This was first published October 16th, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

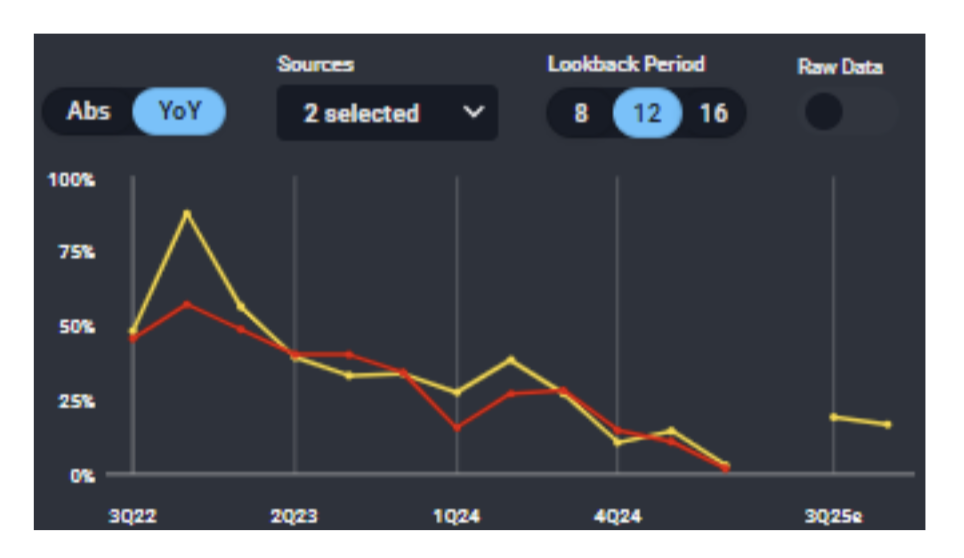

- NFLX: DAUs reaccelerate and time spent rises

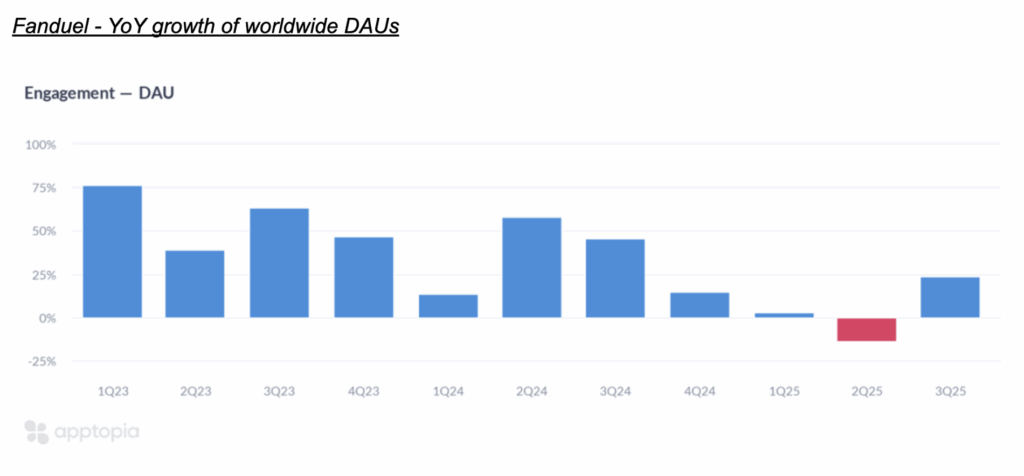

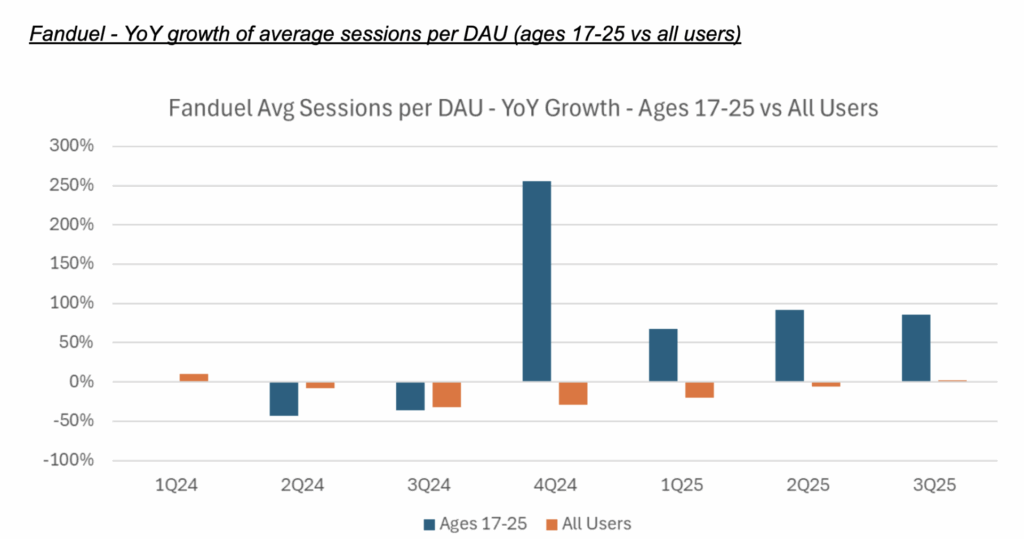

- FLUT: DAU growth flips positive and Gen Z engagement soars YoY

