Amazon is slowly losing its grip on the next generation of mobile customers and Walmart is benefitting.

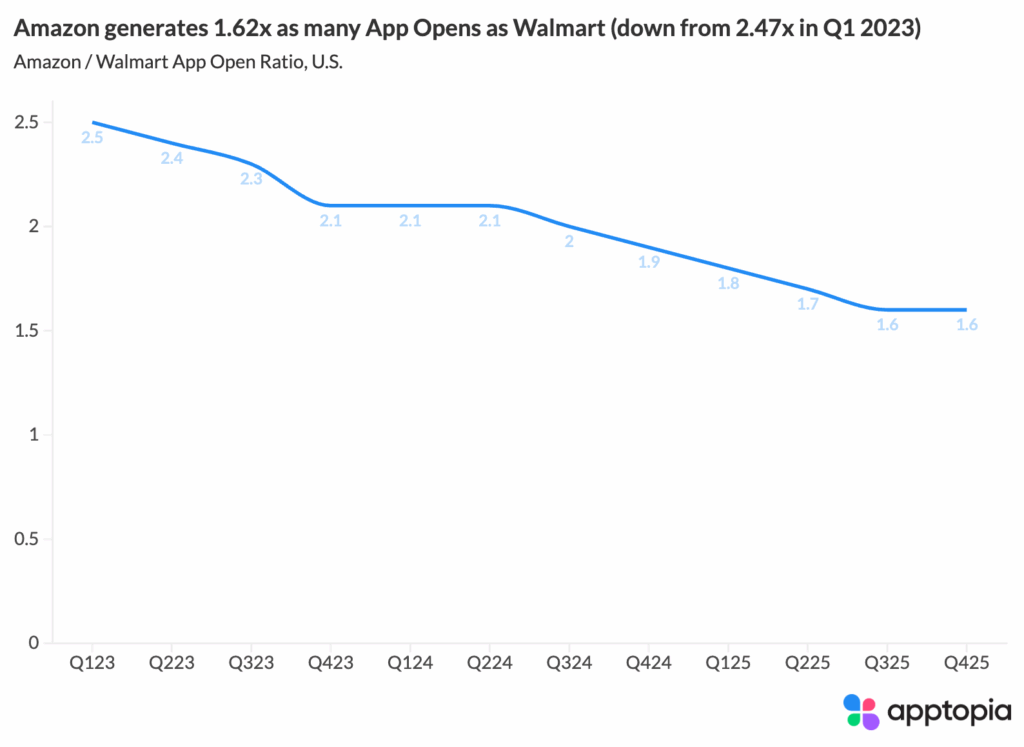

As far as mobile commerce goes, Amazon is still the larger player but there are more signs this gap is shrinking. One example is App Opens:

Amazon had almost 2.5x as many App Opens in Q1 2023, but is now down to just 1.62x as many. That’s a drop of 34.4%. This is a situation where Walmart’s App Opens have been increasing while Amazon’s have been mostly stable.

