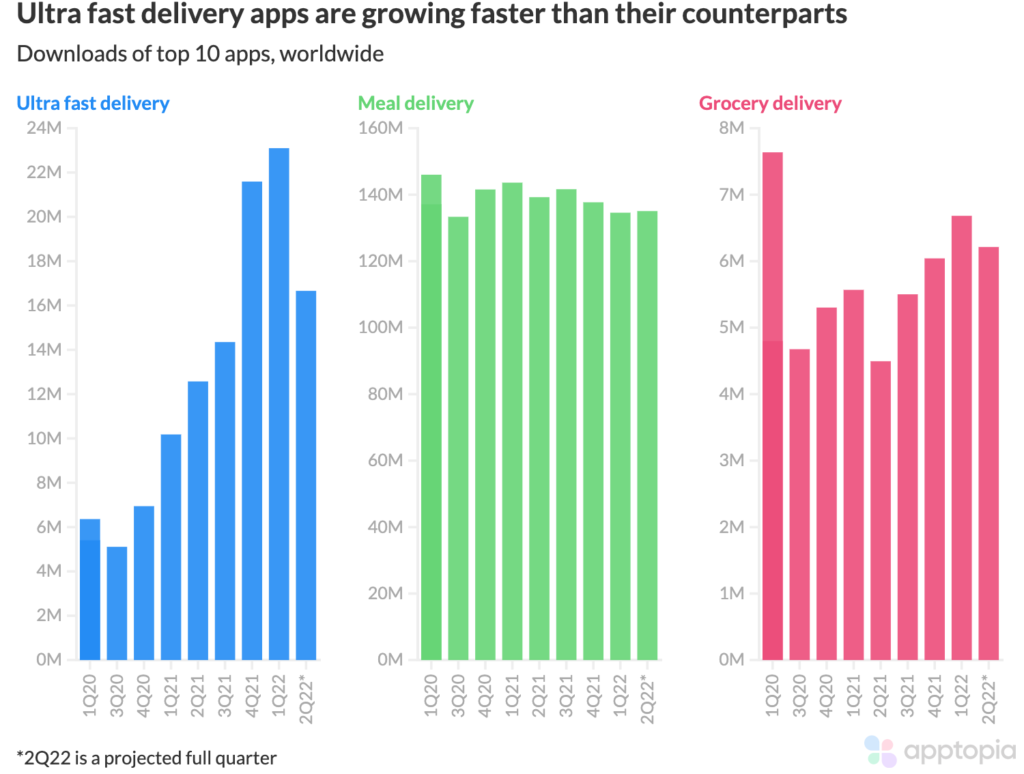

Global downloads of the top 10 ultra fast delivery apps have grown 127%, year-over-year in Q1. With a more granular, monthly breakdown we can see a lot of this growth taking place in Q4 of 2021. As you can see in the chart below, this is a faster growth rate than that of the top 10 meal delivery apps (ex: Uber Eats) or top 10 grocery delivery apps (ex: Instacart). Meal delivery still takes the cake when it comes to absolute numbers.

Since February 2021, Getir has been the leader in new user acquisition (downloads) for the ultra fast delivery market. The app launched in 2015 but didn’t hit a growth spurt until December 2020. Over the course of its lifetime, 73% of its downloads have come out of Turkey. Looking just at the past six months, that percentage drops to 58% as the app enters other markets.

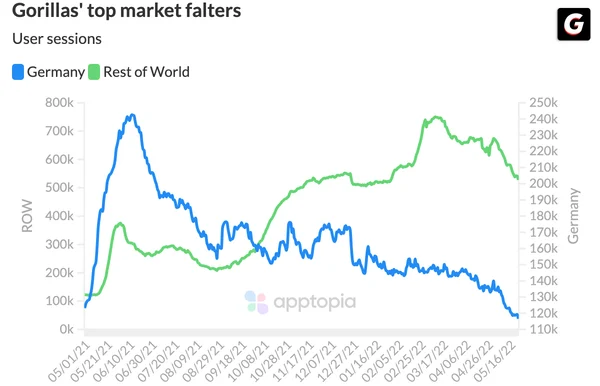

Getir is also a top player in the U.S. market, behind Gopuff, which leads by a comfortable margin. Gorillas, which just laid off half its Berlin staff, has Germany as its largest market. User sessions have been slowly falling in the country since June 2021 while it expands into new markets. In May 2022, Getir had 1.5M app downloads globally, compared to Gorillas which had just 320k.

All of the top 10 ultra fast delivery apps have grown MAU, year-to-date, with Cajoo growing the most at 106%. Cajoo is followed by GetFaster and Flink with growth rates of 73% and 68%, respectively. Like Gorillas, Flink’s top market is also Germany but Flink has about 179% more MAUs in the country which has it headed in a different direction.

It is reported to be acquiring French startup, Cajoo, which launched in early 2021 and struggled to gain ground in the country ever since Getir formally launched there in June 2021. This will help Flink compete with Getir in France. Flink says its reach in the country will now be greater than Getir’s but Apptopia estimates have Getir’s app usage comfortably ahead of Flink and Cajoo combined.

Ultra fast delivery companies do not just have each other to worry about. Traditional, or meal, delivery apps have massive brand power, user bases and deep pockets. Apps like Uber Eats are starting to enter the market of fast grocery delivery. Apptopia reported in January that meal delivery apps extending into grocery delivery, a faster growing segment of the delivery market.

Traditional grocery delivery apps are not standing still either. Instacart started offering 30 minute meal deliveries (sushi, salads, sandwiches) from supermarkets like Kroger and Publix. It will also begin offering 15 minute grocery delivery in the near-future.

To monitor a custom market of your choice, click here. To learn exactly how you would use Apptopia to aid your portfolio and investment strategy, click the blue button below.