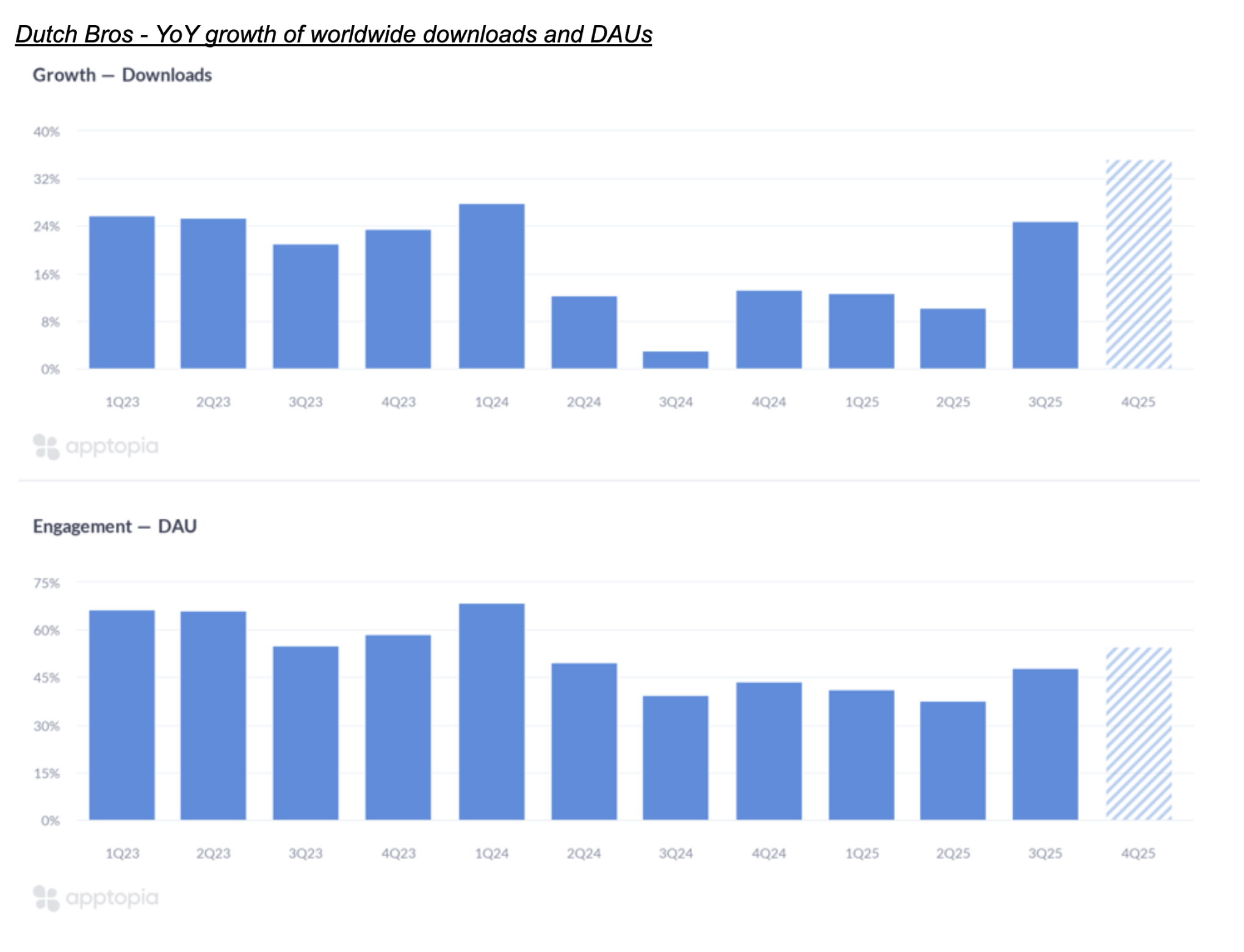

- BROS: Downloads and DAUs accelerated in 3Q25 and 4Q is off to a good start

- Maiden Century’s forecasts project a beat for each

Our 3Q25 earnings previews are here! Please feel free to reach out and discuss any of the 20+ stocks we provide a preview on. Below are a few notable stocks from our perspective.