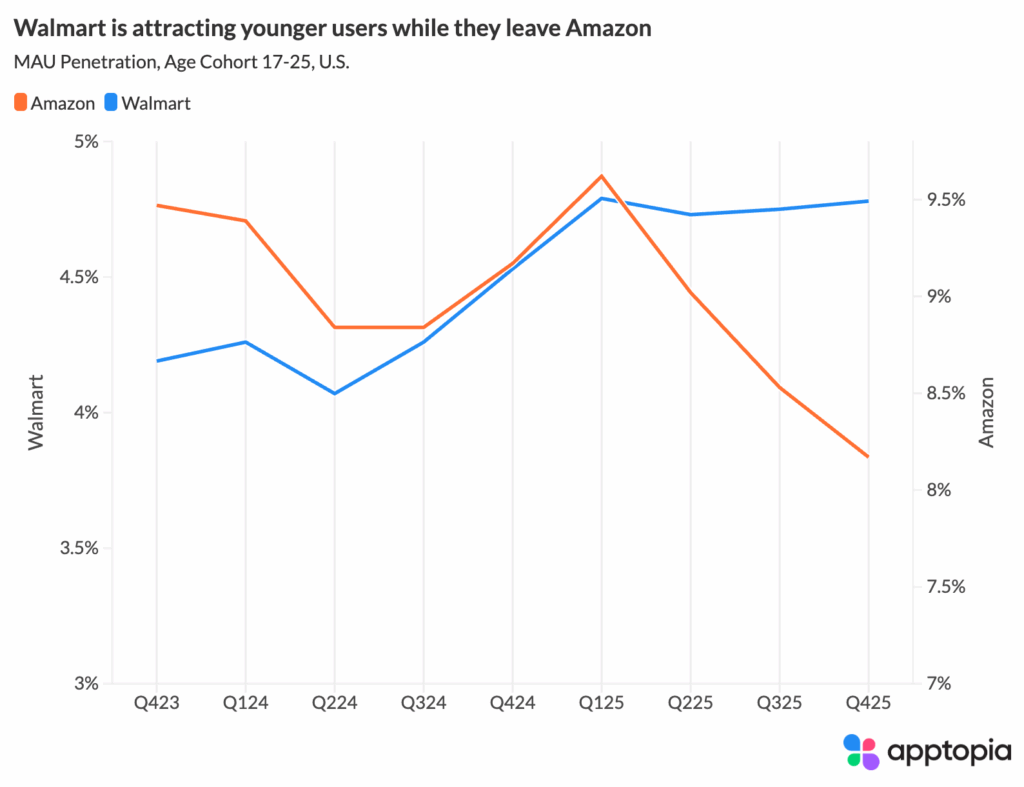

Another issue for Amazon might be that younger monthly active users, those aged 17-25, are using Amazon less and using Walmart’s app more. You can see below that Amazon still has more MAU penetration in our U.S. panel but that the trendlines are going in opposite directions.

Since Q423, Amazon has decreased its younger MAUs by 13.7%, while Walmart has gained younger MAUs by 14% over the same time period:

