Hey there, thanks for coming to the blog. If you’re interested in this topic but you were hoping for fresher data, we certainly have it. Please reach out to humans@apptopia.com and we’ll see what information we can provide!

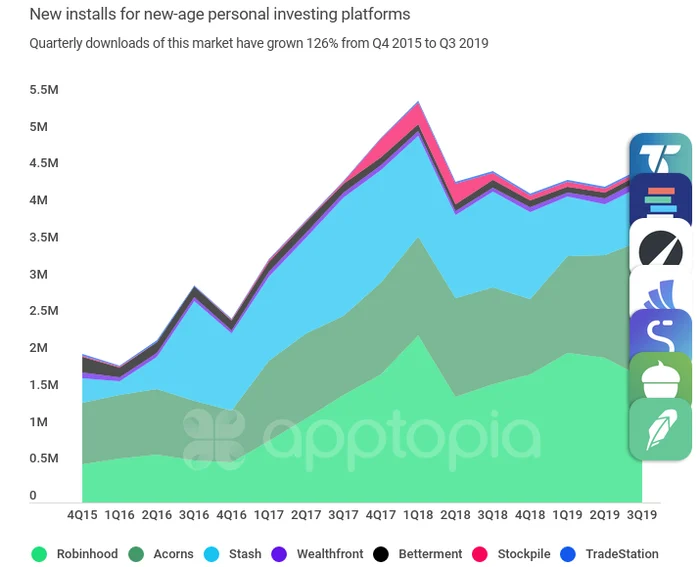

– Top investment-based finance apps, as a grouping, have grown downloads 126% over four years.

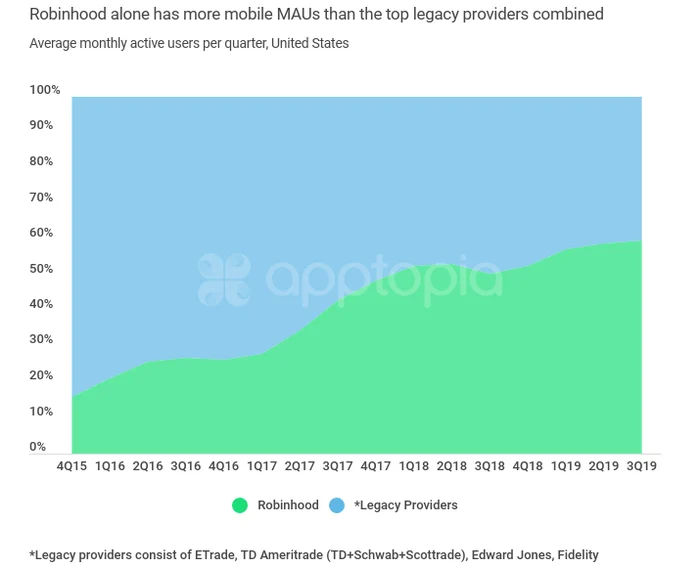

– Robinhood now has more mobile monthly active users than the top legacy providers combined.

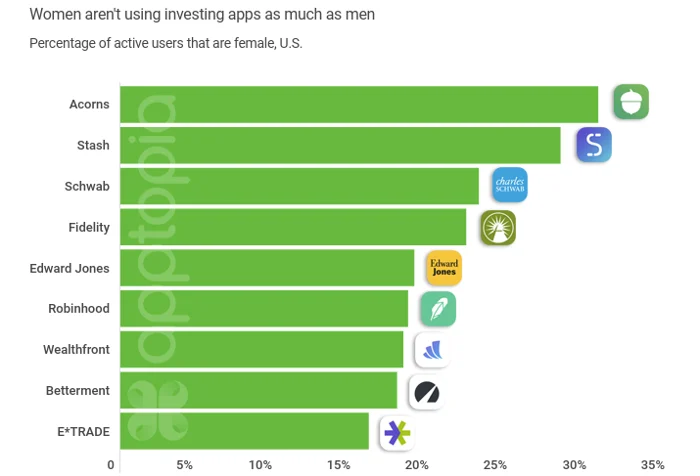

– No top investment app has men making up less than 69% of its total active users.

