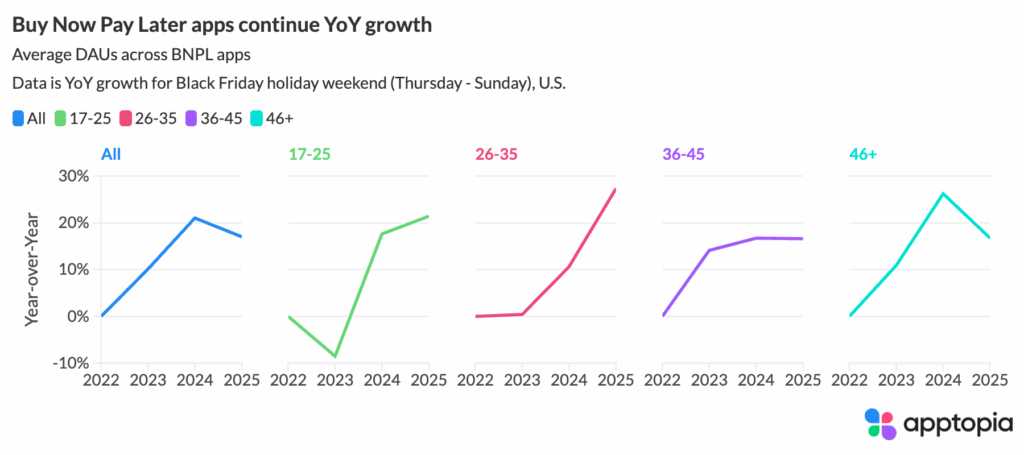

- Average DAUs for buy now, pay later apps grew 17% YoY for the holiday weekend

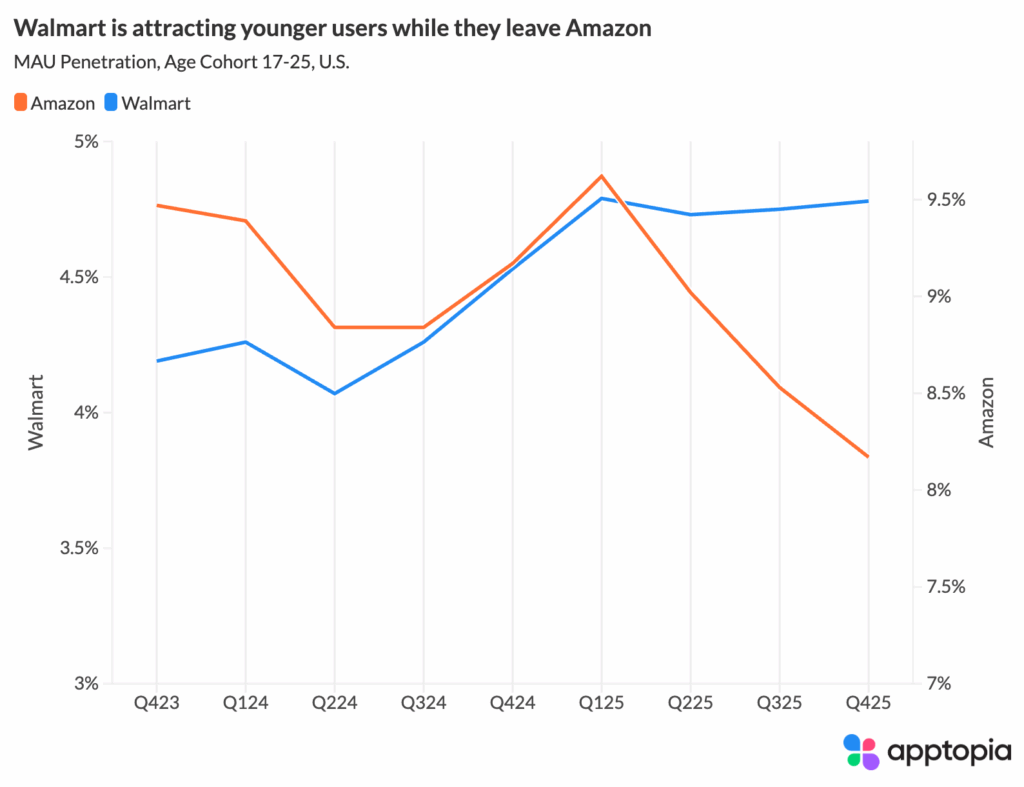

- Since Q423, Amazon has decreased its younger MAUs by 13.7% (ages 17-25), while Walmart has gained younger MAUs by 14% over the same time period (U.S.)

