This was first published January 17, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- Threads displaces TikTok’s 3-year run at #1 with 193 million downloads. Threads almost doubled DAUs in December after testing new “retention hooks” to bring users from Instagram to Threads. While Threads stalled after the initial launch, the app ramped users significantly in December with positive momentum continuing into 1Q24.

- TikTok growth slows, down -18% YoY. For the first time in 3 years, it was not the #1 most downloaded app in all categories in the US.

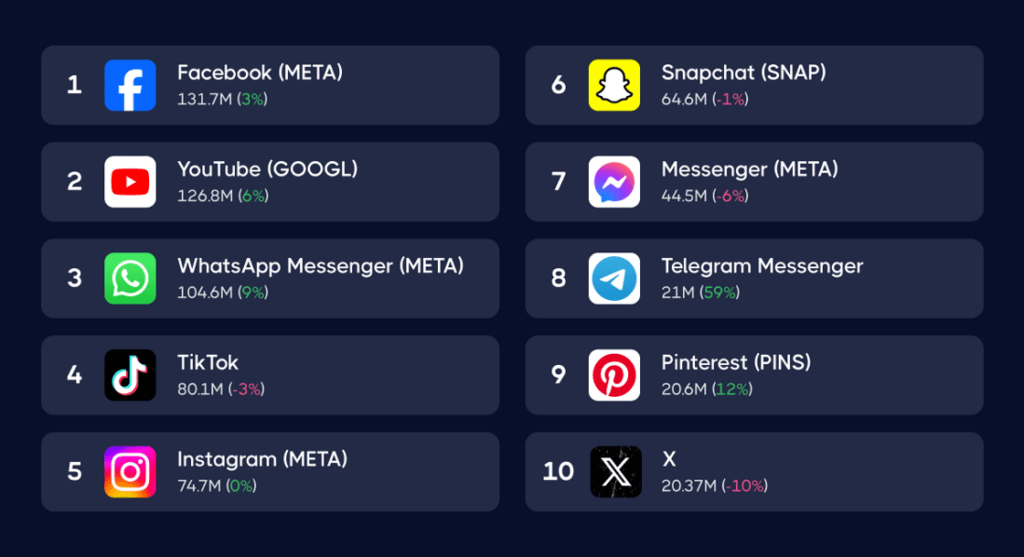

- Social messaging apps grow: Telegram Messenger sees the most positive growth overall in both DAUs (+59%) and Downloads (+19%). Whatsapp also had positive growth in DAUs (+9%) and downloads (+5%).

Top 10 Social Apps by New User Growth in 2023 (US)

From 2020 to 2022, TikTok ranked #1 most downloaded app in the US in all app categories. This year, it falls to Threads and Temu in our ‘All Categories’ chart, and falls between Threads and WhatsApp in our Social category ranking (above). What’s more notable than TikTok’s second-place rank is the YoY decline in new users (-18%) and daily active users (-3%).

2023 was a strong year for Meta’s Family of Apps, which make up half the chart; however, 4Q23 engagement trends indicate Instagram and Facebook usage growth has peaked:

- Instagram DAU in 4Q were down QoQ and +7% YoY (a deceleration)

- Instagram and Facebook Average Minutes per DAU in 4Q were positive YoY but decelerating

On the flipside, Meta has had engagement momentum with Threads and Whatsapp for Business in 4Q:

- Threads doubled DAU in December

- WhatsApp for Business DAU grew +41% YoY

Top 10 Social Apps by Daily Usage in 2023 (US)

Final notes

Telegram had the highest new user growth YoY (+19%), followed by WhatsApp (+5%) – suggesting interest in alternative messenger apps in the US.

While Pinterest did not rank in our chart in terms of downloads, it ranked 9th in terms of daily usage, growing 12%. Pinterest management has been prioritizing increased engagement, and our data predicts PINS will deliver ahead of expectations in 4Q23 earnings.