This was first published March 6, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- Apptopia estimated IAP Revenue for Sea Limited (SE) Garena Free Fire stabilized in 4Q, up 1% sequentially over 3Q23. Year-over-year growth also was less negative at -26%.

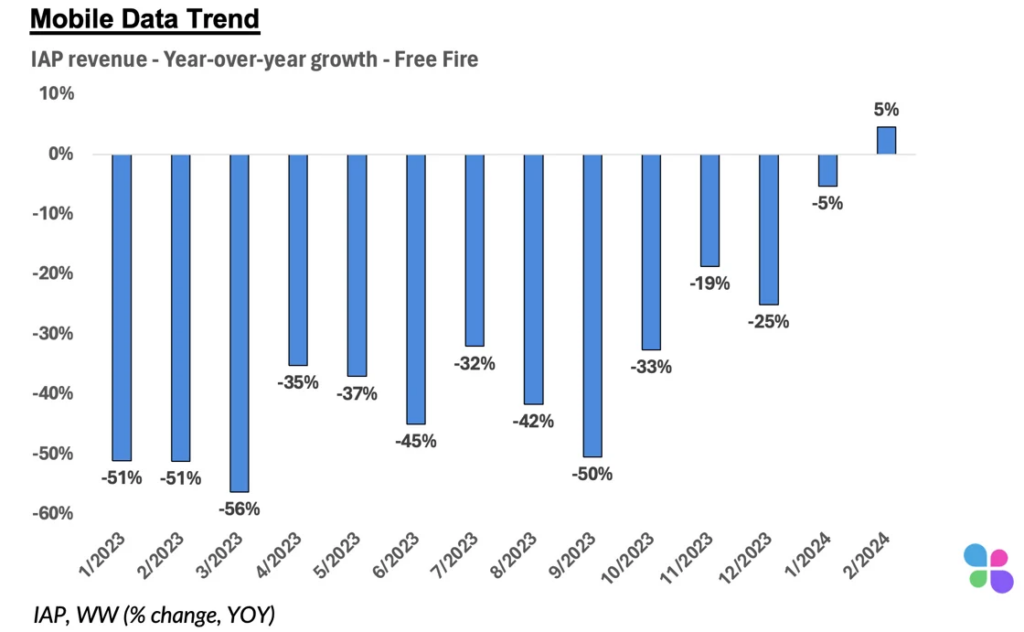

- More importantly, Garena Free Fire growth flipped positive in February (+5% YoY), with IAP revenue rising sequentially each month since September.

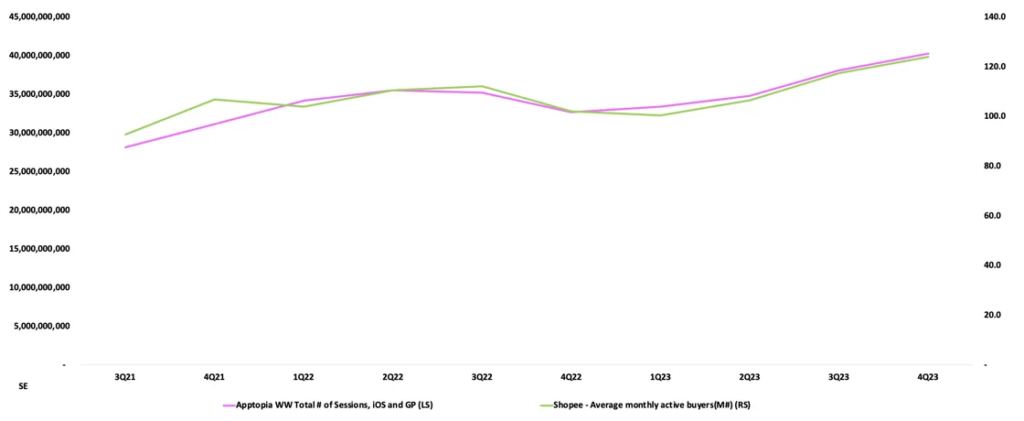

- Meanwhile, Sea Limited Shopee’s YoY growth in total sessions hit 23% in 4Q, and continued to grow YoY in 2024.

Garena Free Fire’s Mobile IAP Revenue shows signs of turnaround

Sea Limited’s stock is far from its 52-week high, but their earnings report shows positive signals for its businesses in gaming (Garena) and e-commerce (Shopee).

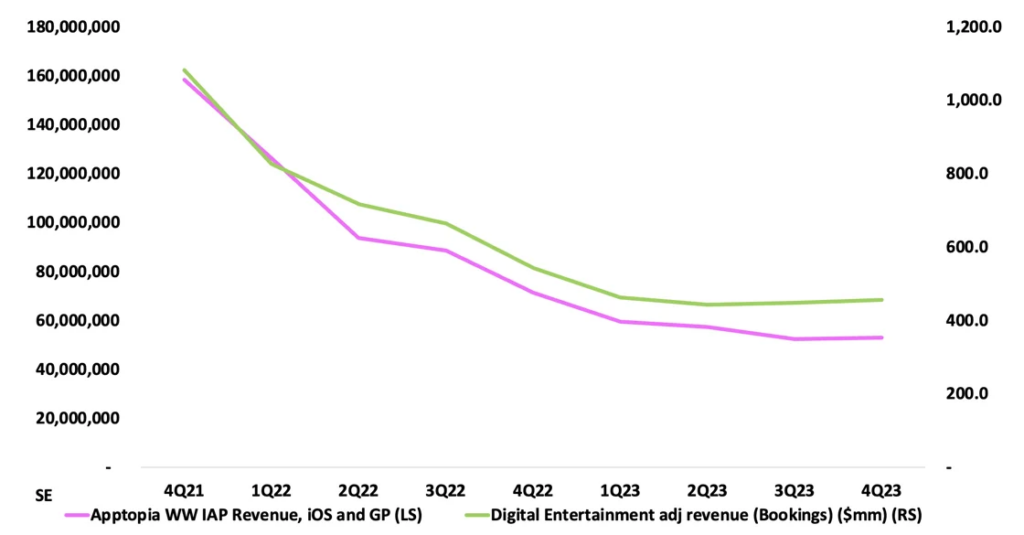

Our data indicates that Garena Free Fire is experiencing a turnaround in mobile In-App Purchase (IAP) revenue. IAP revenue inflected positively in February, growing upwards of 5% YoY, and has been steadily rising each month since September. Sea Limited highlighted the successful stabilization of the company’s digital entertainment business in their recent earnings, and announced their expectations for Garena Free Fire to achieve double-digit growth in both user base and bookings throughout 2024. Since digital entertainment bookings and IAP revenue correlate at >0.9, accelerated growth looks possible for 2024.

Garena Free Fire IAP Revenue to Digital Entertainment Bookings

Sea Limited also announced that they achieved profitability in 2023 and strengthened market leadership for the company’s e-commerce business, despite intensified competition in Southeast Asia. Our mobile correlation data shows that in 4Q23, there was a three-year correlation of 0.95 between Shopee monthly active buyers and Apptopia total sessions. Additionally, YoY growth is up 23%, indicating Shopee’s solidification of their market share into 2024.

Shopee Sessions Grow

Reddit (listed as NYSE: RDDT) will reportedly hold its initial public offering sometime this month. To gain insights into Reddit’s IPO journey, including its growth, competitive analysis, and user engagement, download our IPO Primer.