This was first published July 16, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- UBER – Trips outlook is strong for 2Q25

- MELI – Strength in adding new Buyers

- PTON – An unexpected bump in subscribers

- WISE LN – Customers growth inflects up

In our attached earnings previews, we summarize in one slide what our data is saying relative to consensus for each of the stocks mentioned above (and many more!). For UBER, MELI, PTON, and WISE LN, we see upside to consensus.

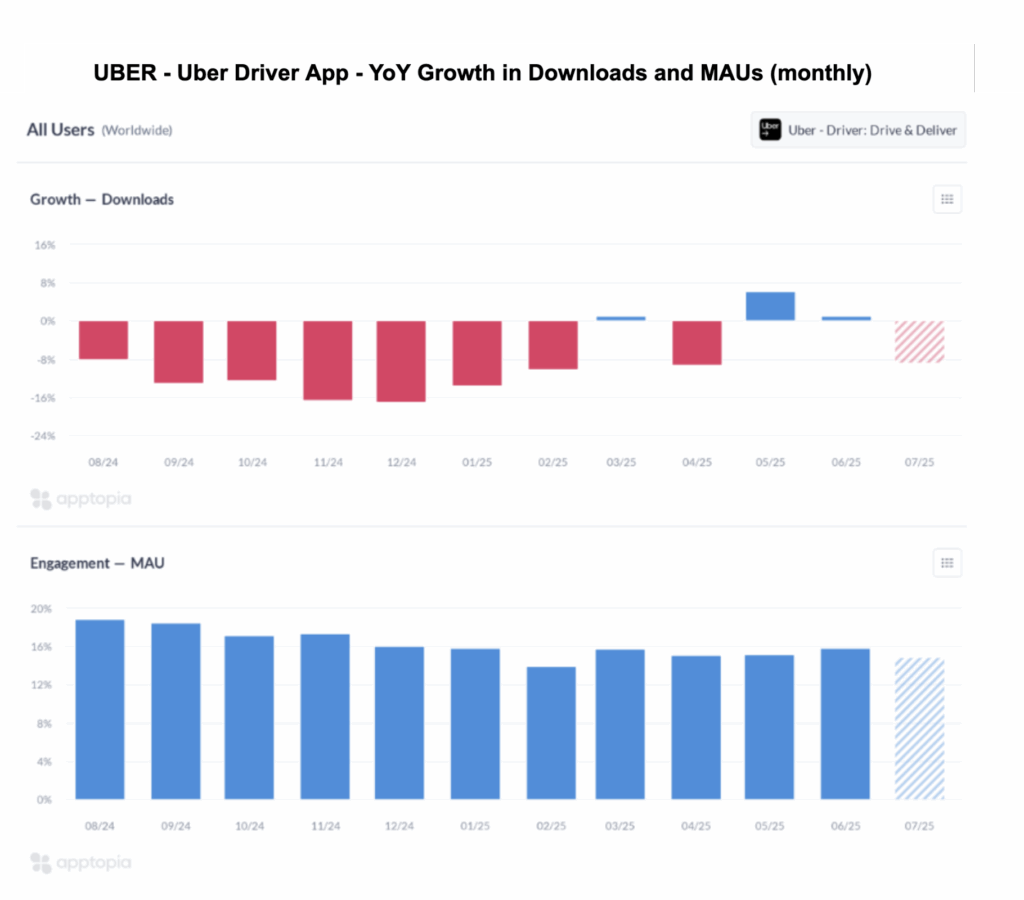

Uber (UBER)

Our newly released MPI for Uber suggests that the deceleration expected by consensus for the YoY growth of Trips is too negative. There are a number of metrics that show improvement for Uber, but two we always like to look at for Uber are downloads and MAUs of the Driver app. The chart below shows how during 2Q25, the YoY growth of both metrics started to turn positive relative to 1Q25.