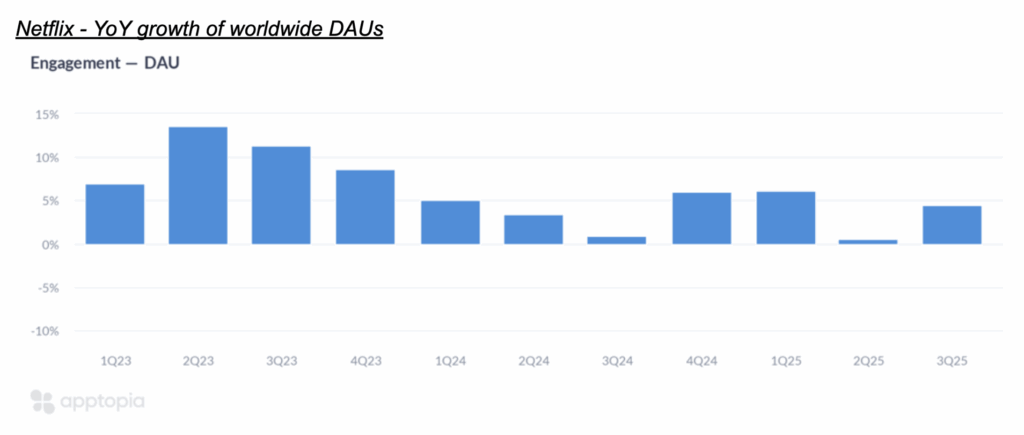

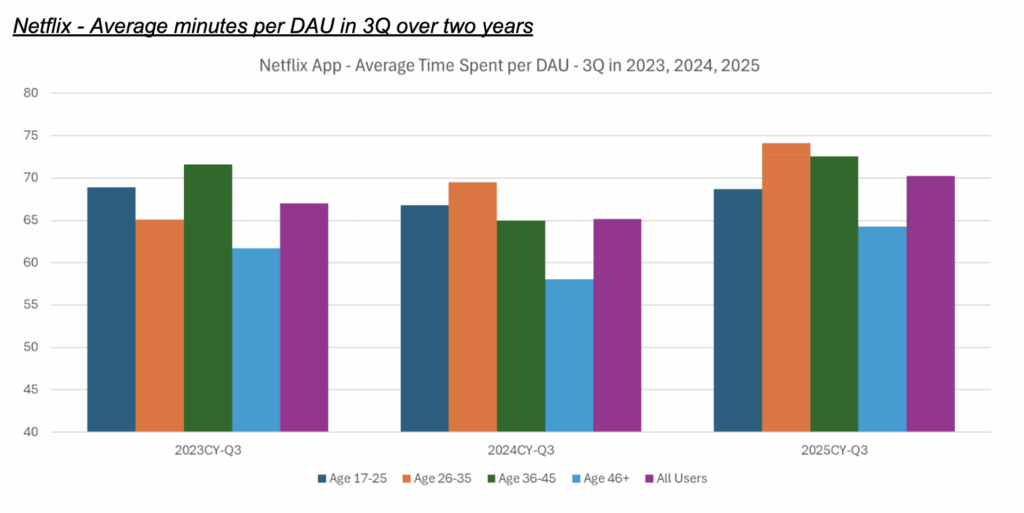

NFLX: User growth and engagement looked strong in 3Q25. Our data showed a re-acceleration in worldwide DAUs (chart below). While it was not a huge number (~5%), it was far better than 2Q25 which was barely positive. Potentially more importantly, we saw time spent on the app in 3Q rise to an average of 70 minutes per user per day, up from 65 minutes in 3Q24. Engagement improved across the board, but most notably with Millennials who spent the most time of any age group on the app.

While Netflix does not report quarterly subs anymore, we still get consensus and our data shows a better-than-expected result. If you want an actual point estimate, no need to go any further than our partner, Maiden Century, who does forecasting using our data. Their forecast for NFLX subs using Apptopia data is 13.4% YoY growth compared to consensus at 11.6%. NFLX subscriber data looks strong no matter how you look at it.

