This was first published December 9th, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- MTCH: Tinder reignites

- PINS: Growth is stable and engagement is improving

Our 4Q25 mid-quarter earnings previews are here! Please feel free to reach out and discuss any of the 20+ stocks we provide a preview on. Here are two that we thought were worth going a bit deeper into.

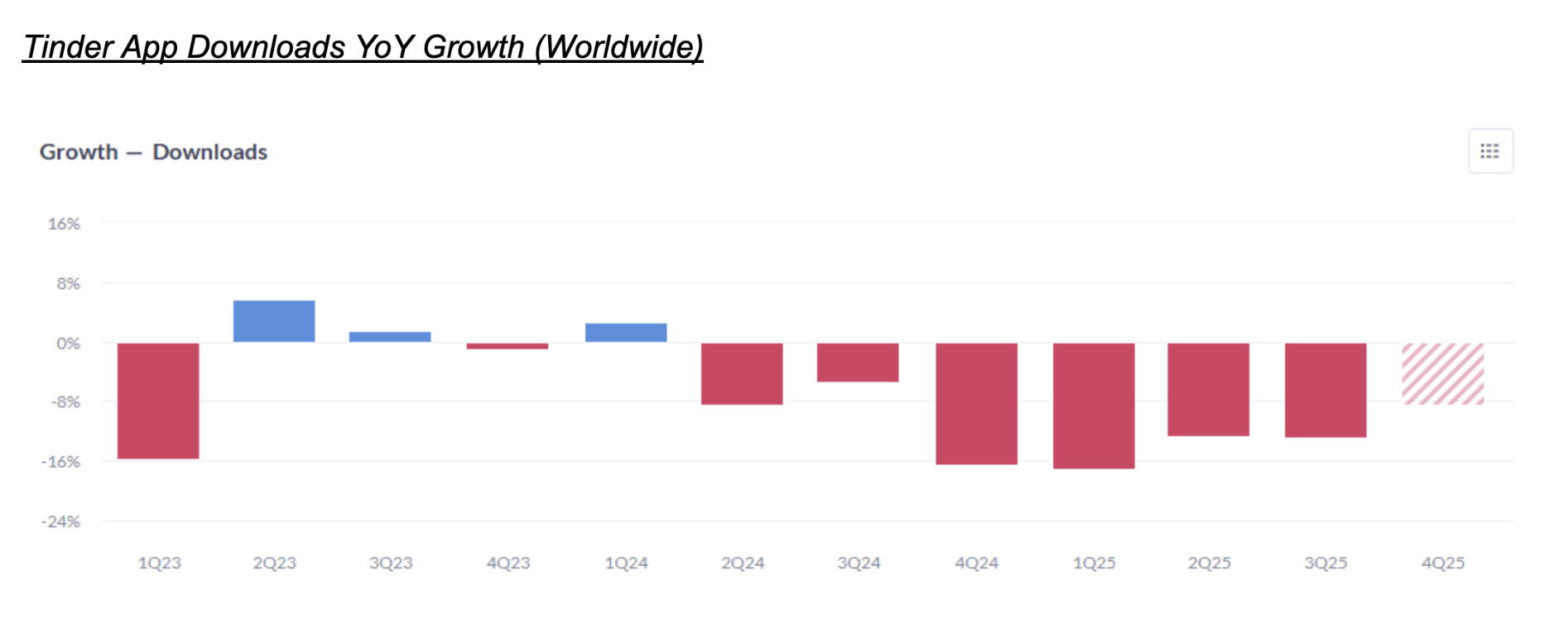

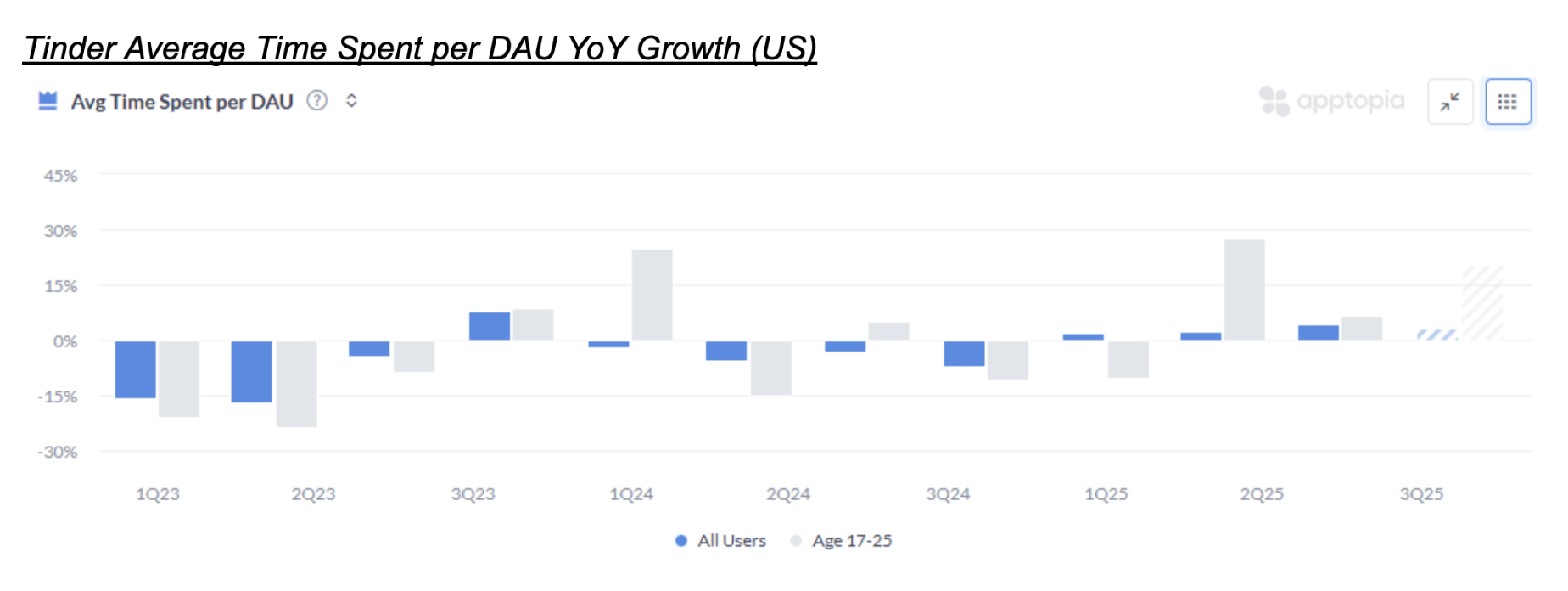

MTCH: Match has had Tinder in turnaround mode for a while now. The good news is that we are starting