- Asia-headquartered retailers made up 4 of the top 6 retailers this Black Friday by Time Spent

While online spending hit a record dollar amount for the Black Friday holiday weekend, Time Spent per DAU in retailer mobile apps was down 18.2% year-over-year (YoY), after being up 7% the year prior. Still, Downloads of retailer mobile apps grew 9.7% YoY.

What could these signals mean? They may suggest inflation-driven pricing masking weaker consumer engagement. A record dollar amount doesn’t necessarily mean more things purchased but it could mean the same items, or even less items, are costing people more. Looking at Apptopia’s data, it feels like mobile shoppers aren’t necessarily browsing and discovering, they’re hunting specific deals and downloading apps where necessary for said deals. Brands might not be building loyal customers, but attracting coupon clippers. In today’s economic environment, that might still qualify as a win.

Even though time spent was down YoY for Gen X+ this holiday, the older Americans still led the way in Average Time Spent per DAU across retailer mobile apps. Younger Americans (17-25) were the only cohort to increase Average Time Spent per DAU over 2024’s holiday weekend, but still represented the shorted amount of time spent in retailer mobile apps this year.

While Average Time Spent per DAU was down, there were still many winners who beat the market over the Black Friday holiday weekend. Here’s a look at the top five:

1. Wayfair at +49.5% YoY

2. Foot Locker at +32.5% YoY

3. BJ’s Wholesale at +22% YoY

4. Macy’s at +21.3% YoY

5. DICK’s Sporting Goods at +21.1% YoY

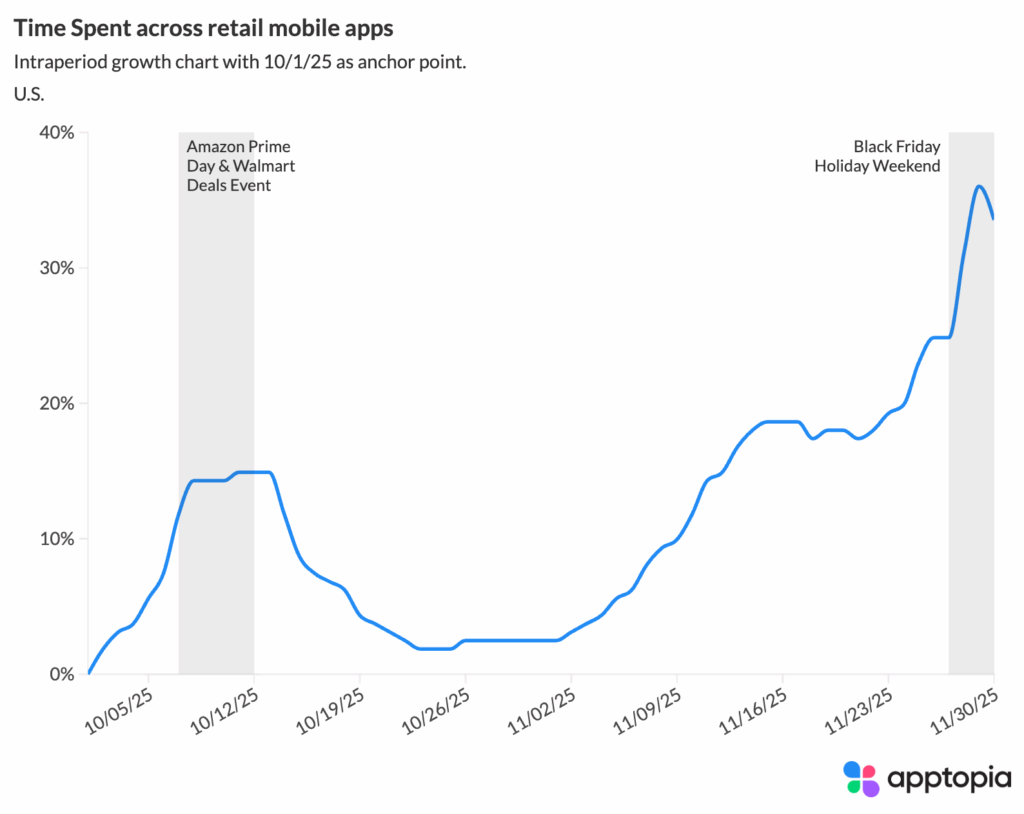

How much does the Black Friday holiday weekend matter for retailers?

