This was first published July 23, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

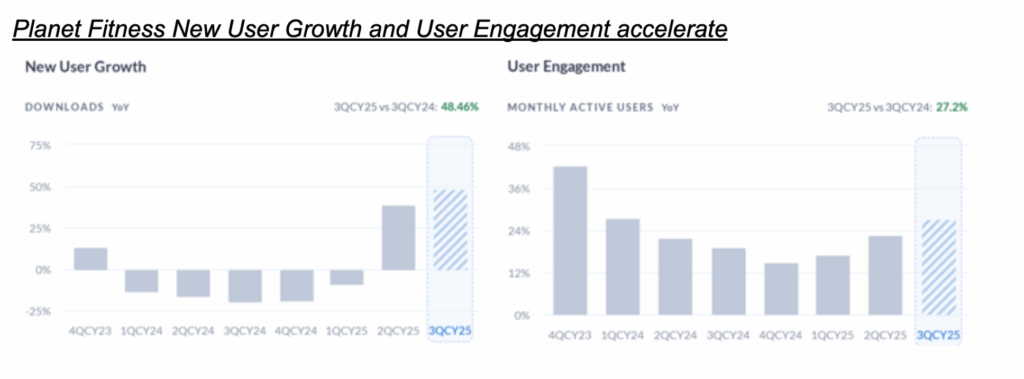

- PLNT – Signs of life! An upwards inflection in 2Q25

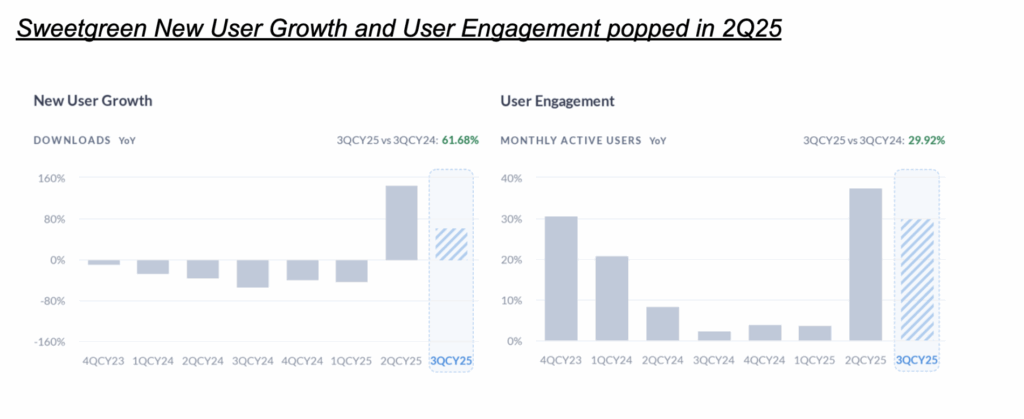

- SG – Digital revenue accelerates

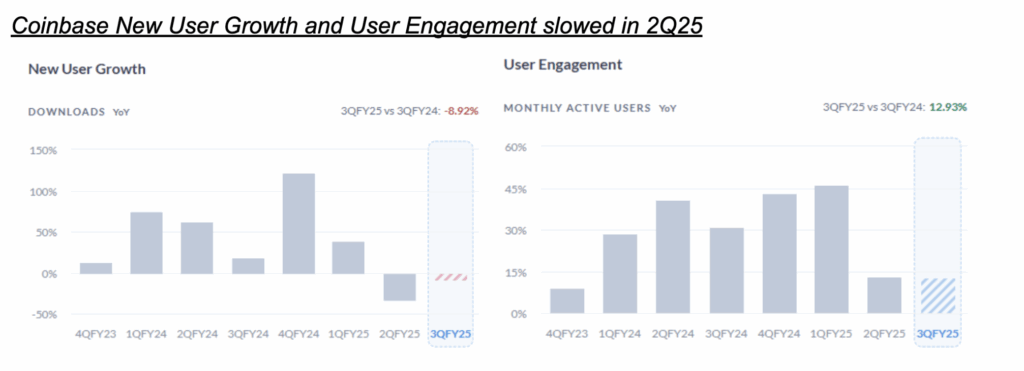

- COIN – User growth underwhelms

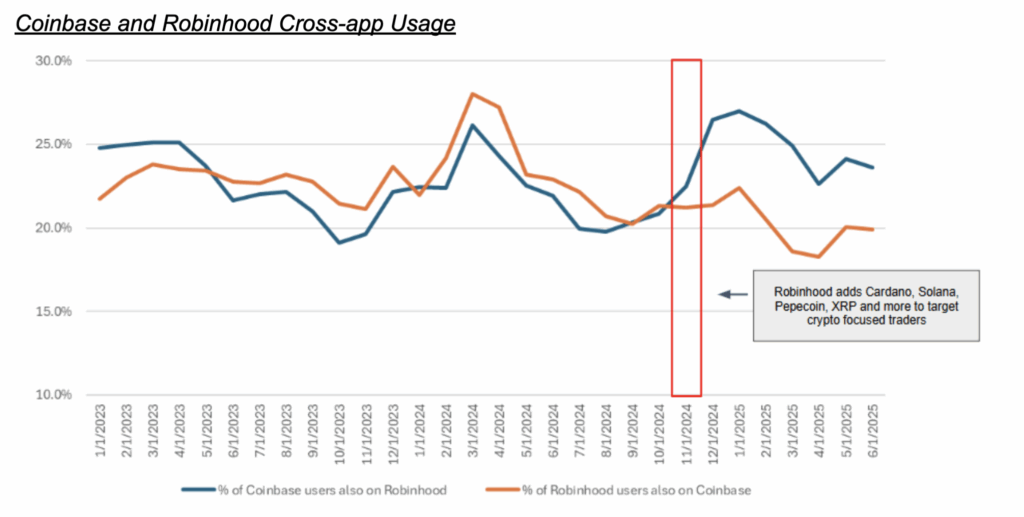

- COIN – Hmm, what is HOOD doing over there?

Welcome to our second round of earnings previews. Please click here to see all our earnings previews in Apptopia’s Research Library. In our earnings previews, we summarize in one slide what our data is saying relative to consensus for each stock. For PLNT and SG, we are seeing some smaller stocks that have been left behind start to see some positive inflections. For COIN, a stock that has been on fire, we have some questions both about user growth and competition from HOOD.

Planet Fitness (PLNT)

Our newly released MPI for PLNT shows a positive inflection, with mobile data indicating YoY growth will improve from last quarter for the first time in two years. Indeed, both app downloads and MAUs are accelerating this quarter from last. App downloads are showing positive YoY growth for the first time since 4Q23, and MAU growth has reached its highest level since 1Q24. Encouragingly, both of these trends appear to be continuing into 3Q25.

Sweetgreen (SG)

