This was first published February 7, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

Meta, Snapchat 4Q Earnings Review

Apptopia Research caught the divergence between META and SNAP results with engagement data

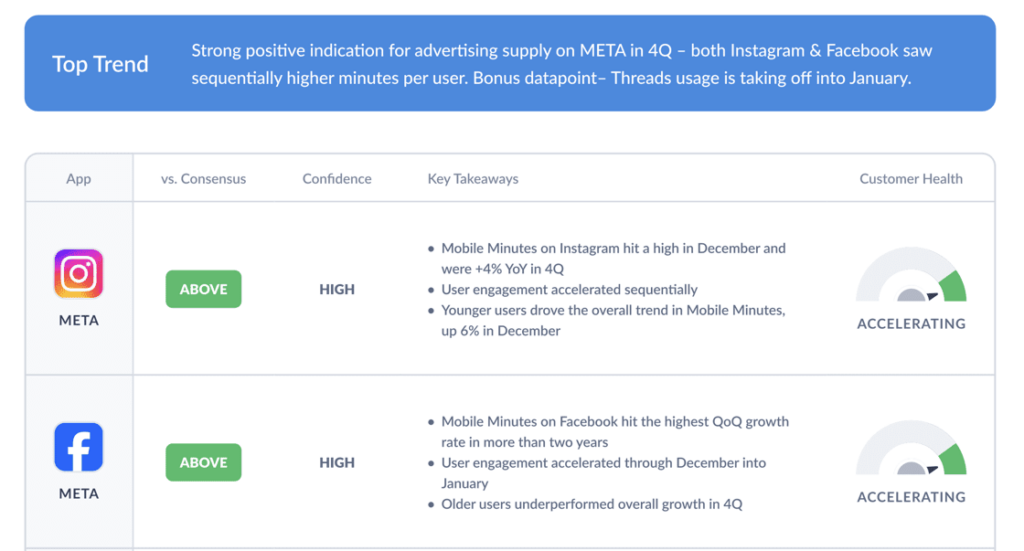

- Instagram and Facebook saw record high growth for Average Minutes per Daily User in December and Q4, respectively.

- Apptopia Research’s 4Q Social Media report highlighted this as a top trend and positive indicator for Meta’s advertising business.

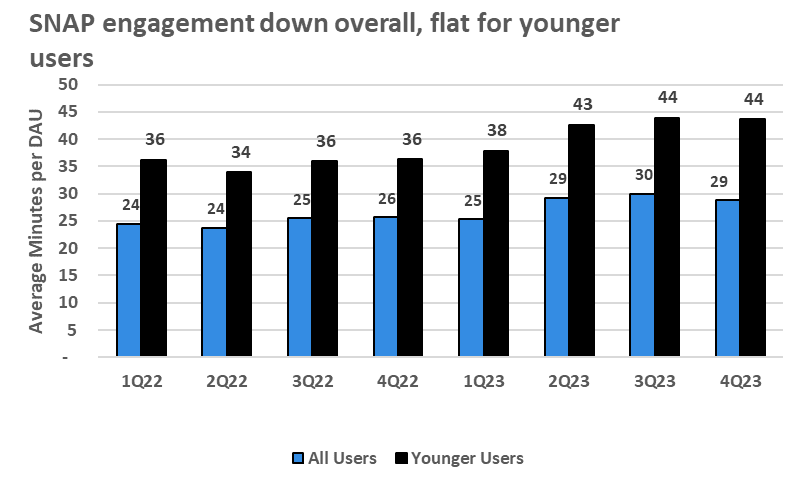

- Meanwhile, Snapchat’s Average Minutes per Daily User fell QoQ – below Street expectations of sequential growth.

- The Street turned positive on SNAP after META’s results, missing this nuance captured by mobile engagement.

SNAP and META have been increasing engagement for six quarters leading up to 4Q23, at which point, Facebook and Instagram continued the trajectory while Snapchat softened.

The more “Mobile Minutes”, or average minutes per daily user, the more eyeballs are on advertisers. Therefore, in our first official Apptopia Research report on the sector, we highlighted Meta apps’ positive trends below as a positive indication for advertising supply in 4Q:

- Overall engagement is higher in 4Q – average time spent per user up +4% QoQ in 4Q. Mobile minutes high the highest QoQ growth rate in 2+ years.

- Overall mobile minutes hit a high in December up over 46 minutes per day per user. Mobile minutes +2% QoQ.

- Younger users are driving the trend. Growth in engagement for the segment has outpaced overall growth in recent quarters. Younger users mobile minutes +3% QoQ in 4Q.

Meta’s historic surge in market cap cast a halo effect over the impending results of SNAP and PINS. But looking under the hood with our engagement data would have revealed these contrasting engagement trend lines for Snapchat:

- Overall engagement is lower in 4Q – down 4% quarter-over- quarter to 29 mins per day.

- Snapchat app ‘Days opened’ also ticked down modestly.

- Younger users mobile minutes flat in 4Q, providing some offset for negative engagement trends.

The above analysis was shared in our 4Q Apptopia Research report for Social Media companies.

What does this mean for Pinterest?

Pinterest reports tomorrow (2/8) and our research shows mixed signals. On the one hand, 4Q US user growth looks strong and jumped up 25%+ YoY. However, growth faded into 1Q with January up +15% YoY; and engagement trends looked weaker, with Mobile Minutes down 6% QoQ.