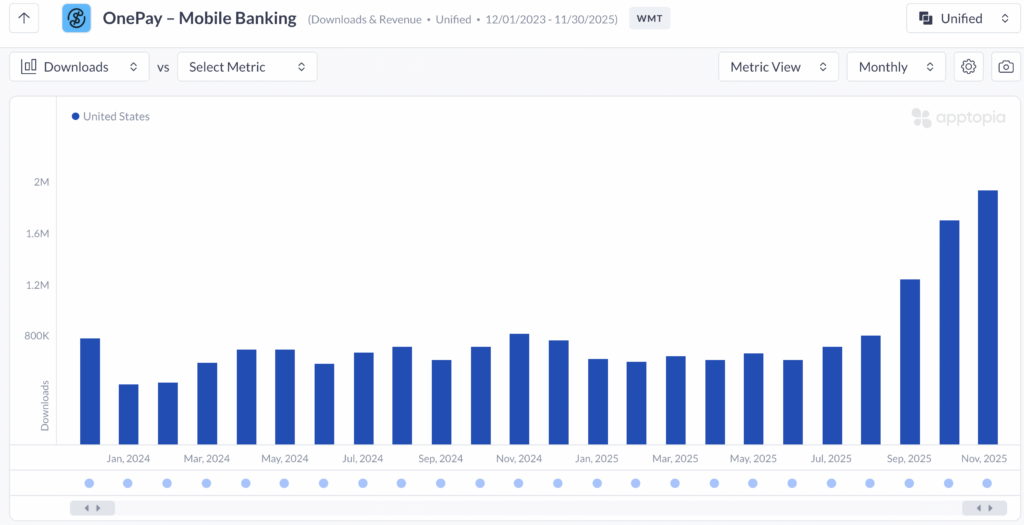

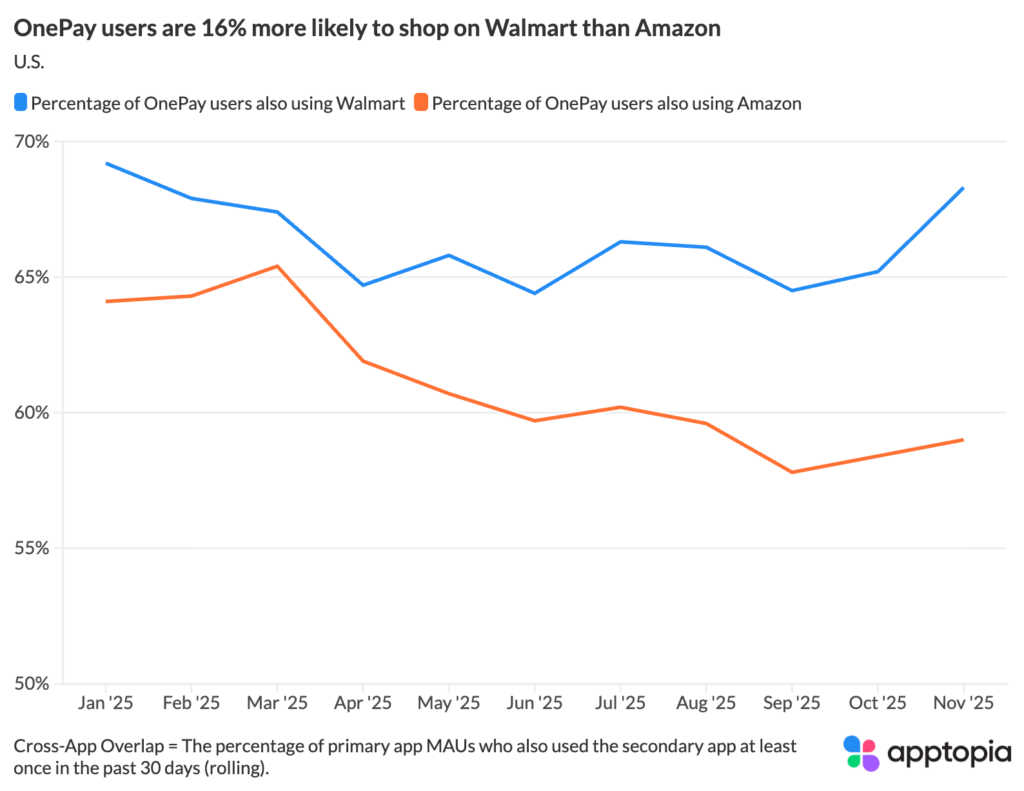

Walmart’s fintech offering, OnePay, is helping build a stickier commerce ecosystem. Users can pay for purchases with OnePay but the app also offers wallets, BNPL, P2P payments, debit cards, and credit cards via Synchrony Financial and Mastercard. When using OnePay to pay for Walmart purchases, users get 3% cash back and 5% cash back if they are Walmart+ members.

The OnePay app hit a new high-water mark for monthly downloads in November, with 1.98 million. Looking at the November market share of digital wallets in the United States, OnePay pulled in 23% of downloads but just 1.2% of monthly active users.

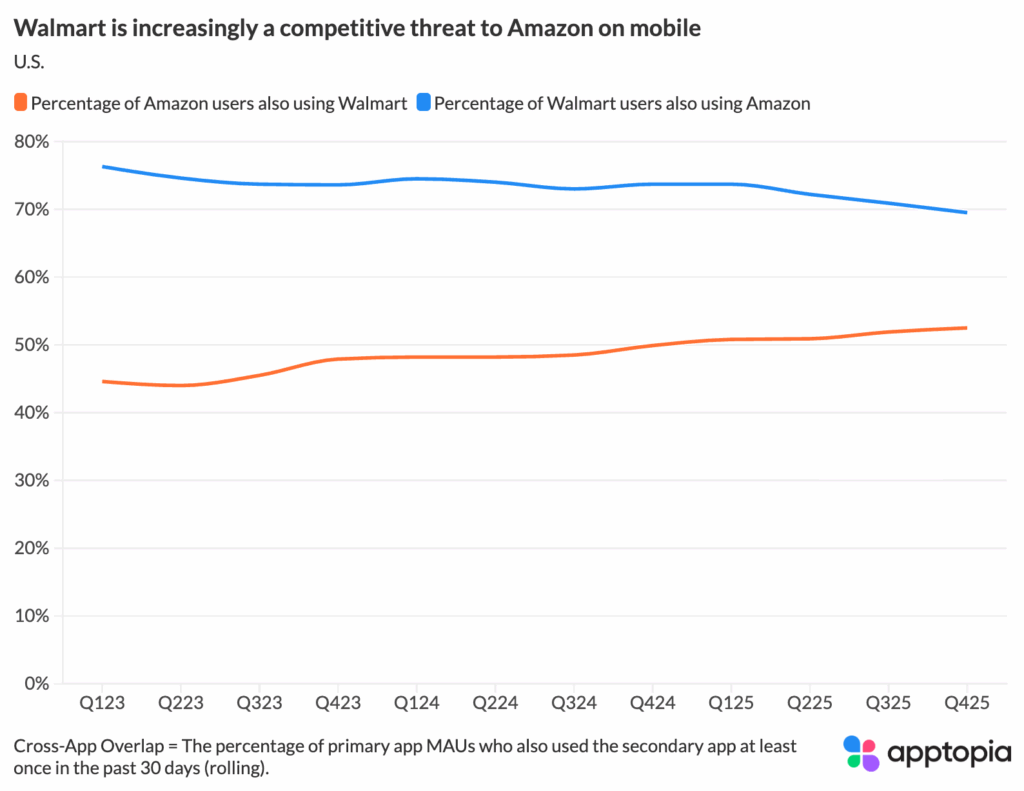

Looking at the cross-app usage above, we see what you probably expected; a higher overlap with Walmart than Amazon, with the gap widening. In November, OnePay users were 16% more likely to be shopping at Walmart than Amazon.

These trends really caught my eye. Have ideas of what else could be insightful to look into? Tweet me.

Questions on the underlying data included in this analysis?