Subscribe to our weekly newsletter to get data like this sent straight to your inbox.

Fintech advancements

Financial tech, or fintech, has been “having a moment” for a few years now. Here’s a simplified journey of fintech innovation from my perspective:

First, PayPal enabled us to easily pay for things online. It’s how I bought CDs online from Sam Goody when I was only 12 and couldn’t open a credit card. Then, balancing a checkbook wasn’t revealing enough, so we turned to Mint to help us manage our finances. Next, Square came along to make it easier and cheaper for small businesses to accept payments. Braintree and Stripe enabled Uber to thrive by removing the physical act of paying from the equation. Venmo solved the problem of splitting the cost of dinner with friends. Most recently, digital banks like Nubank and Monzo have been growing like gangbusters, catering to unbanked individuals.

Now, we turn our attention to investing. Apps like Robinhood, Acorns and Betterment have helped simplify investing for everyday people while bringing down associated consumer costs. Robinhood pioneered zero-fee stock investing and larger companies like TD Ameritrade have had to follow suit. Acorns enabled us to invest our spare change in the stock market without any friction and without even having to realize it. Betterment enabled us to spin up low-fee retirement accounts based on our personal needs, without human interaction. So, let’s do what we always do here at Apptopia and see how they’re performing.

Top investment-based finance apps grow downloads 126% in four years

This grouping of top investment-based finance apps has grown quarterly downloads 126% from Q4 2015 through Q3 2019. The largest quarter was in Q1 2018 with a combined 5.44 million downloads. There was lots of action in the two quarters sandwiching this one as well, which leads me to believe the crypto craze played a large role here and shined a light on the fintech industry as a whole. Q1 2018 is also when Robinhood rolled out the ability to purchase cryptocurrencies. A rising tide floats all boats.

Robinhood is stealing from the rich

Combining the monthly active users (MAU) of the top legacy providers and pitting them against Robinhood’s MAU makes for an interesting story. The legacy providers consist of E*TRADE, TD Ameritrade (comprised of TD Ameritrade, Scottrade and Schwab), Fidelity and Edward Jones. The below graph depicting MAU market share shows Robinhood has grown to the point where it’s crossed the 50% mark.

Do these legacy players have more users on web? Maybe. But in terms of mobile real estate, an individual’s most personal device, Robinhood is winning. According to Apptopia’s estimated U.S. demographic data, 40% of Robinhood’s active users are between the ages of 19 and 34. For E*TRADE, 36% of its active users are between the ages of 19 and 34, and this is the highest of any legacy provider.

Investment apps have a gender gap

The app with the highest percentage of active female users is Acorns, but only with 30.4% of its users. E*TRADE ranks last in our grouping with just 15.8%. While I’m not an expert on this situation and what the reasons behind it may be, I thought it was important to include the data and let you discuss and draw conclusions for yourself.

Worthy Mentions

There’s a few other investment apps that aren’t as big but I think they’re innovative enough to be worthy of a mention. The first is Ellevest; the app says it provides women with investment tools, options, and advice created specifically for women. Late last year, according to Forbes, “Ellevest launched new portfolios designed to help people invest in companies with products, policies and practices that benefit women and away from companies that are harmful to them.”

Next up we have Fundrise; this app enables everyday people to easily invest in real estate. Users determine whether they want their investments to yield long-term gains or short term supplementary income. The app is transparent with what projects are in your portfolio and their respective statuses.

Finally, there’s Titan; the hedge fund that says it’s not a hedge fund. From TechCrunch, “Titan lets anyone invest as little as $1,000 for just a 1 percent fee on assets while keeping all the profits. Titan picks the top 20 stocks based on data mined from the most prestigious hedge funds, then invests your money directly in those with personalized shorts based on your risk profile.” Titan is also very transparent with what moves it’s making, thinking about making, and why.

Again, this is such a hot space that there are certainly more apps popping up all the time that are interesting and valuable to track. Feel free to poke me on Twitter or LinkedIn if you want to talk more.