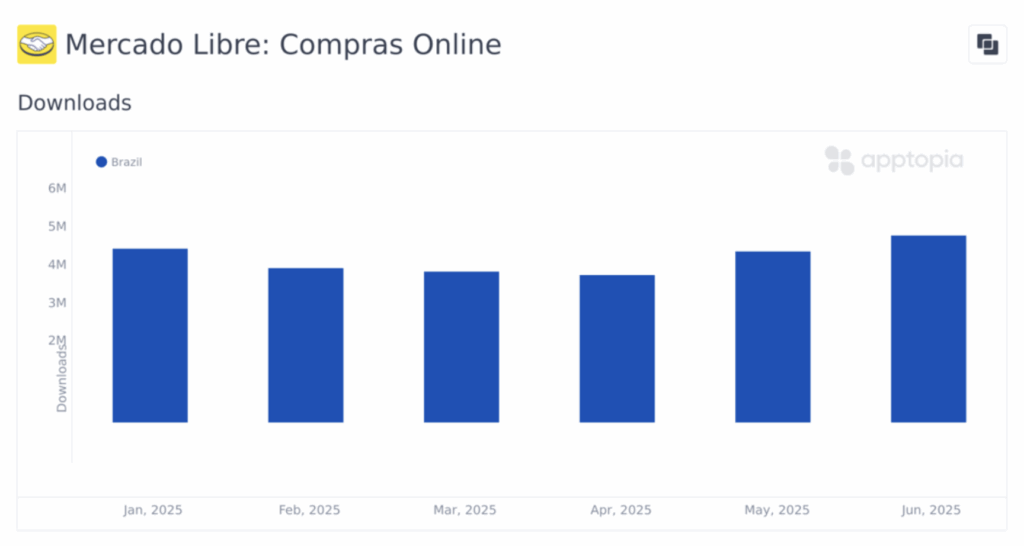

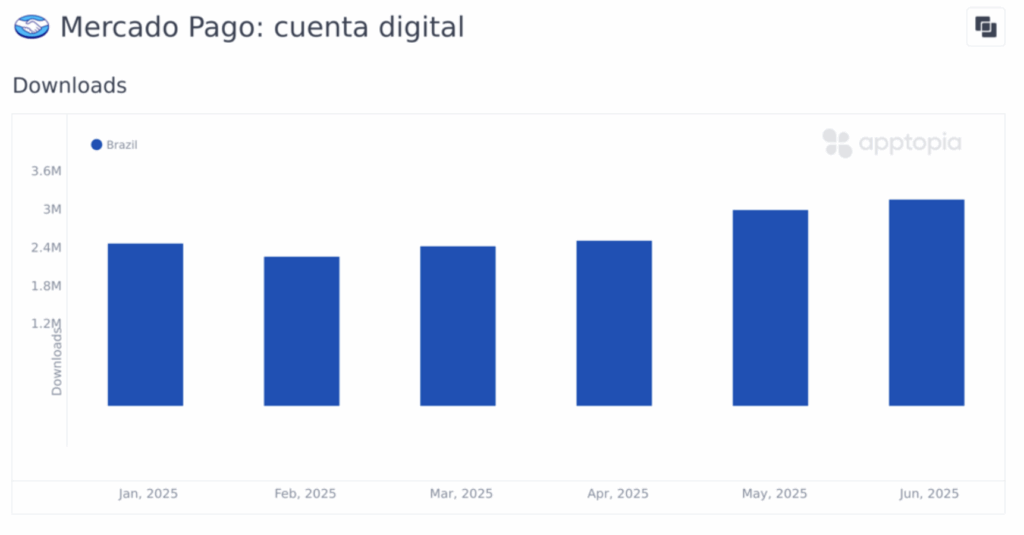

Mercado Libre (MELI)

Apptopia’s MPI for MELI showed a nice acceleration in growth, as downloads showed a solid resurgence during the quarter. This occurred principally in Brazil, where both the shopping app, Mercado Libre, and the finance app, Mercado Pago, saw downloads strengthen into June.