One thing we’ve seen over and over again is that brands are pushing to get consumer dollars earlier and earlier in the year. However, the Black Friday still looms large. You can see increased Time Spent throughout October, but it hits its height during the holiday weekend.

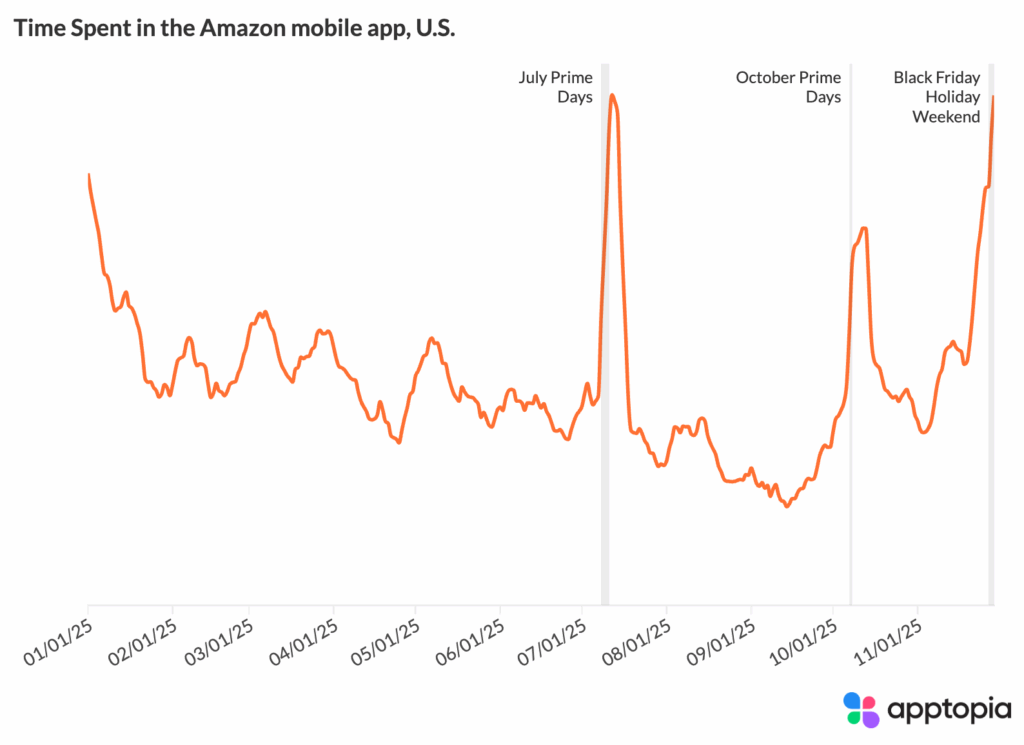

Looking at Amazon specifically, October Prime Days give the mobile app less engagement than Black Friday, but the event in July had almost the same exact spike:

