This was first published December 18th, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- SOFI: Rising user engagement

- RBLX: When 33% growth is a disappointment

Our 4Q25 mid-quarter earnings previews are here! Please feel free to reach out and discuss any of the 20+ stocks we provide a preview on. Here are two that we thought were worth going a bit deeper into as the quarter comes to a close.

SOFI: SoFi’s stock is up 64% this year, but -23% off its recent highs. While the stock price is going to do whatever it is going to do, user growth looks good and user engagement is coming back. Downloads and DAUs are growing nicely and accelerating slightly QoQ in 4Q25:

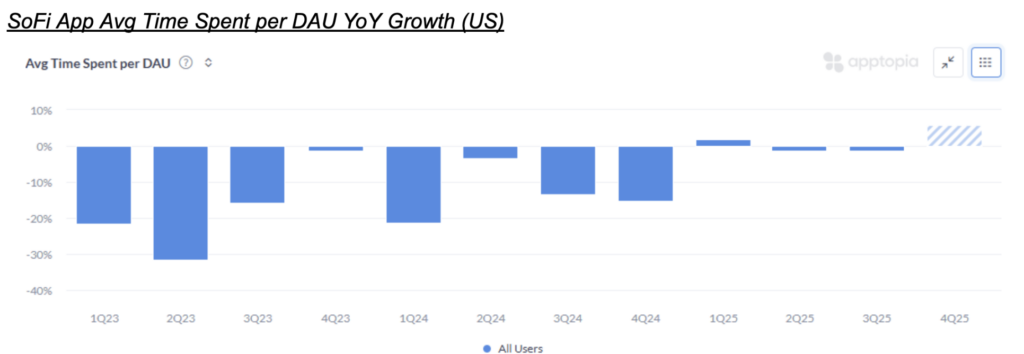

Meanwhile, SoFi’s users have been spending more time on the app this quarter. After two quarters of seeing time spent per DAU fall YoY, that metric is up about 6% so far in 4Q25:

All this adds up to a better outlook for SoFi’s Total Members this quarter than what consensus expects.

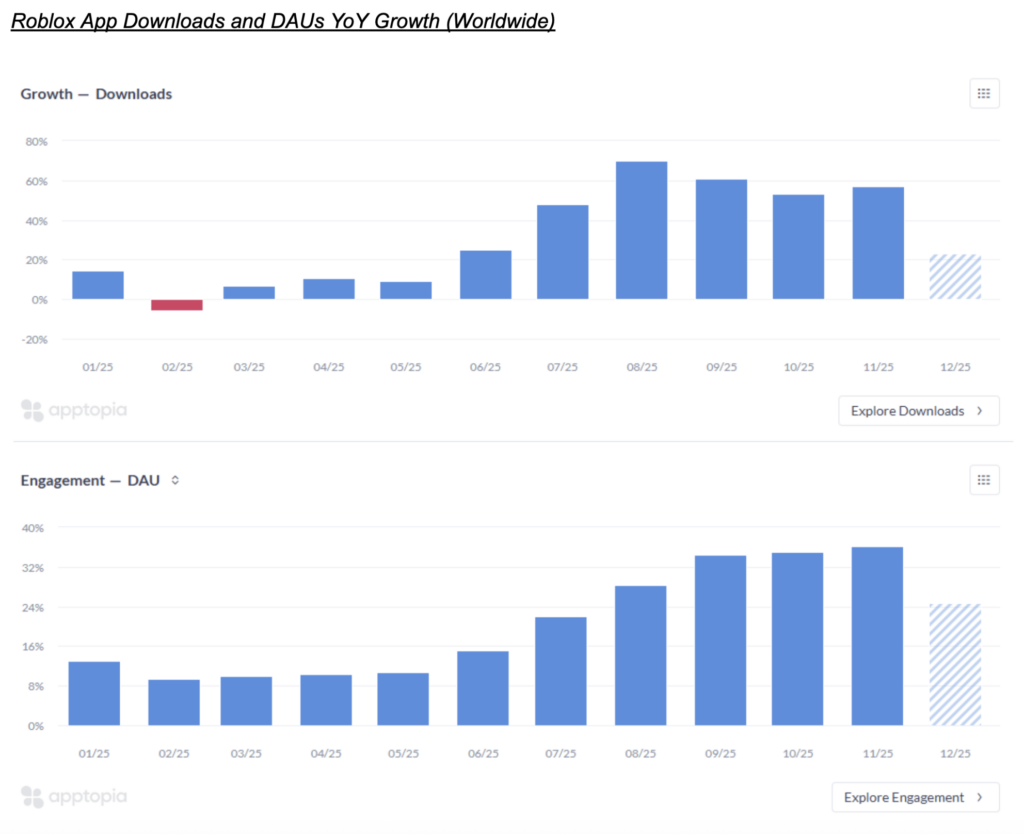

RBLX: It’s really tough for a company to be on pace to grow their users by >30% and have that be a disappointment, but unfortunately that’s the reality for Roblox. Their fast growth earlier this year set such a high bar that at some point the second derivative had to turn negative. That time was September for Downloads and December for DAUs:

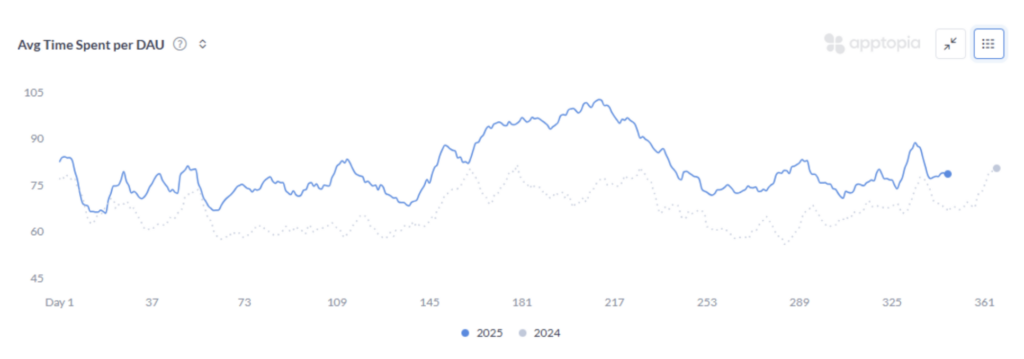

While our DAUs are still showing a QoQ acceleration for all of 4Q25 combined, the monthly chart above shows that the good times have come to an end in December. We wrote back in July how user engaged had peaked at 102 minutes per day; that numbers is now down to 78:

Most apps would kill to have their users spending 78 minutes per day on it! But again, this is Roblox and they have had quite the year in 2025. All of this data above is adding up to a deceleration in DAU growth that is worse than what consensus expects in 4Q25.

Please feel free to reach out if you want to discuss these stocks in more detail.