Peloton (PTON)

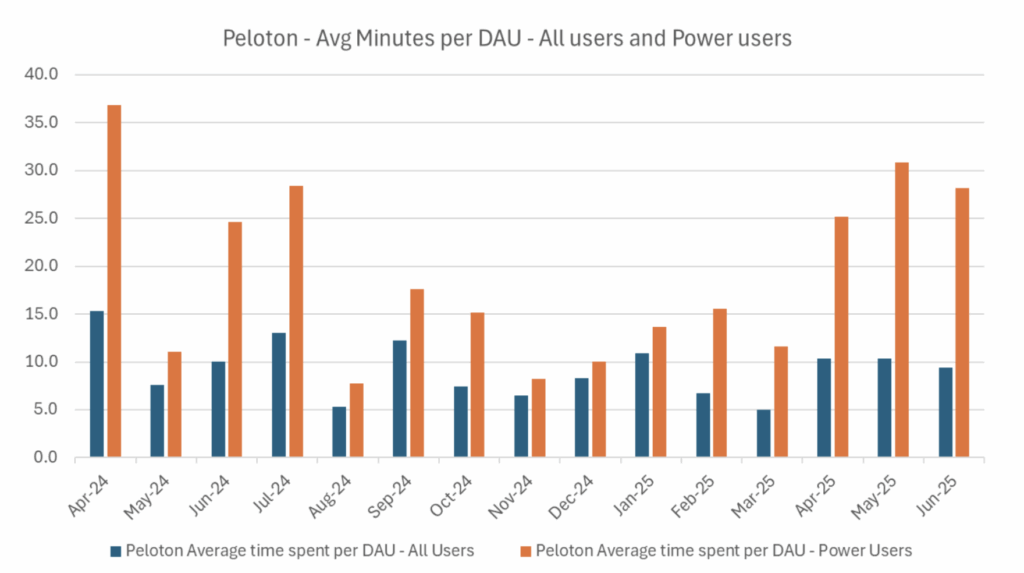

Apptopia’s MPI for Peloton shows better-than-expected YoY change in subscribers. Indeed, the data suggests that the decline became less bad in 2Q25, while the market expects the trend of YoY declines to continue to worsen. The ray of light is coming from user engagement, as all users spent more time on the app in 2Q25 than they have in months, and power users also spent way more time on the app. For power users, the time spent on average these past three months was higher than every month back to July 2024 and April 2024. People want that beach body!

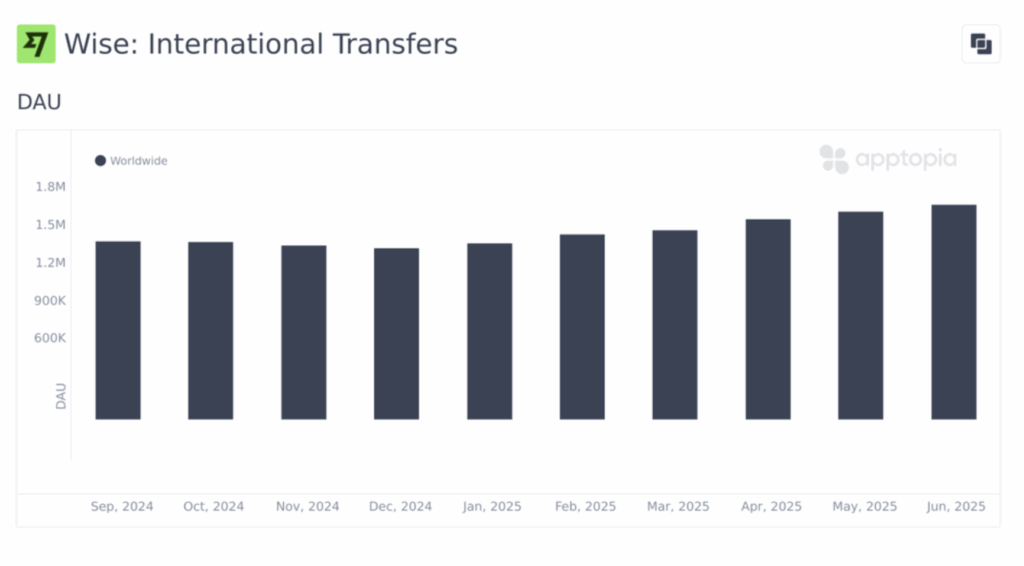

WISE LN

Apptopia’s MPI for Wise suggests a positive inflection in the YoY growth rate for Customers, which has been positive but declining for at least two years. The chart below demonstrates how DAUs, which started declining from September 2024, have grown sequentially each month in 2025, and began making new highs again in 2Q25.