In the midst of a slow-down in retail apps, Big Box retailers’ mid-summer sales were effective in regaining consumer attention and competing with Amazon. This Prime Day, on July 11 and 12, shoppers purchased more than 375 million items, making it the “biggest Prime Day ever.” Our data indicates a bigger shopping year:

While downloads on the two days were down 16% year-over-year (YoY), daily active users (DAU) on the Amazon Shopping app were up 16% in the U.S. from last year’s Prime Day.

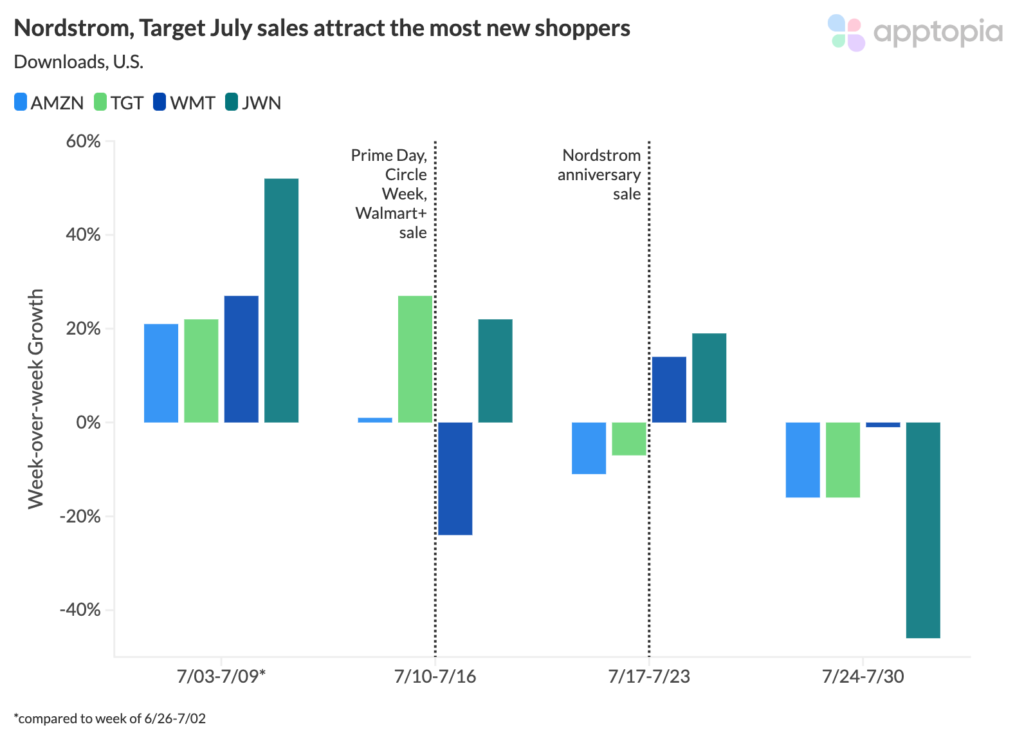

As shoppers flocked to Amazon to claim deals and online spending was top of mind for consumers, shopping apps Target, Nordstrom, and Walmart played defense. Target and Walmart ran “Target Circle Week” and “Walmart+ Week,” and both started sales a day before Prime Day. Nordstrom grew ahead by promoting pre-Anniversary sales and offered even earlier sales to card members.

Target and Nordstrom showed to be competitive with Amazon on Prime Day, but Walmart didn’t grow as we expected. Rather, they focused efforts on Sam’s Club, particularly in Mexico, where we saw engagement spike during Prime Week. Sam’s Club Mexico offered sales on their membership card that gives shoppers further discounts on items and Ticketmaster events.

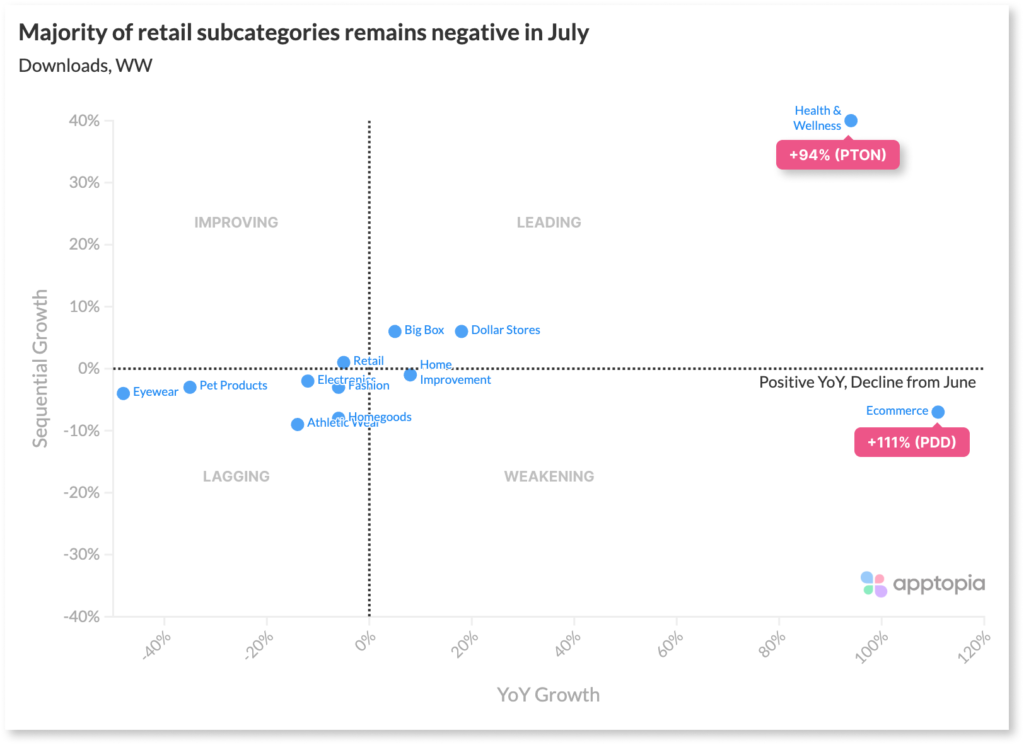

Consumer purchases on Amazon Prime Day revealed that home goods and essentials are top categories for shoppers, a possible indicator of an increase in home improvement projects as mortgage rates soar, covered in our Housing Market Blog. Apptopia data indicates that home improvement apps Lowes and Home Depot are seeing a steady growth—downloads are up 13% and daily active users are up 22% since the beginning of 2023. No wonder this was a top retail category this summer.

Other benefactors of Prime Day were BNPL apps, namely Affirm, the official Amazon partner. Affirm grew downloads 14% the week of Prime Day, while Afterpay and Klarna stalled and declined, respectively.

So did Amazon and its Big Box competitors help improve the retail category overall this summer? Our data shows that the retail category is improving, but it’s important to note that bargain shopping lines, Temu and Shein, are continuous drivers of this growth. Temu and Shein as leaders are big outliers in the retail market, and are not a sign of consumer strength, but rather a sign of consumer curiosity in cheap goods.

Still, Big Box retailers did see growth after mid-summer sales with Amazon Prime Day and by using competitive tactics of giving early access, significant discounts, and exclusive membership perks, to customers. We will be interested to see how back-to-school shopping impacts the market even further and which retailers customers will choose.