to see it in our data. While new user growth is still negative YoY, it is tracking “less bad” than in the previous four quarters. Meanwhile, engagement on the app has really improved. Look at the growth of time spent per day by users aged 17-25 (+20% YoY compared to all users at +3% YoY). Who says Gen Z doesn’t want an app to find dates anymore?

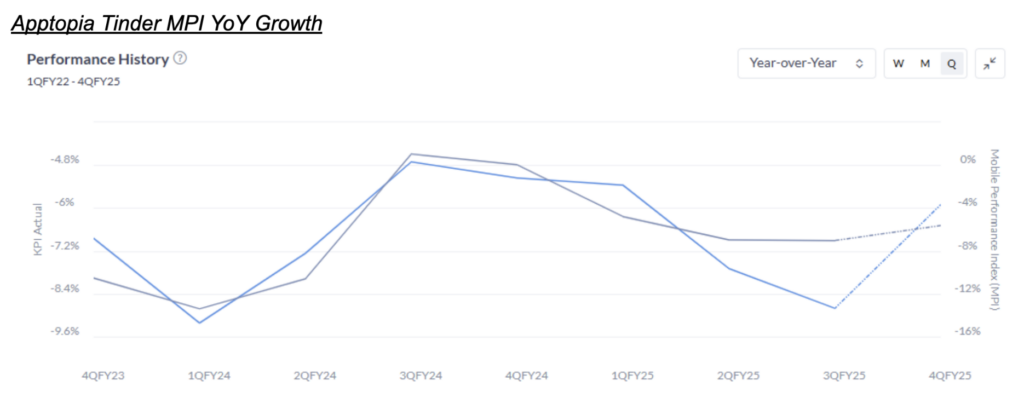

Our data, when combined into our Mobile Performance Index (MPI) for Tinder, suggests a better YoY growth rate than what Consensus expects for Tinder Payers in 4Q25:

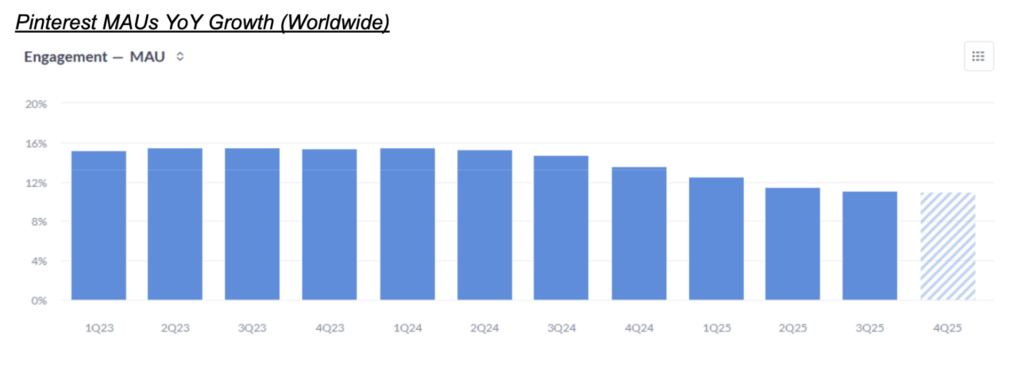

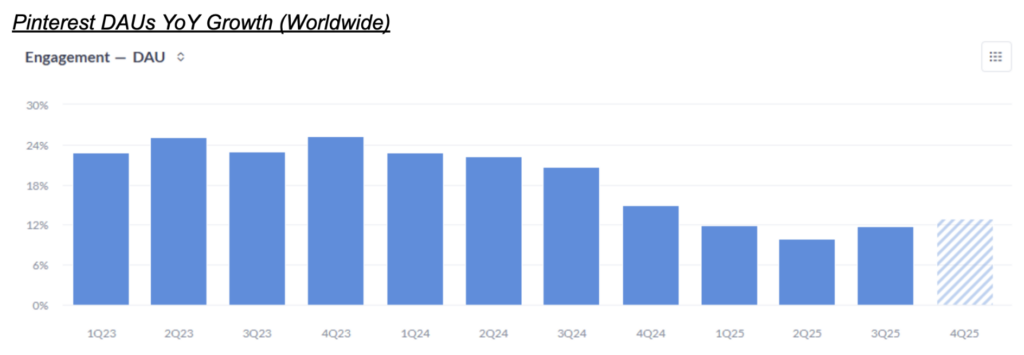

PINS: When a stock is lagging the market, sometimes it only takes a small amount of positive news to get it going again. So far this quarter, we are seeing some of that positivity in our app data on Pinterest. While MAU growth is looking flat compared to last quarter, DAU growth has started to accelerate slightly.

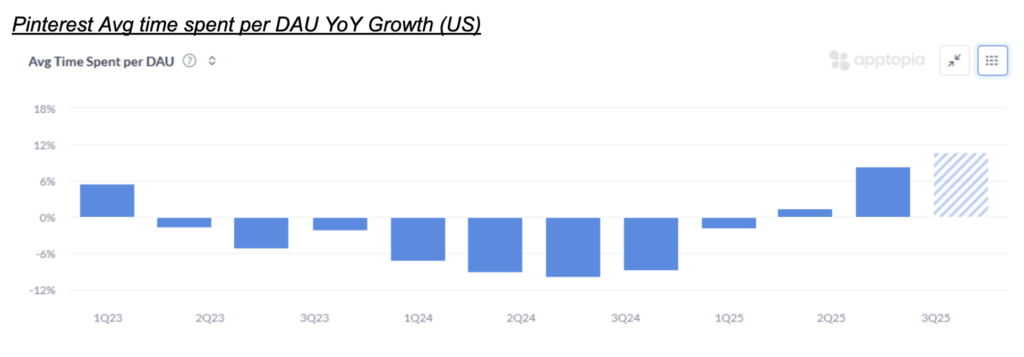

More interestingly, one thing social media apps target more than anything else is user engagement, and specifically time spent per user. Pinterest has seen the YoY growth of user time spent accelerate for the second quarter in a row so far in 4Q:

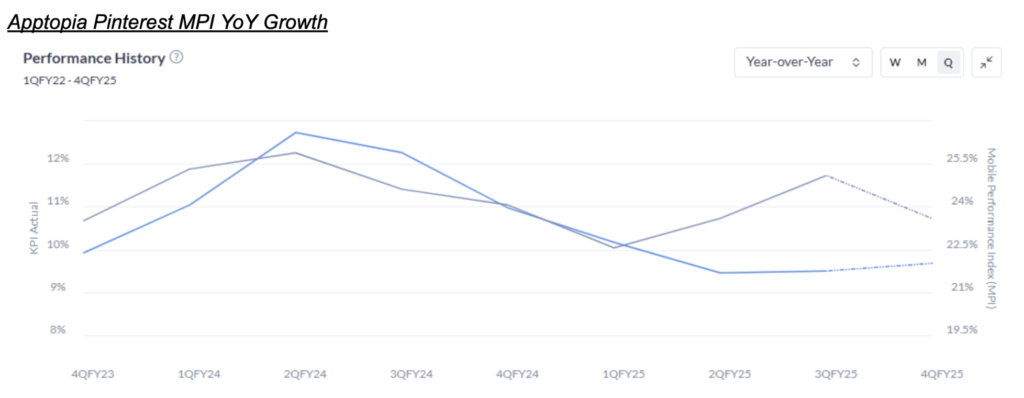

It appears that Pinterest has a growing, engaged user base. Maybe they can do a deal like Snap did last quarter? Either way, things are shaping up for a beat on MAU this quarter, according to our MPI:

Please let us know if you want to dive deeper into MTCH, PINS, or any other stock in our mid-quarter preview!