This was first published January 24, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

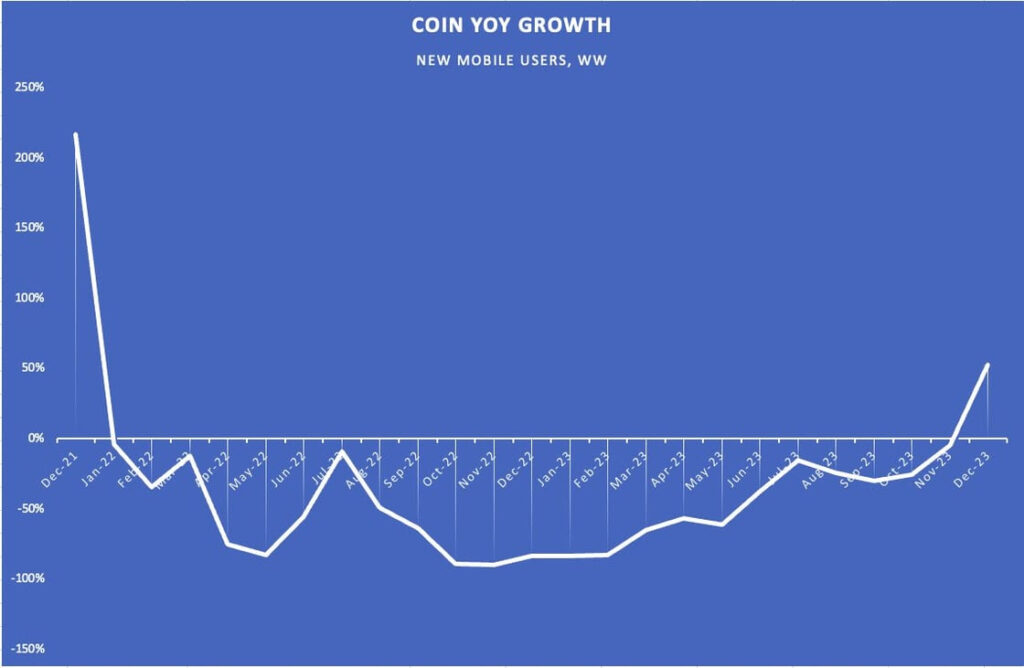

- In December 2023, Coinbase (COIN) mobile growth bounced positive for the first time in two years (+47% YoY).

- Meanwhile, Apptopia estimated sessions for Robinhood (HOOD) grew in 4Q, up +2% QoQ and +16% YoY, an acceleration from +14% YoY in 3Q23.

- What was the commonality? The price of bitcoin rose +73% YoY.

Coinbase grows new users in 4Q23

Rising crypto prices look to be improving the outlook for Coinbase and Robinhood.

While COIN shares turned down after 3Q23 earnings because of a decrease in Consumer Trading Volume and a subsequent decline in mobile engagement, 4Q23 signaled the first positive YoY growth in Coinbase mobile activity (+3%) in two years. This reversal can be attributed to a substantial surge in new mobile users (+47% YoY) during December, fueled by the growth of bitcoin prices (+149% YoY in December). Mobile trends look strong for Coinbase from all angles, as new user growth and transacting users are growing positive.

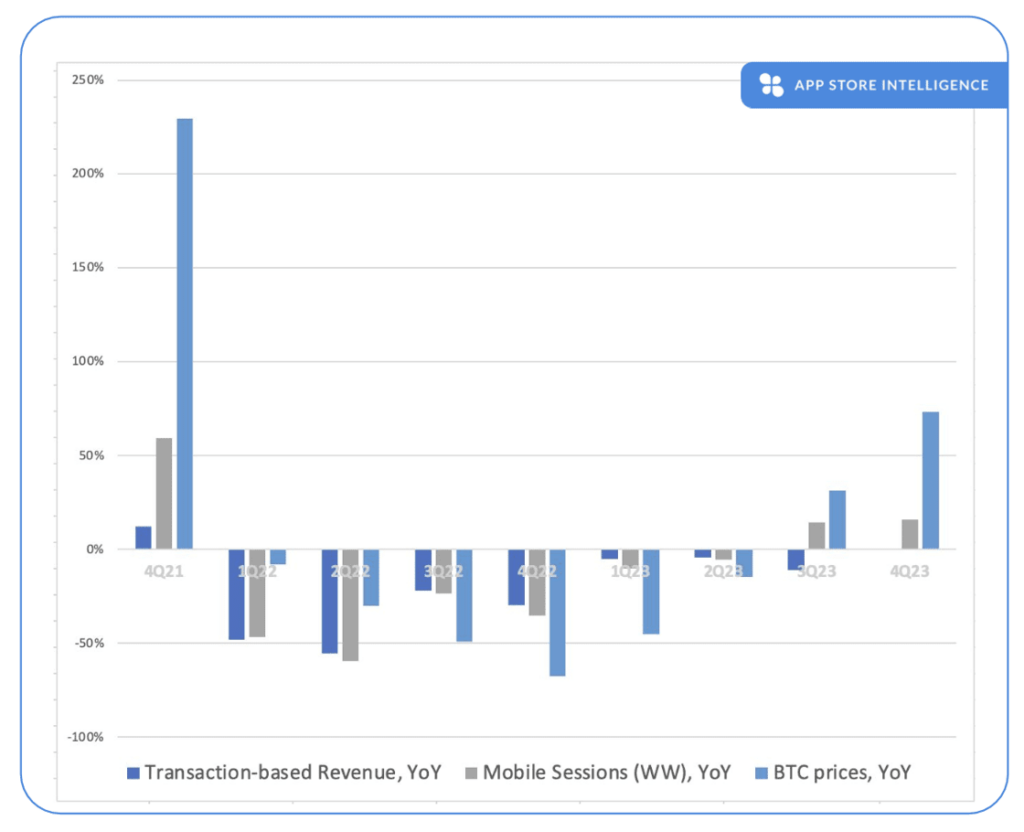

Robinhood faced a sequential decline in transaction-based revenues in 3Q23, despite an increase in mobile sessions (+14% YoY) for the first time in two years. Their shareholder letter attributed this decline to lower crypto volumes, coinciding with flat QoQ crypto prices in 3Q. While Consensus anticipates a continued decline in transaction-based revenues, Apptopia’s analysis suggests that the sequential strengthening of bitcoin in 4Q (+73% YoY versus +31% in 3Q) may act as a catalyst, potentially steering transaction-based revenues positive for Robinhood this quarter

Robinhood Mobile sessions grow sequentially with bitcoin prices.

Earnings Previews

Social companies report over the next two weeks. For a limited time, meet 1:1 with our team for previews on META, SNAP, and PINS.