This was first published May 9, in our weekly newsletter Apptopia Insight. To receive insights like this weekly, sign up here.

- Max benefits most. Max users already use Disney+ and Hulu more than vice versa, creating an opportunity for Max to gain new users.

- Bundling may not help churn. Despite Disney’s claim, we only saw a short-lived benefit to user churn from its bundle with Hulu; we are skeptical that this bundle will perform differently

- Strong demographic synergy. Each app is strongest in a different demographic, with Disney+ strong with younger users, Hulu with older users, and Max with females.

Disney (DIS) and Warner Bros Discovery (WBD) announced a brand new bundle for Disney+, Hulu, and Max. We have found our mobile data correlates highly with the user activity metrics for these apps and thought we would use our data to understand the strengths and weaknesses of this offering.

We think that:

1) Max has the most new users to gain, as it is less penetrated into Disney+ and Hulu user bases than vice versa;

2) Disney+ has the most potential to reduce churn, though we are skeptical that bundling actually helps with churn; and

3) there is good synergy across each app’s demographics, as each has a different user segment that is most engaged with the app.

Cross-app usage

A critical place to start in agreements like this is understanding just how much one set of customers already uses the partner’s product.

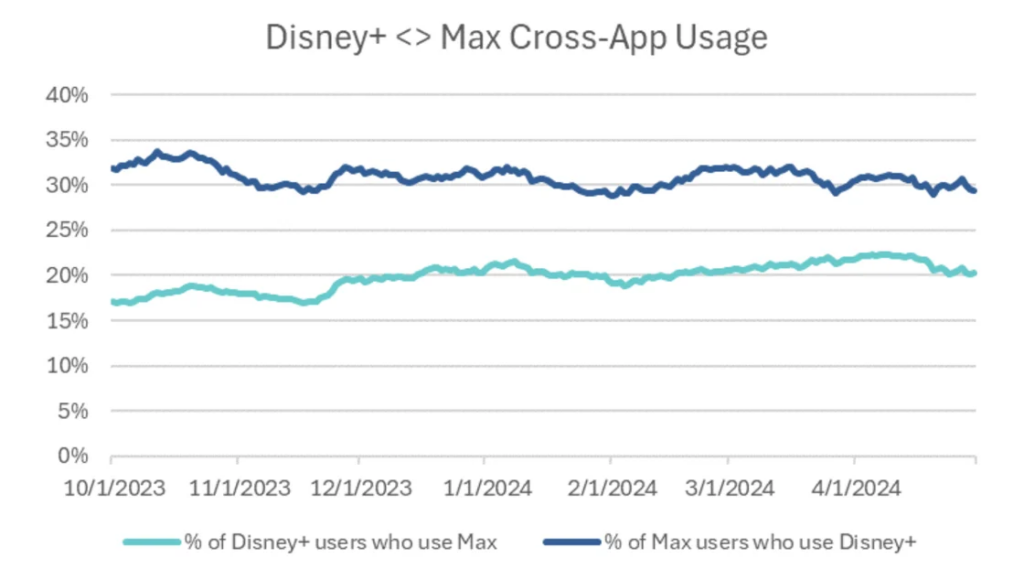

In the mobile world, we get at this by looking at cross-app usage, i.e. what percent of App 1’s users also use App 2? We found that 30% of Max users already use Disney+, and 40% of Max users already use Hulu; meanwhile, only 20% of Disney+ users use Max, and 18% of Hulu users use Max.

Max appears to have the most room to gain from this bundle, as Max is much less penetrated into Disney+ and Hulu user bases.

User Churn

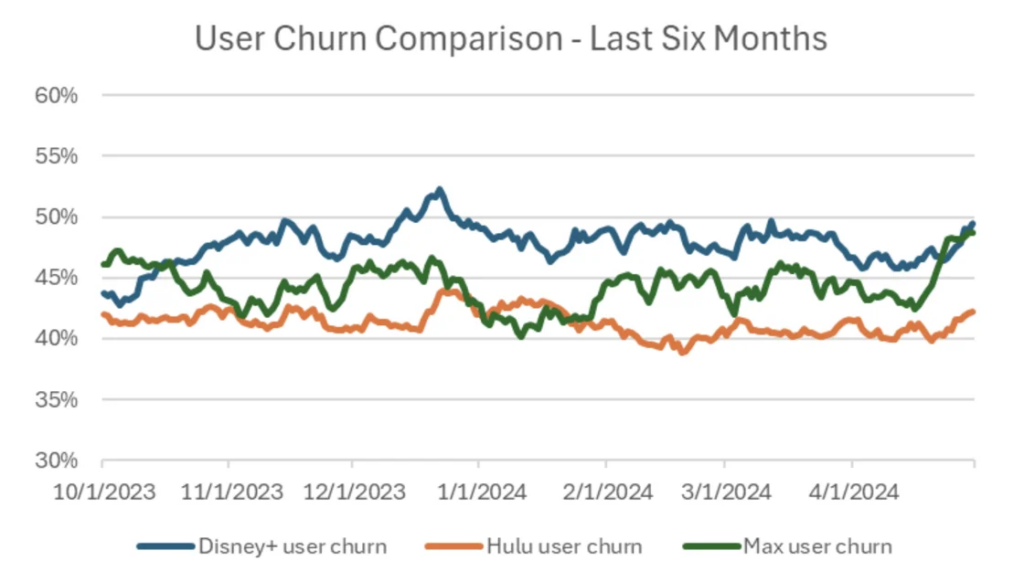

Disney talked about bundles reducing user churn, so we compared user churn levels to see who might actually benefit. It turns out that Disney+ actually has the highest user churn, while Hulu is the lowest.

While Max’s user churn is not that much better, Disney+ has the most to benefit from a user churn perspective. One important point to note – our data shows that the reduction in churn from bundling Hulu with Disney+ was short-lived. Reducing user churn by bundling may be a fallacy.

User Segmentation

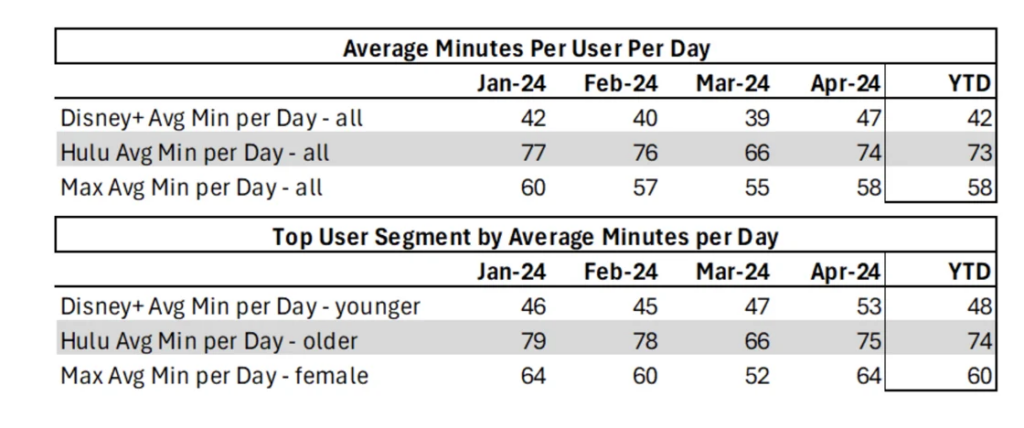

Disney also talked about bundles improving user engagement, so we compared user engagement by segment to see where the potential gains lie. We found that this is an area for synergy, as each app appeals most to a different audience, with Disney+ strong in younger users, Hulu strong in older users, and Max strongest with female users.