Netflix – Maiden Century forecast of YoY Growth of Ending Subs using Apptopia data

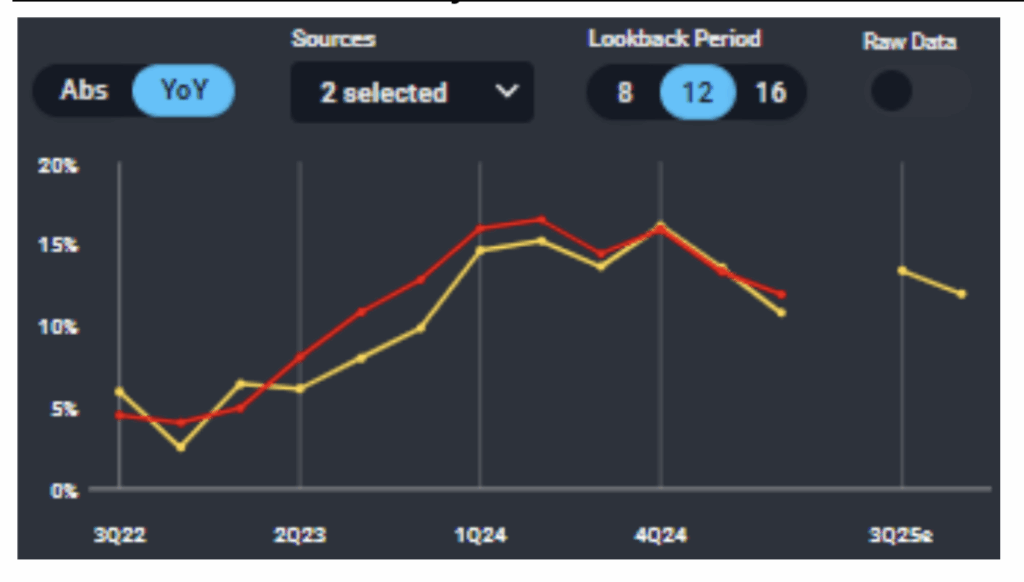

FLUT: Flutter and the whole Online Sportsbetting market has been shaken by prediction markets apps like Kalshi. (Drop us a line if you want to see our analysis on Kalshi) However, Fanduel seems to be doing just fine this NFL season despite this rising risk. Our data shows a nice return to growth of DAUs in 3Q, and especially strong YoY growth in engagement from users ages 17-25. Accelerating growth in users and rising engagement among Gen Z is a promising setup for earnings – just ask Maiden Century, who forecasts Average Monthly Players (US) to grow 18.8% in 3Q25, well above consensus.

Fanduel – Maiden Century forecast of YoY Growth of Average Monthly Players – US using Apptopia data

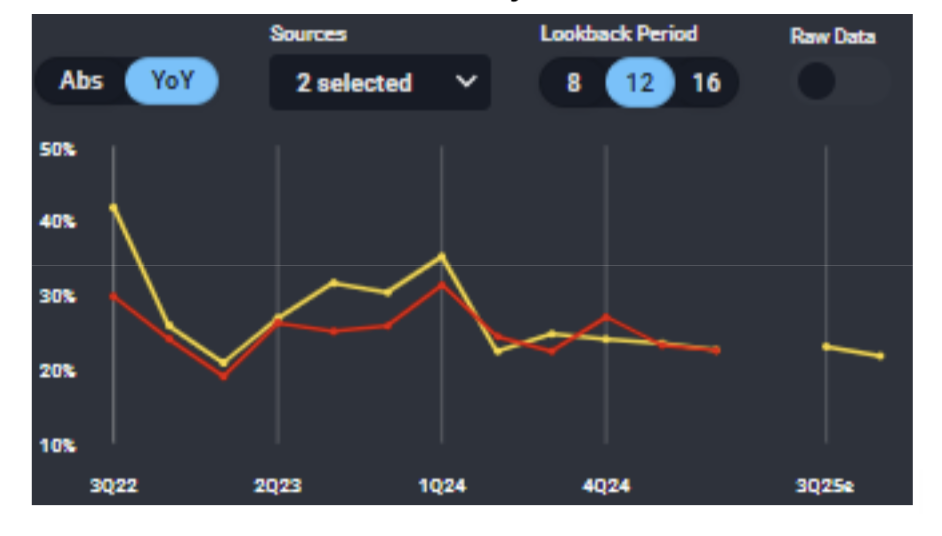

BROS: Dutch Bros is not one we get asked about all the time, but our data is excellent on this one, and it is saying sales will grow at basically the same rate as last quarter when consensus is expecting a slowdown. The YoY growth in downloads and DAUs tells most of the story (and check out the first two weeks of 4Q!). Once again, we can also use Maiden Century’s forecasting tool to put a number on it – using our data, Maiden Century forecasts Systemwide Sales growth of 23% in 3Q25 while consensus expects 19%.

Dutch Bros – Maiden Century forecast of YoY Growth of Systemwide Sales using Apptopia data