I can’t get enough of the Chicken Avocado Ranch! Clearly I am helping drive a resurgence in Sweetgreen’s Digital Revenue, as the YoY growth in downloads is positive for the first time since at least 2023, and MAU growth reached new highs. Similar to PLNT, the trends are continuing into 3Q25, though not at the same rate. The only caveat I have to this analysis is that some of this dramatic growth may have been tied to promotions around the new SG Rewards and hence might not be sustainable. For instance, daily app downloads dropped in late June to the same levels seen prior to the launch of SG Rewards.

Coinbase (COIN)

COIN has been on fire for many reasons, the most important of which were more to do with regulatory changes and less to do with user growth. However, that does not mean that user growth is less important. Indeed, any company that wants to grow sustainably needs to attract new customers and keep their existing customers. To that end, COIN’s user growth has slowed this quarter. In addition, 3Q is showing similar trends to 2Q25 so far.

Coinbase also needs to keep its eye on competitors trying to horn in crypto (which feels like every SPAC these days). Robinhood seems to be a particularly strong challenger to COIN. We noticed that when Robinhood added Cardano, Solana, Pepecoin and more, the percentage of Robinhood users who also used Coinbase started to fall, while the percentage of Coinbase users who also use Robinhood remained elevated. Could it be that Robinhood will steal users from the crypto royalty? This is easy to track with our data, feel free to reach out to us and we can help!