Walmart is gaining on Amazon

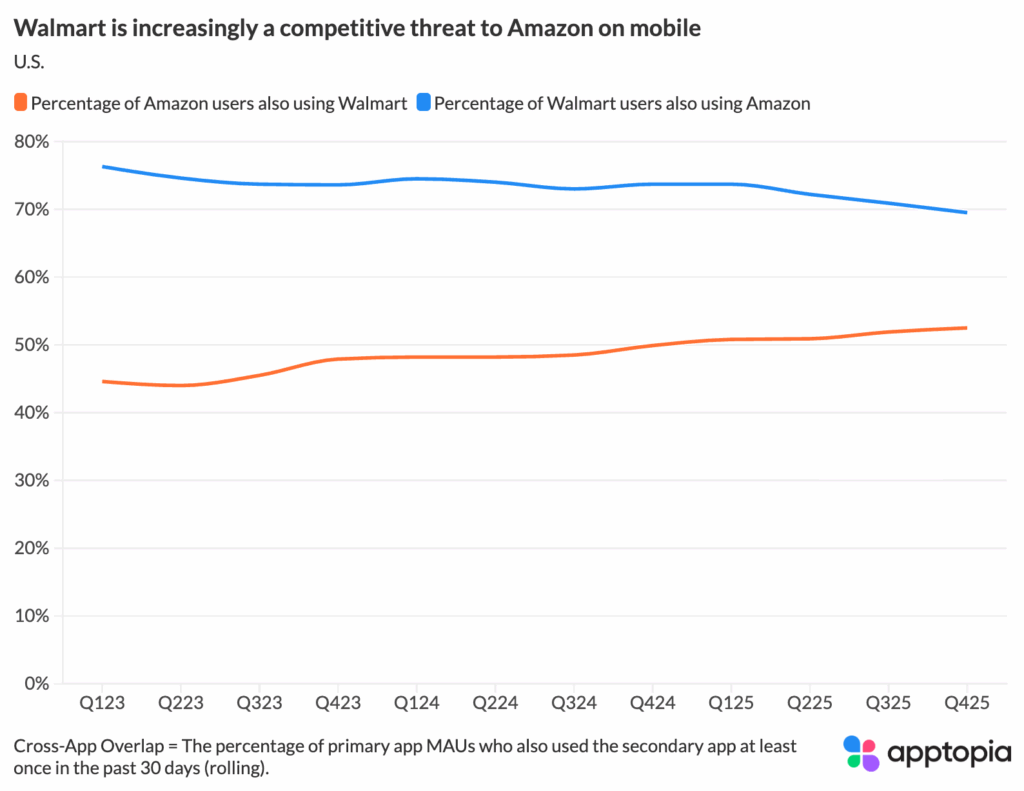

Amazon’s ecommerce dominance on mobile is sliding and Walmart appears to be a beneficiary. Through a cross-app overlap analysis, Apptopia determined that Amazon users who also use Walmart are increasing while Walmart users who also use Amazon are decreasing.

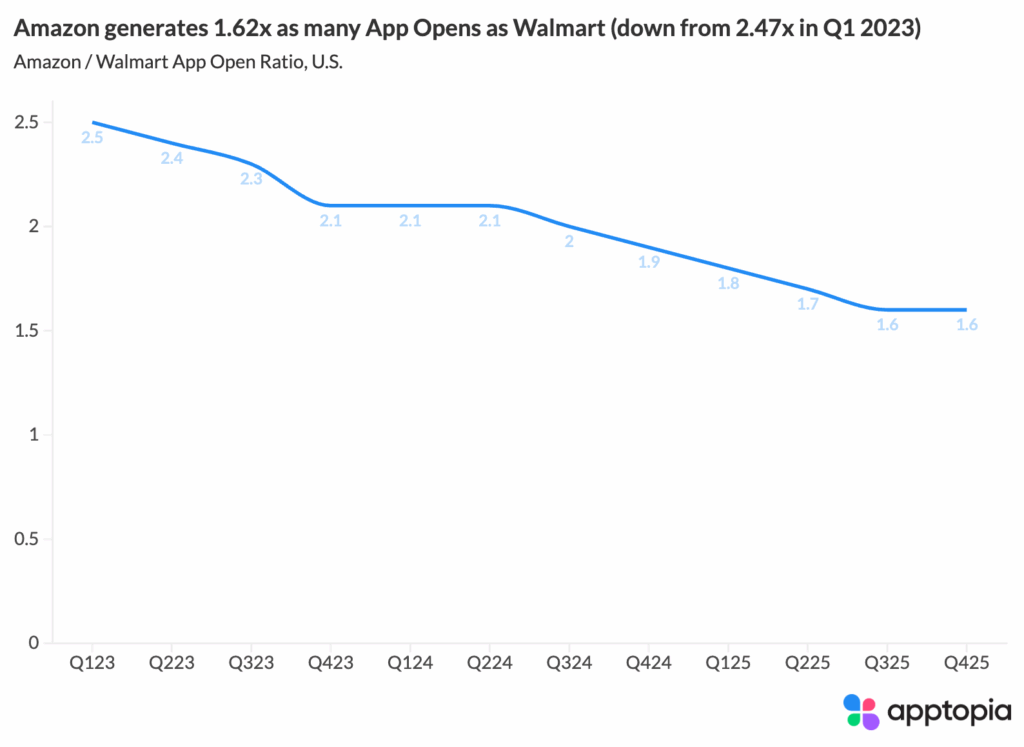

Additionally, the gap between App Opens is shrinking. Amazon had almost 2.5x as many App Opens in Q1 2023, but is now down to just 1.62x as many. That’s a drop of 34.4%. This is a situation where Walmart’s App Opens have been increasing while Amazon’s have been mostly stable.

Another issue for Amazon might be that younger monthly active users, those aged 17-25, are using Amazon less and using Walmart’s app more. You can see below that Amazon still has more MAU penetration in our U.S. panel but that the trendlines are going in opposite directions. Since Q423, Amazon has decreased its younger MAUs by 13.7%, while Walmart has gained younger MAUs by 14% over the same time period.

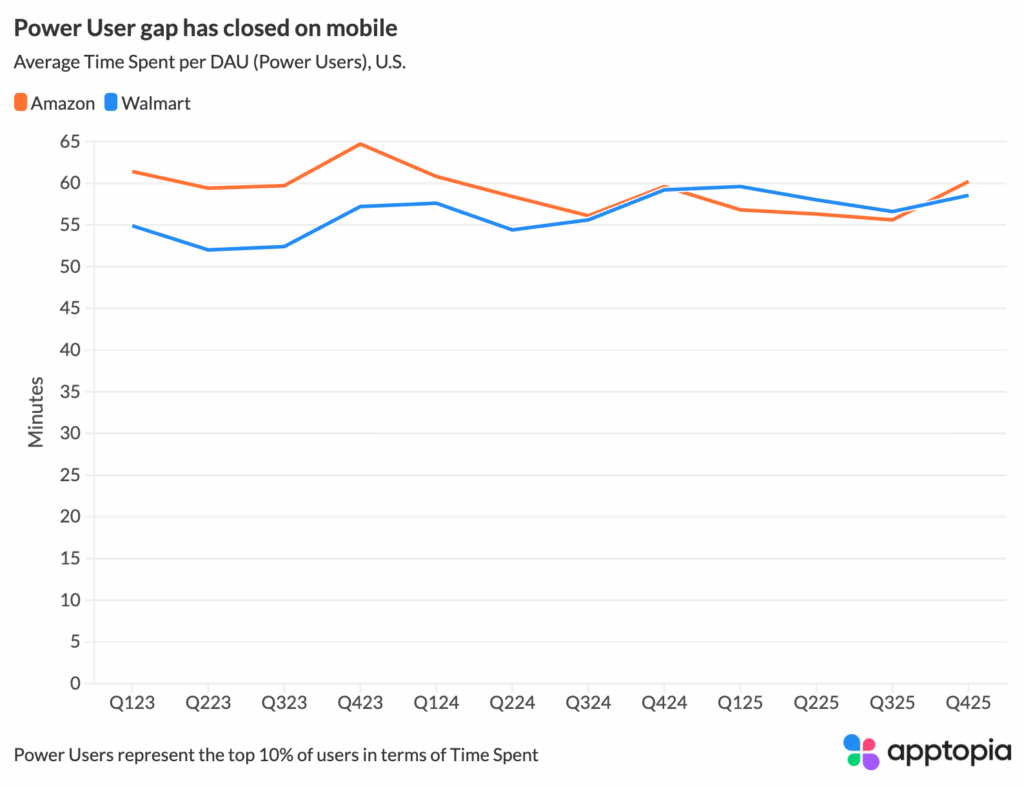

But a bigger worry might be Power Users. These are defined as the users who make up the top 10% of Time Spent in a mobile app. Power Users are spending slightly less time in Amazon while Walmart has been able to increase their time allocation.

Buy now, pay later apps fuel Black Friday

Buy now, pay later apps continue to grow in use. Average DAUs for the top BNPL apps (Klarna, Affirm, Aferpay, Sezzle, Zip) grew 17%, YoY for the Black Friday holiday weekend. While growth was strongest with younger Americans (17-35), Older Americans (36+) made up 68% of DAUs for BNPL apps. For each of these four apps, more than 50% of the users were female, averaging about 65% across the market.

Asia-Headquartered Retailers Benefit on Black Friday

Temu, AliExpress, SHEIN, and Mercari all had Time Spent figures above the average for our retail market. In fact, Temu led the market entirely, posting a figure 108% above the market’s average. Temu was the top Shopping app in Apple’s iOS App Store on Thanksgiving and never dropped below #4 over the weekend. While Temu led, Both Amazon and Walmart were above AliExpress, SHEIN and, Mercari. However, these were the top six apps by Time Spent for our retail market.